Global Systemic Lupus Erythematosus Market Size, Trends & Analysis - Forecasts to 2026 By Drug Class (Antimalarial Drugs, Non-Steroidal Anti-Inflammatory Drugs, Immunosuppressants, Corticosteroids, Disease-Modifying Anti-Rheumatic Drugs, BLyS-specific Inhibitors or Monoclonal Antibodies, Anticoagulants, Biologics, Others), By Route of Administration (Oral, Intravenous, Subcutaneous), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

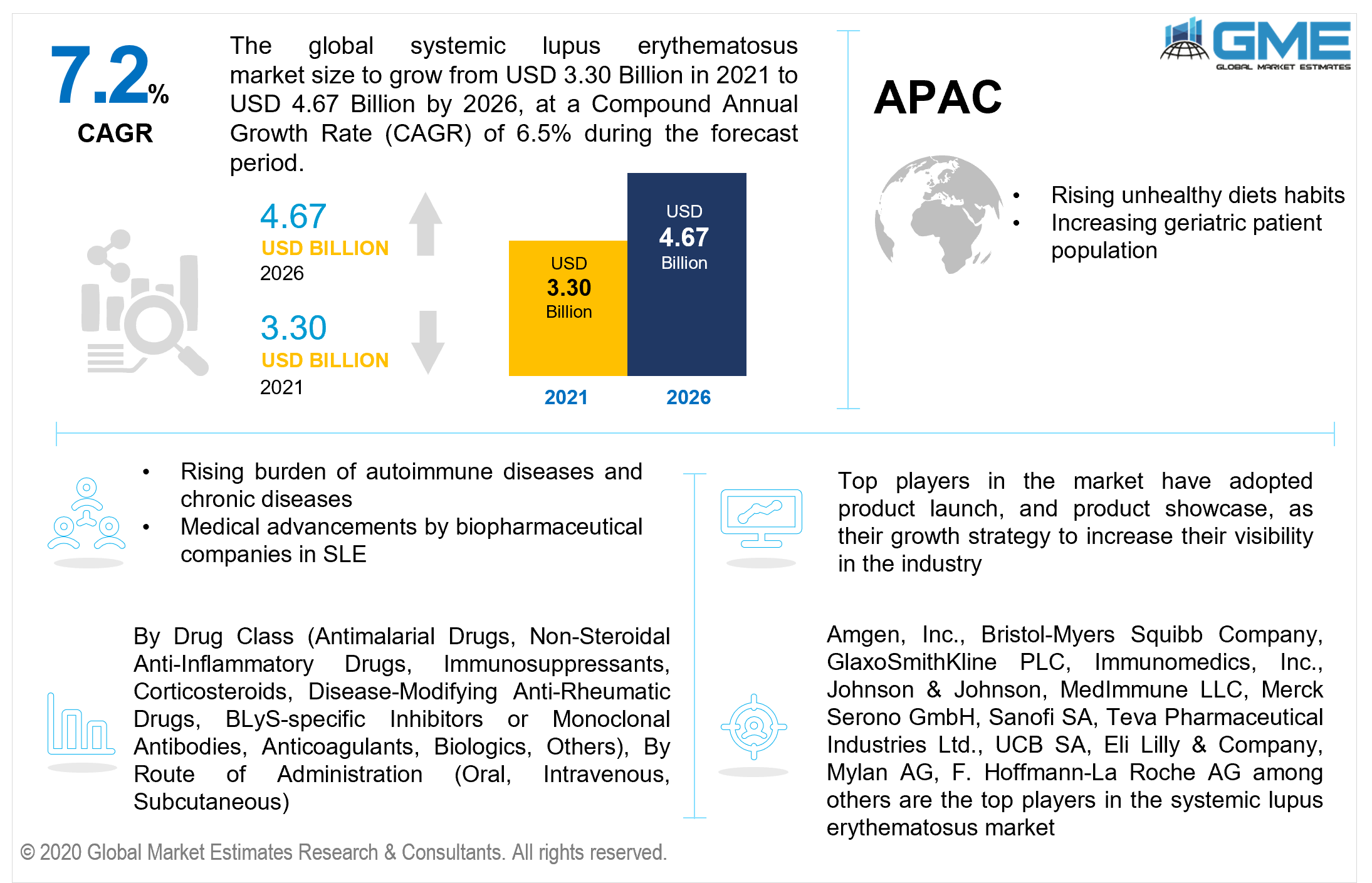

The systemic lupus erythematosus market is estimated to be valued at USD 3.30 Billion in 2021 and is projected to reach USD 4.67 Billion by 2026 at a CAGR of 7.2%. The core drivers which contribute to the market expansion include the increasing prevalence of chronic diseases, the growing need for targeted treatment, soaring levels of inflammatory diseases, increasing therapeutic interventions, and the emergence of biologics.

Moreover, mounting demand and desire for novel therapeutics, evolving medical facilities, a growing geriatric population, increasing technological advancements, and expanding government initiatives are the major aspects supporting market growth. Expanding public understanding of inflammatory autoimmune disease prognosis & medication, and expanding the level of research & development projects, further aids in overall market advancement.

The multitude of SLE cases has increased, which is boosting demand for SLE therapies and contributing to the global market's growth. According to the Lupus Foundation of America, it affects approximately 1.5 million people in the United States and 6 million people worldwide. This disease primarily affects females of Asian, Afro-Caribbean, and Hispanic descent. According to the National Institute of Arthritis and Musculoskeletal and Skin Diseases, this disorder is most prevalent in African-American and Asian populaces. Thus, the emergence of key pipeline agents and the latest drug authorizations will fuel market growth.

In recent years, the global SLE drug market has seen a dialectic transition away from generic and off-label medications and toward conventional pioneer drugs with improved delivery options. Previously, the market was stocked with a variety of drugs that were administered via traditional routes, such as oral, intravenous, and topical compositions. Nevertheless, with the notable introduction of a subcutaneous formulation of an extant drug, Benlysta has acknowledged the unaddressed necessity of improved and more effective visionary medications with a comfortable mode of administration.

The emergence of innovative biological therapies in the production pipeline which will increase therapeutic options and lower drug costs is expected to accelerate market revenue. Specific unique enticing drugs in Phase III trials are foreseen to supplement the market because they may approach the lupus nephritis patient dataset with sophisticated viable options and substantial unrealized necessitates. This aspect is inclined to have a significant influence on the market as nearly 50% of SLE patients possess lupus nephritis.

In order to retain their market share, pharmaceutical companies are concentrating on the manufacture of biopharmaceutical drugs. Moreover, patients are likely to seek out novel and marketed drugs as oral product efficacy improves. Furthermore, novel molecules provide therapeutic substitutions for patients who have previously received treatment and often demonstrate superior protection and efficacy. Biopharmaceutical output capacity is projected to increase as a consequence of advancements in production capabilities. Thus, the cumulative effect of these aspects will induce growth in the market.

Based on drug class, the market is segmented into Antimalarial Drugs, Non-Steroidal Anti-Inflammatory Drugs, Immunosuppressants, Corticosteroids, Disease-Modifying Anti-Rheumatic Drugs, BLyS-specific Inhibitors or Monoclonal Antibodies, Anticoagulants, Biologics, and Others.

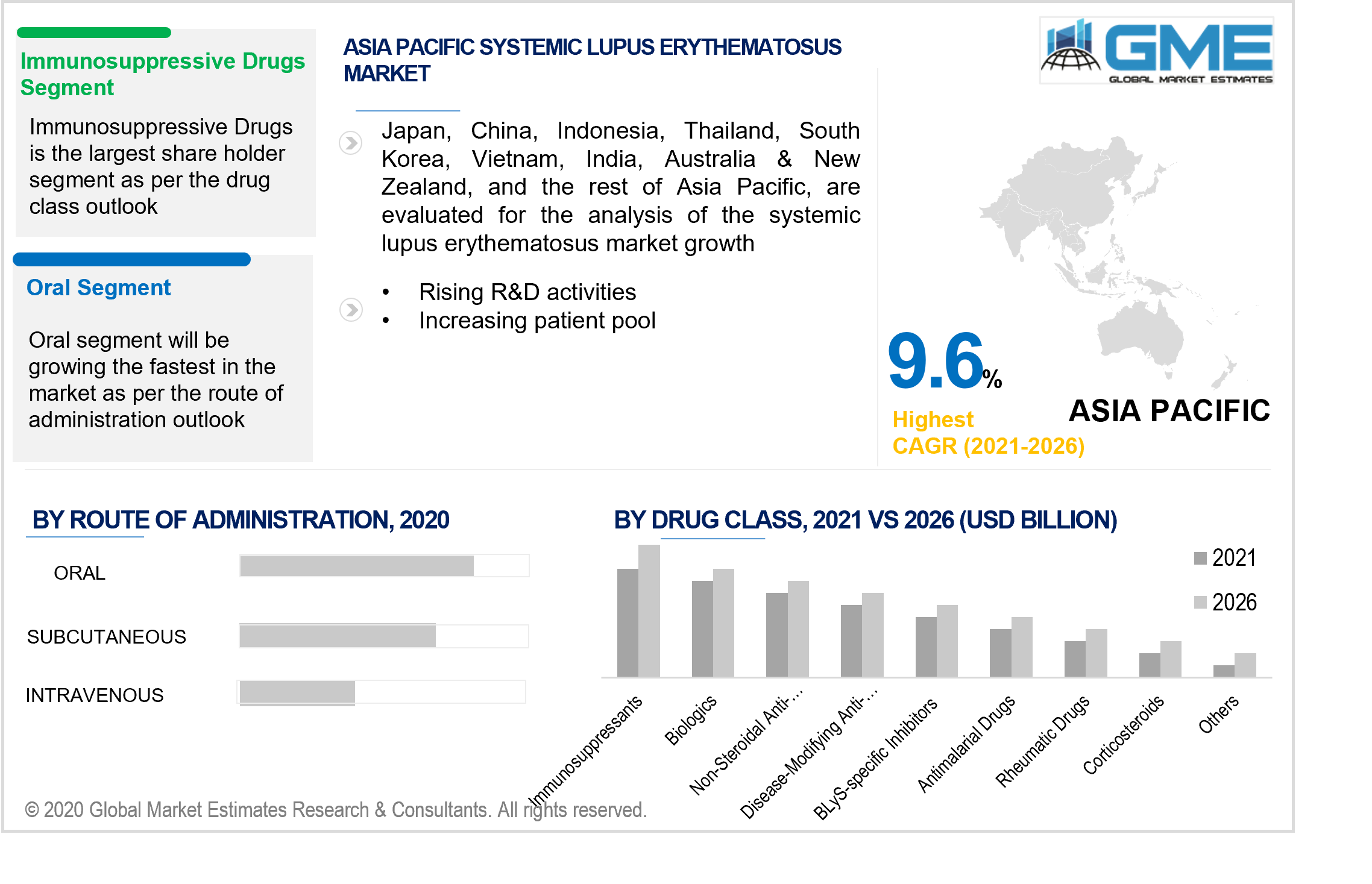

During the forecast period, the market for the Immunosuppressive Drugs segment is estimated to predominate because of the widespread use of methotrexate, which is inexpensive. Immunosuppressants are used in post organ transplants and to treat various chronic diseases. Increasing organ transplants, rising chronic diseases, growing autoimmune disorders, changing lifestyles, unhealthy diet, overeating, lack of proper sleep, smoking, and increasing stress levels are driving this segment forward.

Biologics is presumed to grow at the highest CAGR during the forecast period. As the biologic’s products are derived from genes and modified proteins that target the infection and eradicate the infection, the adoption level is witnessing a sudden spike. Growing biologics studies, increasing scope of implementation domains of novel medicinal technology, soaring rate of drugs receiving FDA approval, growing research and development, the launch of new products, and rising awareness about biologics are the key contributors to this market segment.

Based on the route of administration, the market is segmented into oral, intravenous, and subcutaneous.

During the forecast period, the market for the oral segment is estimated to predominate. The oral segment encompasses minuscule molecule medications that are easy to manage and continue to be the standard treatment for SLE. No sterile precautions are needed and the danger of acute drug reaction is minimal in oral drugs. Oral is non-invasive, convenient, and safe. The patient can self-administer with ease to store and is portable because of which this segment is driven the most in the forecast period.

During the forecast period, the market for subcutaneous has been estimated to report lucrative growth. Subcutaneous is applied to the tissue layer to better access medications to the nerve, the patient can himself inject without training, and have a low risk of systemic infection.

During the forecast period, North America is presumed to account for the highest market share. The increased preponderance of SLE, as well as penetration of specialized medications and strengthened healthcare infrastructure, are propelling the regional market forward. This supremacy is owed to improved societal knowledge and understanding of the disease, as well as an increasing proportion of foundations and autonomous enterprise organizations promoting biopharmaceutical producers. Several corporations in the North American region have unveiled public awareness programs about the disease's prognosis, misperceptions, and therapeutic interventions.

This is predominantly due to the numerous non-profit organizations and financing groups that endorse the motive. Approximately 1.5 million people in the United States have some form of lupus, with SLE accounting for 70% of cases, and more than 90% of those diagnosed are women in their adolescent and adult years. Numerous encouraging considerations from the government and private sectors, and also financial support for developing drugs, strengthen the requirement for this market in the area, and it is thus foreseen to be an important market throughout geographic regions over the forecast period.

Owing to the growing impact of chronic diseases and viral infections, the APAC region is foreseen to report the highest CAGR. The increasing incidence of autoimmune disorders, rising medical expenditure, and altering inclination for advanced therapy are booming the overall investments in R&D activities. Increasing incidents of accidents and genetic disease, an evolving trend of unhealthy diet habits, continually changing lifestyles, and the rising prevalence of climatic changes, are the major drivers due to which the Asia Pacific market is anticipated to develop at the fastest pace during the forecast period.

Amgen, Inc., Bristol-Myers Squibb Company, GlaxoSmithKline PLC, Immunomedics, Inc., Johnson & Johnson, MedImmune LLC, Merck Serono GmbH, Sanofi SA, Teva Pharmaceutical Industries Ltd., UCB SA, Eli Lilly & Company, Mylan AG, and F. Hoffmann-La Roche AG are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Systemic Lupus Erythematosus Market Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Drug Class Overview

2.1.3 Route of Administration Overview

2.1.5 Regional Overview

Chapter 3 Systemic Lupus Erythematosus Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Burden of Autoimmune Diseases

3.3.1.2 Medical Advancements by Biopharmaceutical Companies in SLE

3.3.2 Restraints

3.3.2.1 High Cost of Treatment

3.3.2.2 Several Misconceptions and Social Stigma

3.4 Prospective Growth Scenario

3.4.1 Drug Class Growth Scenario

3.4.2 Route of Administration Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Route of Administration Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Systemic Lupus Erythematosus Market, By Drug Class

4.1 Drug Class Outlook

4.2 Antimalarial Drugs

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Non-Steroidal Anti-Inflammatory Drugs

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Immunosuppressants

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Disease-Modifying Anti-Rheumatic Drugs

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 BLyS-specific Inhibitors or Monoclonal Antibodies

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

4.7 Anticoagulants

4.7.1 Market Size, By Region, 2019-2026 (USD Million)

4.8 Biologics

4.8.1 Market Size, By Region, 2019-2026 (USD Million)

4.9 Corticosteroids

4.9.1 Market Size, By Region, 2019-2026 (USD Million)

4.10 Others

4.9.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Systemic Lupus Erythematosus Market, By Route of Administration

5.1 Route of Administration Outlook

5.2 Oral

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Intravenous

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Subcutaneous

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Systemic Lupus Erythematosus Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Billion)

6.2.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.2.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.2.5.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Billion)

6.3.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.3.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.3.4 Germany

6.2.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.3.5.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.3.6.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.3.7.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.3.8.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.3.9.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Billion)

6.4.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.4.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.4.4.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.4.5.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.4.6.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.4.7.2 Market size, By Route of Administration, 2019-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.4.8.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Billion)

6.5.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.5.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.5.4.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.5.5.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.5.6.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Billion)

6.6.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.6.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.6.4.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.6.5.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

6.6.6.2 Market Size, By Route of Administration, 2019-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Amgen Inc

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Bristol-Myers Squibb Company

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 GlaxoSmithKline PLC

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Immunomedics, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Johnson & Johnson

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 MedImmune LLC

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Merck Serono GmbH

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Sanofi SA

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Teva Pharmaceutical Industries Ltd.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 UCB SA

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Eli Lilly & Company

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Mylan AG

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 F. Hoffmann-La Roche AG

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Other Companies

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

The Global Systemic Lupus Erythematosus Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Systemic Lupus Erythematosus Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS