Global Synthetic Zeolite Market Size, Trends, and Analysis - Forecasts to 2026 By Framework (Linde Type A, Faujasite, MFI), By Pore Size (3A-7A, 7A-10A), By Function (Ion Exchange, Molecular Sieve, Catalyst), By Application (Detergent Builder, Drying, Separation, and Adsorption, Catalytic Cracking, Specialties), By Type of Zeolite (Zeolite A, Type X, Type Y, Ultra-Stable Y (USY), Zsm-5), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

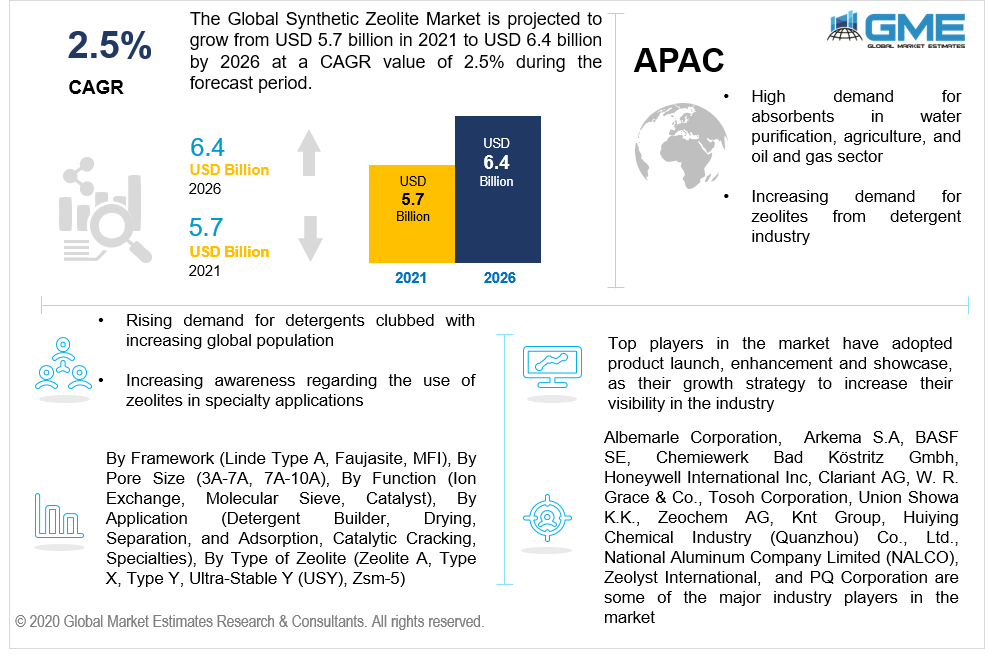

The global synthetic zeolite market is projected to grow from USD 5.7 billion in 2021 to USD 6.4 billion by 2026 at a CAGR value of 2.5% from 2021 to 2026.

The growth of the synthetic zeolites market can be attributed to the rising demand for detergents clubbed with increasing global population and increasing awareness regarding the use of zeolites in specialty applications.

Zeolites can be classified as natural zeolites and synthetic zeolites. Across different industries, more than 100 types of zeolites are used which are processed synthetically. When the volcanic ashes meet the natural water through lakes, this reaction results in the formation of synthetic zeolites. There have been several experiments and researches that tried imitating these reactional processes in laboratories, however, these experiments require high temperature and high-level synthetic silicates, making them costlier than the natural zeolites. Hence, researchers use cheap raw materials like natural zeolites or waste material in synthesizing zeolites.

Also, while producing synthetic zeolites, other silica-based materials like volcanic glasses or minerals made of clay are utilized in the process. Synthetic zeolites naturally have a diverse range of properties and forms. The crystallization process and the reactions in chemical materials, as well as the temperature, pressure, and the time taken during this process results in different types of synthetic zeolites.

Research have showcased the better beneficial features of synthetic zeolites for applicational purposes as compared to natural zeolites. The capacity of synthetic zeolites to absorb metal ions at a comparatively much greater rate than natural zeolites makes it a more favored one among the end-user industries. Synthetic zeolites also facilitate larger pore sizes compared to the natural zeolites thus enabling a better sorption process for the industrial users to use in their applicational purposes. These larger pore sizes in synthetic zeolites are also capable of a higher level of oil sorption compared to the small pore natural zeolites which can cause blockages and defusion. Synthetic zeolites also have high adaptability to various chemical characteristics and a very consistent quality that can cater to various applications in different fields.

COVID-19 has had a negative impact on the chemical industry owing to production shutdowns and closure of non-essential stores across the globe. These measures reduced the sales of essential chemicals and led to losses for most of the synthetic zeolite manufacturers. With restrictions being eased and workers returning, the industry is expected to bounce back during the forecast period.

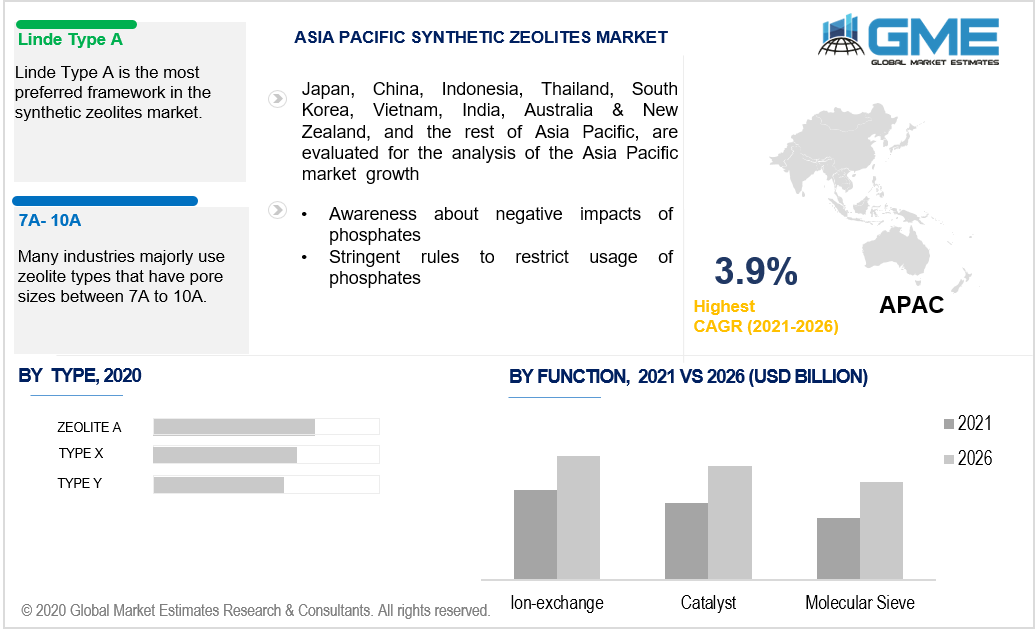

Based on the framework, the market is segmented into Linde Type A, Faujasite, and MFI. Linde Type A will be the fastest growing segment in the market. Linde Type A is formed from various processes of aluminum and sodium powder, along with aluminosilicate molecules. Linde type A is basically an alumino-silicate zeolite. This framework corresponds to have sodium ions which can be exchanged with other positively charged protons like calcium and potassium. These are majorly used in the ion exchange-based application.

Faujasites are also a silicate-mineral based families which have varied quantity of calcium and sodium in their formulation. However, these are very rare minerals, and thus sometimes act as the alternative counterpart for Linde groups.

Based on the pore size, the market is segmented into 3A-7A, and 7A-10A. Zeolites usually are available in pore sizes from 1A to 10A, hence, the market for 1A to 10A will be the fastest growing.

These pore sizes facilitate organic mineral separation and the size selection mostly depends on the applicational purposes. Many industries majorly used zeolite types that have pore sizes between 7A to 10A which enable better separation and greater absorption during any industrial application. Zeolites like type X which belong to the faujasite family, also prefer to have higher pore sizes ranging from 8A to 10A which are being used in industries for gas absorptions.

Based on the function type, the market is segmented into ion exchange, molecular sieve, catalyst. Amongst these, the ion-exchange resin is tremendously used in various kinds of end-user industries and hence is also one of the largest segments in the market.

These ion exchange zeolite functions enable to exchange of one ion of sodium to one ion of calcium. This ion exchange functionality is mainly used in water treatments, to disinfect or remove certain substances, they are also highly used to build detergency.

Based on the application, the market is segmented into detergent builder, drying, separation, and adsorption, catalytic cracking, specialties. Synthetic zeolites are most dominantly used in the detergent industry and hence this segment is ought to be the largest segment in the market.

Detergent builders require high ion exchange functionalities as well as high absorptional qualities. As these synthetic zeolites facilitate more open and larger size pores compared to the natural zeolites, they execute better results when utilized in the detergent builders.

Based on the type, the market is segmented into Zeolite A, Type X, Type Y, Ultra-Stable Y (USY), and Zsm-5. Zeolite A is majorly used across various industries and for various applications owing to its features of three dimensional pore structures, which enables better absorption through ion exchange functionalities.

A-type zeolites also have very well defined structural channels that enable them to be useful in high pressure situations. These qualities of high absorption of industrial liquid as well as gas, encourage demand for A-type from the detergent industries. It helps remove substances causing pollution and disinfection. However, the faujasite family of chemical reaction which includes type X zeolites provides comparatively larger pore sizes of 8A to 10A, which facilitates even better absorption in the industries which require drying and separation applicational processes.

Based on region, the market can be segmented into North America, Europe, Central and South America, Middle East & Africa, and Asia Pacific regions.

North America is the largest shareholder of the market. However, Asia-Pacific region is the fastest growing segment in the synthetic zeolite market. The APAC region has witnessed enormous demand for absorbents in sectors like water purification, agriculture, chemicals, and also the oil and gas sector.

Awareness among the consumers regarding environment friendly detergents and implementation of stringent restraints on the use of phosphates, have helped increase the demand for synthetic zeolites in in the APAC region.

Albemarle Corporation, Arkema S.A, BASF SE, Chemiewerk Bad Köstritz Gmbh, Honeywell International Inc, Clariant AG, W. R. Grace & Co., Tosoh Corporation, Union Showa K.K., Zeochem AG, Knt Group, Huiying Chemical Industry (Quanzhou) Co., Ltd., National Aluminum Company Limited (NALCO), Zeolyst International, and PQ Corporation are key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Synthetic Zeolites Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Pore Size Overview

2.1.4 Framework Overview

2.1.5 Application Overview

2.1.6 Function Overview

2.1.7 Regional Overview

Chapter 3 Synthetic Zeolites Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for detergents clubbed with increasing global population

3.3.2 Industry Challenges

3.3.2.1 Available Alternatives

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Pore Size Growth Scenario

3.4.3 Framework Growth Scenario

3.4.4 Application Growth Scenario

3.4.5 Function Scenario

3.4.6 Clinical Trial Phase Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Synthetic Zeolites Market, By Product Type

4.1 Product Type Outlook

4.2 Zeolite A

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Type X

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Type Y

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.5 Ultra-Stable Y (USY)

4.5.1 Market Size, By Region, 2019-2026 (USD Billion)

4.6 Zsm-5

4.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Synthetic Zeolites Market, By Pore Size

5.1 Pore Size Outlook

5.2 3A-7A

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 7A-10A

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Synthetic Zeolites Market, By Framework

6.1 Linde Type A

6.1.1 Market Size, By Region, 2019-2026 (USD Billion)

6.2 Faujasite

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 MFI

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Synthetic Zeolites Market, By Application

7.1 Detergent Builder

7.1.1 Market Size, By Region, 2019-2026 (USD Billion)

7.2 Drying

7.2.1 Market Size, By Region, 2019-2026 (USD Billion)

7.3 Separation and Adsorption

7.3.1 Market Size, By Region, 2019-2026 (USD Billion)

7.4 Catalytic Cracking

7.4.1 Market Size, By Region, 2019-2026 (USD Billion)

7.5 Specialties

7.5.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 8 Synthetic Zeolites Market, By Function

8.1 Ion Exchange

8.1.1 Market Size, By Region, 2019-2026 (USD Billion)

8.2 Molecular Sieve

8.2.1 Market Size, By Region, 2019-2026 (USD Billion)

8.3 Catalyst

8.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 9 Synthetic Zeolites Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2019-2026 (USD Billion)

9.2.2 Market Size, By Product Type, 2019-2026 (USD Billion)

9.2.3 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.2.4 Market Size, By Framework, 2019-2026 (USD Billion)

9.2.5 Market Size, By Application, 2019-2026 (USD Billion)

9.2.6 Market Size, By Function, 2019-2026 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.2.7.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.2.7.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.2.7.4 Market Size, By Application, 2019-2026 (USD Billion)

9.2.7.5 Market Size, By Function, 2019-2026 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.2.8.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.2.8.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.2.8.4 Market Size, By Application, 2019-2026 (USD Billion)

9.2.8.5 Market Size, By Function, 2019-2026 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.2.9.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.2.9.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.2.9.4 Market Size, By Application, 2019-2026 (USD Billion)

9.2.9.5 Market Size, By Function, 2019-2026 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2019-2026 (USD Billion)

9.3.2 Market Size, By Product Type, 2019-2026 (USD Billion)

9.3.3 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.3.4 Market Size, By Framework, 2019-2026 (USD Billion)

9.3.5 Market Size, By Application, 2019-2026 (USD Billion)

9.3.6 Market Size, By Function, 2019-2026 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.3.7.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.3.7.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.3.7.4 Market Size, By Application, 2019-2026 (USD Billion)

9.3.7.5 Market Size, By Function, 2019-2026 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.3.8.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.3.8.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.3.8.4 Market Size, By Application, 2019-2026 (USD Billion)

9.3.8.5 Market Size, By Function, 2019-2026 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.3.9.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.3.9.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.3.9.4 Market Size, By Application, 2019-2026 (USD Billion)

9.3.9.5 Market Size, By Function, 2019-2026 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.3.10.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.3.10.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.3.10.4 Market Size, By Application, 2019-2026 (USD Billion)

9.3.10.5 Market Size, By Function, 2019-2026 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2019-2026 (USD Billion)

9.4.2 Market Size, By Product Type, 2019-2026 (USD Billion)

9.4.3 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.4.4 Market Size, By Framework, 2019-2026 (USD Billion)

9.4.5 Market Size, By Application, 2019-2026 (USD Billion)

9.4.6 Market Size, By Function, 2019-2026 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.4.7.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.4.7.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.4.7.4 Market Size, By Application, 2019-2026 (USD Billion)

9.4.7.5 Market Size, By Function, 2019-2026 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.4.8.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.4.8.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.4.8.4 Market Size, By Application, 2019-2026 (USD Billion)

9.4.8.5 Market Size, By Function, 2019-2026 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.4.9.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.4.9.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.4.9.4 Market Size, By Application, 2019-2026 (USD Billion)

9.4.9.5 Market Size, By Function, 2019-2026 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2019-2026 (USD Billion)

9.5.2 Market Size, By Product Type, 2019-2026 (USD Billion)

9.5.3 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.5.4 Market Size, By Framework, 2019-2026 (USD Billion)

9.5.5 Market Size, By Application, 2019-2026 (USD Billion)

9.5.6 Market Size, By Function, 2019-2026 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.5.7.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.5.7.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.5.7.4 Market Size, By Application, 2019-2026 (USD Billion)

9.5.7.5 Market Size, By Function, 2019-2026 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.5.8.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.5.8.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.5.8.4 Market Size, By Application, 2019-2026 (USD Billion)

9.5.8.5 Market Size, By Function, 2019-2026 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By Product Type, 2019-2026 (USD Billion)

9.5.9.2 Market Size, By Pore Size, 2019-2026 (USD Billion)

9.5.9.3 Market Size, By Framework, 2019-2026 (USD Billion)

9.5.9.4 Market Size, By Application, 2019-2026 (USD Billion)

9.5.9.5 Market Size, By Function, 2019-2026 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2020

10.2 Albemarle Corporation

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 Arkema S.A

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 BASF SE

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 Chemiewerk Bad Köstritz Gmbh

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Honeywell International Inc

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 Clariant AG

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 W. R. Grace & Co.

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.11 Tosoh Corporation

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.10 Others

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

The Global Synthetic Zeolite Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Synthetic Zeolite Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS