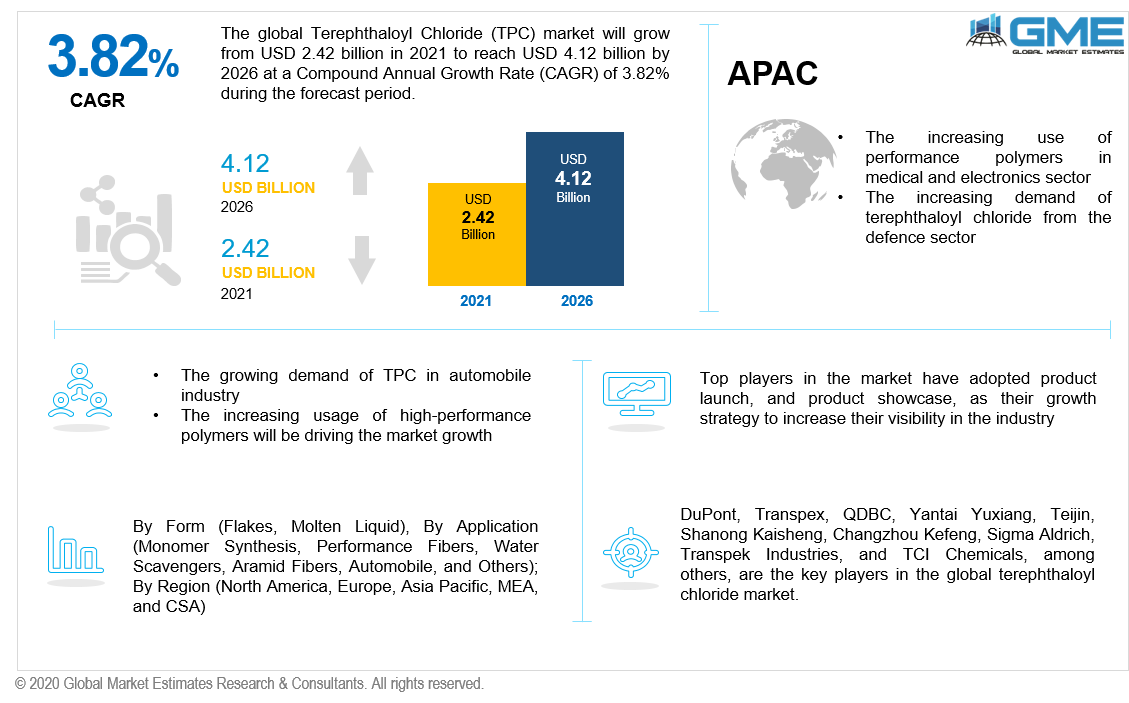

Global Terephthaloyl Chloride (TPC) Market Size, Trends & Analysis - Forecasts to 2026 By Form (Flakes, Molten Liquid), By Application (Monomer Synthesis, Performance Fibers, Water Scavengers, Aramid Fibers, Automobile, and Others); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis.

The Global Terephthaloyl Chloride (TPC) Market will grow from USD 2.42 billion in 2021 to USD 4.12 billion by 2026 at a CAGR of 3.82%. Terephthaloyl Chloride has the chemical formula C8H4Cl2O2 and is produced from terephthalic acid. Terephthaloyl Chloride with excellent chemical, mechanical, and physical characteristics has high demand in the automotive sector and the expanding industrial, aerospace and defense industries are the major factors driving the demand for Terephthaloyl Chloride in the market.

TPC is a white crystalline solid at ambient temperature and a translucent water-white liquid beyond its freezing point. Terephthaloyl Chloride has qualities such as flame resistance, lightweight, temperature stability, chemical resistance, and high physical strength. For performance polymers and aramid fibers, TPC is an essential component. The demand for Kevlar, a material made by mixing Terephthaloyl Chloride and para-phenylenediamine, is driving the Terephthaloyl Chloride (TPC) market. Kevlar is used in several industries, including the automotive and maritime industries.

Terephthaloyl Chloride (TPC) is in high demand due to the growing automobile market and its applications owing to its physical, mechanical, and chemical properties. Furthermore, the usage of Terephthaloyl Chloride in a broad array of applications, from consumer goods to industrial devices, and rising research and developmental activities to launch advanced chemicals are anticipated to spur lucrative potential for Terephthaloyl Chloride (TPC) market growth.

Terephthaloyl Chloride (TPC) is used to make copolymers that can be used to replace tires in racing wheels. It enhances wheel performance by reducing wheel wear and tear. It even helps to reduce the vehicle's total weight, which reduces emissions. Hence, the rising use of Terephthaloyl Chloride in automotive sports activities will boost the Terephthaloyl Chloride (TPC) market growth from 2021 to 2026.

The COVID-19 pandemic has affected the Terephthaloyl Chloride (TPC) market as the manufacturing industry had to be shut down and new product launches and other activities had to be dialed back. The market is expected to recover from the impact of the pandemic during the forecast period of 2021 to 2026.

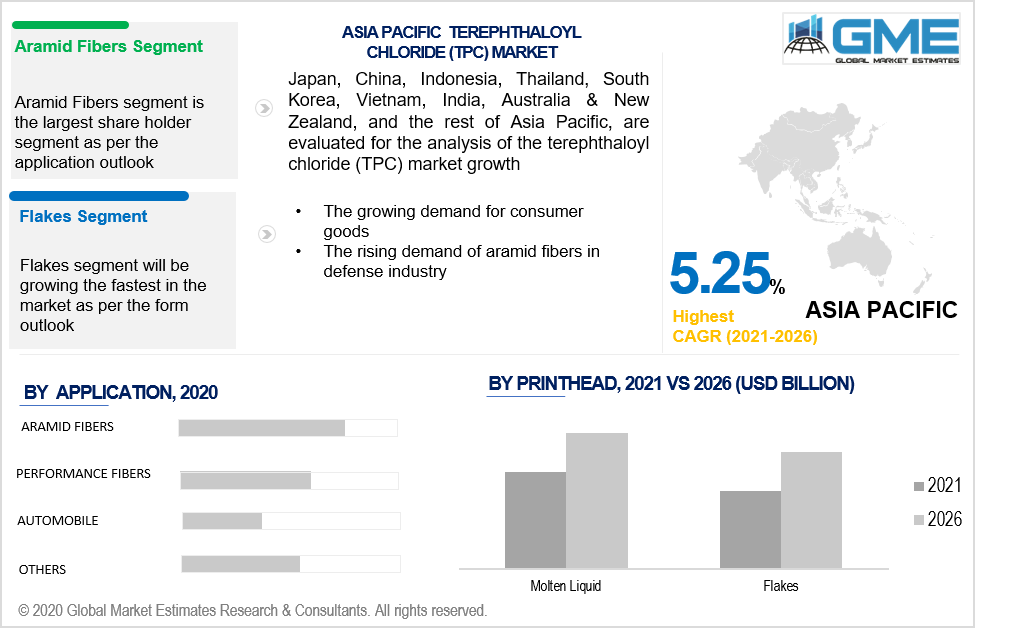

Depending on the form, the Terephthaloyl Chloride market is categorized as flakes and molten liquid. The molten liquid segment is expected to hold the largest share in the global Terephthaloyl Chloride (TPC) market from 2021 to 2026. It is due to the increasing demand for the production of chemical and flame-resistant materials, that this segment will have the highest revenue share in the market.

Moreover, the flakes will be the fastest-growing segment with the highest CAGR value from 2021 to 2026 owing to the increasing demand for high-performance polymers. This segment is also projected to spur lucrative opportunities in the market.

Depending on the application, the market is categorized into monomer synthesis, performance fibers, water scavengers, aramid fibers, automobiles, and others. The aramid fibers segment is expected to hold the largest market share in terms of volume from 2021 to 2026. Protective clothing is in high demand from the industrial, defense, and aerospace industries due to its high material strength and heat-resistant qualities. Aramid fibers have the best tensile strength/weight ratio and are made of a highly oriented crystalline polymer. Moreover, performance polymers, which are primarily used in the oil and gas, mining, and construction industries, also account for a significant portion of the Terephthaloyl Chloride (TPC) market and are analyzed to be the 2nd largest segment.

As per the geographical analysis, the Terephthaloyl Chloride market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. North America region is expected to hold the largest share in the market due to the presence of key players in the U.S., increasing demand for aramid fibers from the defense and automobile industries, and use of performance polymers in end-use industries.

Furthermore, the Asia Pacific region (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) will grow with the highest CAGR rate in the market due to the rapidly rising demand for consumer goods, increasing adoption of performance polymers in electronics, electrical, and medical sector. Product penetration in the region will be aided by growth in the transportation sectors in developing countries such as India, China, and South Korea.

DuPont, Transpex, QDBC, Yantai Yuxiang, Teijin, Shanong Kaisheng, Changzhou Kefeng, Sigma Aldrich, Transpek Industries, and TCI Chemicals, among others, are the key players in the global Terephthaloyl Chloride market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Terephthaloyl Chloride (TPC) Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Form Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Terephthaloyl Chloride (TPC) Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand for aramid fibers from the defense and automobile industries

3.3.2 Industry Challenges

3.3.2.1 Fluctuation in prices of raw materials

3.4 Prospective Growth Scenario

3.4.1 Form Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Terephthaloyl Chloride (TPC) Market, By Form

4.1 Form Outlook

4.2 Flakes

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Molten Liquid

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Terephthaloyl Chloride (TPC) Market, By Application

5.1 Application Outlook

5.2 Performance Polymers

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Aramid Fibers

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Water Scavengers

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Monomer Synthesis

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Automobile

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Others

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Terephthaloyl Chloride (TPC) Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Form, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Form, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Form, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Form, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Form, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Form, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Form, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Form, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Form, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Form, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Form, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Form, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Form, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Form, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Form, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Form, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Form, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Form, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Form, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Form, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Form, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Form, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Form, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Form, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 DuPont

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 Transpek Industry Ltd

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Yantai Yuxiang Fine Chemical Co. Ltd.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 TCI Chemicals Pvt. Ltd.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Sigma-Aldrich Corporation

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 Teijin

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 QDBC

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 Shanong Kaisheng

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 Changzhou Kefeng

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 Transpex

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

The Global Terephthaloyl Chloride (TPC) Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Terephthaloyl Chloride (TPC) Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS