Global Testing and Commissioning Market Size, Trends & Analysis - Forecasts to 2028 By Service Type (Testing, Certification, and Commissioning), By Sourcing Type (Inhouse and Outsourcing), By End-use Industry (Consumer Products, Healthcare, Oil and Gas, Food and Agriculture, Manufacturing, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

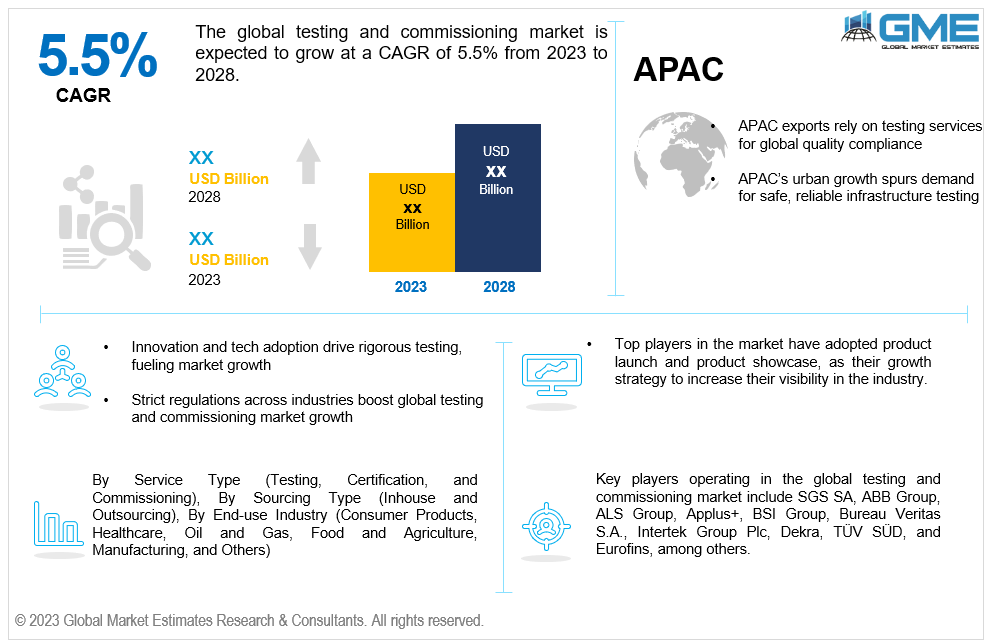

The global testing and commissioning market is expected to exhibit a CAGR of 5.5% from 2023 to 2028. Testing and commissioning processes ensure that systems, equipment, and facilities operate as intended, meet safety and regulatory standards, and are ready for regular use. Functional testing involves checking individual components and subsystems to ensure they function correctly. Integration testing focuses on how components work together. System capabilities are evaluated during performance testing under various circumstances, including load, stress, and scalability. Safety testing ensures that a system complies with safety standards and operates safely. Commissioning involves testing a system or facility to ensure it operates coherently, adhering to relevant laws and regulations, maintaining proper documentation, and training personnel to operate and maintain the system. This phase ensures compliance with industry standards, proper operation, and effective response to issues.

Several factors impact the global testing and commissioning market growth and evolution. Governments worldwide have imposed mandatory testing regulations to ensure product safety and quality, pushing organizations to seek independent laboratories for compliance. Industries like automotive are grappling with strict emissions standards, compelling original equipment manufacturers (OEMs) to control carbon emissions through testing and commissioning services. Leading manufacturers are outsourcing these services to meet quality and safety standards, reduce environmental impacts, and cut operational costs. Outsourcing allows organizations to allocate more resources to their core processes, enhancing production efficiency and ultimately improving net profits. The market structure is fragmented with numerous global and regional players, and while new entrants are moderate due to high legal barriers, competitive analysis reveals a growing market with product differentiation. In summary, the testing and commissioning market growth is propelled by regulatory compliance, environmental sustainability, cost reduction, and outsourcing benefits.

The market faces several challenges that can impact its growth. Budget constraints and economic fluctuations can hinder investment in testing and commissioning services, especially in sectors like construction and infrastructure. Additionally, the shortage of skilled professionals and the high cost of training can limit the industry's capacity to meet demand effectively. Geopolitical tensions and trade disputes can disrupt supply chains and increase the cost of equipment and technology needed for testing. These restraints collectively challenge the growth of the global testing and commissioning market, necessitating strategic adaptations to mitigate their impact and foster resilience in the industry.

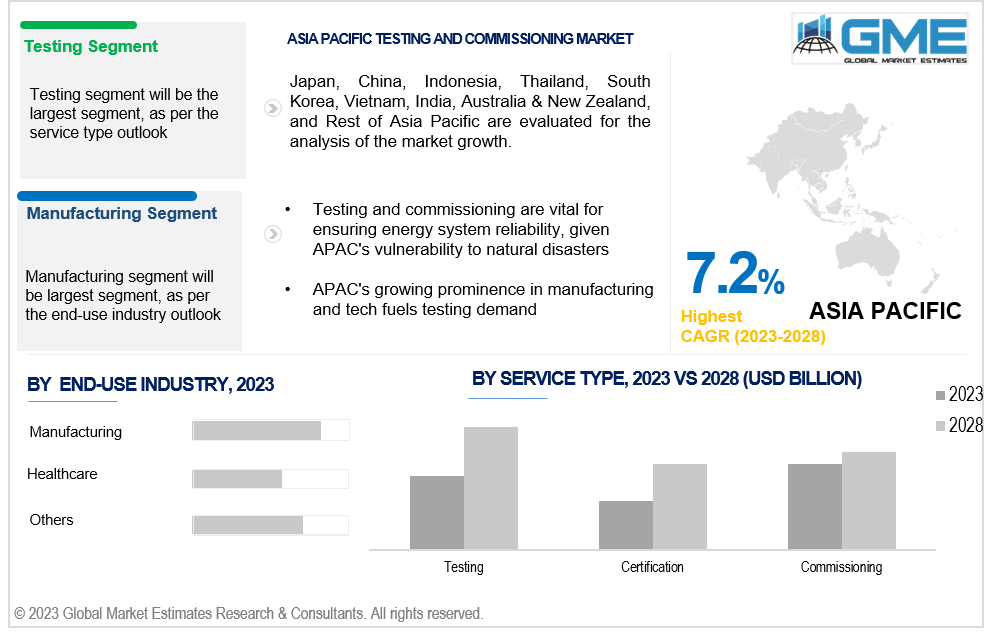

On the basis of service type, the market is segmented into testing, certification, and commissioning. The testing segment is expected to be the largest segment during the forecast period. Manufacturing, construction, and healthcare industries rely heavily on rigorous testing to meet regulatory standards and customer expectations. Increasing technology complexity and the need for precise evaluation have driven the demand for testing services, making it a pivotal and expanding segment within the testing and commissioning market.

The certification segment is expected to be the fastest-growing segment in the global testing and commissioning market during the forecast period. Industries such as healthcare, automotive, and electronics require certifications to ensure product quality and safety. Furthermore, environmental concerns and the need for energy-efficient solutions are driving certifications in sustainable practices. As a result, companies are seeking certification services to validate their products and operations, propelling the growth of this segment.

On the basis of sourcing type, the market is segmented into inhouse and outsourcing. The inhouse segment is expected to be the largest segment during the forecast period. This is because many organizations prefer to handle these critical processes internally. This allows them to have greater control over quality, timelines, and costs, particularly in industries with specific needs or proprietary technologies. In-house testing and commissioning teams are often tailored to the organization's unique requirements, making them a preferred choice for ensuring precision, security, and compliance in various sectors.

The outsourcing segment in the global testing and commissioning market is expected to be the fastest-growing due to its cost-efficiency and access to specialized expertise. Many organizations outsource testing and commissioning services to reduce operational expenses, leverage external knowledge, and focus on their core competencies. Outsourcing enables companies to adapt quickly to changing market dynamics and access a global pool of skilled professionals, fostering rapid growth in this segment.

On the basis of the end-use industry, the market is segmented into consumer products, healthcare, oil and gas, food and agriculture, manufacturing, and others. The manufacturing segment is expected to be the largest segment during the forecast period. This is due to the industry's extensive reliance on quality assurance and compliance testing. Manufacturers need rigorous testing to ensure product safety, reliability, and regulatory compliance. Additionally, the growing complexity of manufacturing processes, increased automation, and the demand for precision requires comprehensive testing and commissioning services. This consistent need for quality control and adherence to standards has propelled the manufacturing sector to the forefront of the market.

The healthcare segment is the fastest-growing in the global testing and commissioning market. The increasing global population, aging demographics, and rising prevalence of chronic diseases have driven higher demand for healthcare facilities and services. Stringent regulatory requirements and the need for precision and reliability in healthcare equipment and systems also contribute to the growing demand for testing and commissioning services in this segment. Additionally, the pandemic has accelerated investments in healthcare infrastructure and technology, further boosting the segment growth.

North America is analysed to account for the largest share in the global testing and commissioning market during the forecast period. North America's diverse industrial landscape, including construction, manufacturing, energy, healthcare, and information technology, necessitates rigorous testing and commissioning services for compliance, safety, and optimal performance. Stringent regulatory standards in the U.S., including building codes, environmental standards, and safety protocols, require significant investment in testing. North America's technological advancements, adoption of automation and AI-driven solutions, and strong focus on quality assurance further contribute to its leadership in the market. A robust presence of testing and commissioning service providers further strengthens North America’s dominance in the global market.

Asia Pacific is expected to be the fastest-growing region across the global testing and commissioning market. Rapid urbanization and industrialization in countries like China, India, and Southeast Asia drive demand for testing and commissioning services. Stringent government regulations and a growing focus on quality and safety standards also drive the need for comprehensive testing in sectors like energy, construction, and healthcare. The region's adoption of advanced technologies and burgeoning middle-class drive innovation and market expansion. The skilled labour and cost-effective workforce make it an attractive outsourcing destination.

Key players operating in the global testing and commissioning market include SGS SA, ABB Group, ALS Group, Applus+, BSI Group, Bureau Veritas S.A., Intertek Group Plc, Dekra, TÜV SÜD, and Eurofins, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL TESTING AND COMMISSIONING MARKET, BY SERVICE TYPE

4.1 Introduction

4.2 Testing and Commissioning Market: Service Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Testing

4.4.1 Testing Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Commissioning

4.5.1 Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Certification

4.6.1 Certification Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL TESTING AND COMMISSIONING MARKET, BY END-USE INDUSTRY

5.1 Introduction

5.2 Testing and Commissioning Market: End-use Industry Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Consumer Products

5.4.1 Consumer Products Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 Healthcare

5.5.1 Healthcare Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6 Oil and Gas

5.6.1 Oil and Gas Market Estimates and Forecast, 2020-2028 (USD Billion)

5.7 Food and Agriculture

5.7.1 Food and Agriculture Market Estimates and Forecast, 2020-2028 (USD Billion)

5.8 Manufacturing

5.8.1 Manufacturing Market Estimates and Forecast, 2020-2028 (USD Billion)

5.9 Other Industries

5.9.1 Other Industries Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL TESTING AND COMMISSIONING MARKET, BY SOURCING TYPE

6.1 Introduction

6.2 Testing and Commissioning Market: Sourcing Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Inhouse

6.4.1 Inhouse Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5 Outsourcing

6.5.1 Outsourcing Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL TESTING AND COMMISSIONING MARKET, BY REGION

7.1 Introduction

7.2 North America Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.1 By Service Type

7.2.2 By End-use Industry

7.2.3 By Sourcing Type

7.2.4 By Country

7.2.4.1 U.S. Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.1.1 By Service Type

7.2.4.1.2 By End-use Industry

7.2.4.1.3 By Sourcing Type

7.2.4.2 Canada Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.2.1 By Service Type

7.2.4.2.2 By End-use Industry

7.2.4.2.3 By Sourcing Type

7.2.4.3 Mexico Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.3.1 By Service Type

7.2.4.3.2 By End-use Industry

7.2.4.3.3 By Sourcing Type

7.3 Europe Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.1 By Service Type

7.3.2 By End-use Industry

7.3.3 By Sourcing Type

7.3.4 By Country

7.3.4.1 Germany Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.1.1 By Service Type

7.3.4.1.2 By End-use Industry

7.3.4.1.3 By Sourcing Type

7.3.4.2 U.K. Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.2.1 By Service Type

7.3.4.2.2 By End-use Industry

7.3.4.2.3 By Sourcing Type

7.3.4.3 France Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.3.1 By Service Type

7.3.4.3.2 By End-use Industry

7.3.4.3.3 By Sourcing Type

7.3.4.4 Italy Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.4.1 By Service Type

7.3.4.4.2 By End-use Industry

7.2.4.4.3 By Sourcing Type

7.3.4.5 Spain Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.5.1 By Service Type

7.3.4.5.2 By End-use Industry

7.2.4.5.3 By Sourcing Type

7.3.4.6 Netherlands Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.7.1 By Service Type

7.3.4.7.2 By End-use Industry

7.2.4.7.3 By Sourcing Type

7.3.4.7 Rest of Europe Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.7.1 By Service Type

7.3.4.7.2 By End-use Industry

7.2.4.7.3 By Sourcing Type

7.4 Asia Pacific Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.1 By Service Type

7.4.2 By End-use Industry

7.4.3 By Sourcing Type

7.4.4 By Country

7.4.4.1 China Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.1.1 By Service Type

7.4.4.1.2 By End-use Industry

7.4.4.1.3 By Sourcing Type

7.4.4.2 Japan Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.2.1 By Service Type

7.4.4.2.2 By End-use Industry

7.4.4.2.3 By Sourcing Type

7.4.4.3 India Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.3.1 By Service Type

7.4.4.3.2 By End-use Industry

7.4.4.3.3 By Sourcing Type

7.4.4.4 South Korea Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.4.1 By Service Type

7.4.4.4.2 By End-use Industry

7.4.4.4.3 By Sourcing Type

7.4.4.5 Singapore Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.5.1 By Service Type

7.4.4.5.2 By End-use Industry

7.4.4.5.3 By Sourcing Type

7.4.4.6 Malaysia Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.1 By Service Type

7.4.4.7.2 By End-use Industry

7.4.4.7.3 By Sourcing Type

7.4.4.7 Thailand Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.1 By Service Type

7.4.4.7.2 By End-use Industry

7.4.4.7.3 By Sourcing Type

7.4.4.8 Indonesia Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.8.1 By Service Type

7.4.4.8.2 By End-use Industry

7.4.4.8.3 By Sourcing Type

7.4.4.9 Vietnam Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.9.1 By Service Type

7.4.4.9.2 By End-use Industry

7.4.4.9.3 By Sourcing Type

7.4.4.10 Taiwan Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.10.1 By Service Type

7.4.4.10.2 By End-use Industry

7.4.4.10.3 By Sourcing Type

7.4.4.11 Rest of Asia Pacific Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.11.1 By Service Type

7.4.4.11.2 By End-use Industry

7.4.4.11.3 By Sourcing Type

7.5 Middle East and Africa Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.1 By Service Type

7.5.2 By End-use Industry

7.5.3 By Sourcing Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.1.1 By Service Type

7.5.4.1.2 By End-use Industry

7.5.4.1.3 By Sourcing Type

7.5.4.2 U.A.E. Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.2.1 By Service Type

7.5.4.2.2 By End-use Industry

7.5.4.2.3 By Sourcing Type

7.5.4.3 Israel Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.3.1 By Service Type

7.5.4.3.2 By End-use Industry

7.5.4.3.3 By Sourcing Type

7.5.4.4 South Africa Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.4.1 By Service Type

7.5.4.4.2 By End-use Industry

7.5.4.4.3 By Sourcing Type

7.5.4.5 Rest of Middle East and Africa Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.5.1 By Service Type

7.5.4.5.2 By End-use Industry

7.5.4.5.2 By Sourcing Type

7.6 Central and South America Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.1 By Service Type

7.7.2 By End-use Industry

7.7.3 By Sourcing Type

7.7.4 By Country

7.7.4.1 Brazil Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.1.1 By Service Type

7.7.4.1.2 By End-use Industry

7.7.4.1.3 By Sourcing Type

7.7.4.2 Argentina Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.2.1 By Service Type

7.7.4.2.2 By End-use Industry

7.7.4.2.3 By Sourcing Type

7.7.4.3 Chile Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.3.1 By Service Type

7.7.4.3.2 By End-use Industry

7.7.4.3.3 By Sourcing Type

7.7.4.4 Rest of Central and South America Testing and Commissioning Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.4.1 By Service Type

7.7.4.4.2 By End-use Industry

7.7.4.4.3 By Sourcing Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 SGS SA

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 ABB Group

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 ALS Group

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Applus+

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 BSI Group

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Intertek Group Plc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 Bureau Veritas S.A.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Dekra

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Eurofins

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Other Companies

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

2 Testing Market, By Region, 2020-2028 (USD Billion)

3 Commissioning Market, By Region, 2020-2028 (USD Billion)

4 Certification Market, By Region, 2020-2028 (USD Billion)

5 Global Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

6 CONSUMER PRODUCTS Market, By Region, 2020-2028 (USD Billion)

7 HEALTHCARE Market, By Region, 2020-2028 (USD Billion)

8 Oil and Gas Market, By Region, 2020-2028 (USD Billion)

9 Food and Agriculture Market, By Region, 2020-2028 (USD Billion)

10 Manufacturing Market, By Region, 2020-2028 (USD Billion)

11 Other Industries Market, By Region, 2020-2028 (USD Billion)

12 Global Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

13 Inhouse Market, By Region, 2020-2028 (USD Billion)

14 Outsourcing Market, By Region, 2020-2028 (USD Billion)

15 Regional Analysis, 2020-2028 (USD Billion)

16 North America Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

17 North America Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

18 North America Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

19 North America Testing and Commissioning Market, By Country, 2020-2028 (USD Billion)

20 U.S. Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

21 U.S. Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

22 U.S Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

23 Canada Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

24 Canada Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

25 Canada Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

26 Mexico Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

27 Mexico Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

28 Mexico Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

29 Europe Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

30 Europe Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

31 Europe Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

32 Germany Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

33 Germany Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

34 Germany Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

35 U.K. Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

36 U.K. Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

37 U.K. Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

38 France Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

39 France Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

40 France Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

41 Italy Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

42 Italy Testing and Commissioning Market, By T End-use Industry Type, 2020-2028 (USD Billion)

43 Italy Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

44 Spain Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

45 Spain Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

46 Spain Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

47 Rest Of Europe Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

48 Rest Of Europe Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

49 Rest of Europe Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

50 Asia Pacific Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

51 Asia Pacific Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

52 Asia Pacific Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

53 Asia Pacific Testing and Commissioning Market, By Country, 2020-2028 (USD Billion)

54 China Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

55 China Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

56 China Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

57 India Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

58 India Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

59 India Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

60 Japan Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

61 Japan Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

62 Japan Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

63 South Korea Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

64 South Korea Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

65 South Korea Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

66 Middle East and Africa Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

67 Middle East and Africa Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

68 Middle East and Africa Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

69 Middle East and Africa Testing and Commissioning Market, By Country, 2020-2028 (USD Billion)

70 Saudi Arabia Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

71 Saudi Arabia Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

72 Saudi Arabia Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

73 UAE Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

74 UAE Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

75 UAE Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

76 Central and South America Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

77 Central and South America Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

78 Central and South America Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

79 Central and South America Testing and Commissioning Market, By Country, 2020-2028 (USD Billion)

80 Brazil Testing and Commissioning Market, By Service Type, 2020-2028 (USD Billion)

81 Brazil Testing and Commissioning Market, By End-use Industry, 2020-2028 (USD Billion)

82 Brazil Testing and Commissioning Market, By Sourcing Type, 2020-2028 (USD Billion)

83 SGS SA: Products & Services Offering

84 ABB Group: Products & Services Offering

85 ALS Group: Products & Services Offering

86 Applus+: Products & Services Offering

87 BSI Group: Products & Services Offering

88 INTERTEK GROUP PLC.: Products & Services Offering

89 Bureau Veritas S.A. : Products & Services Offering

90 Dekra: Products & Services Offering

91 Eurofins, Inc: Products & Services Offering

92 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Testing and Commissioning Market Overview

2 Global Testing and Commissioning Market Value From 2020-2028 (USD Billion)

3 Global Testing and Commissioning Market Share, By Service Type (2022)

4 Global Testing and Commissioning Market Share, By End-use Industry (2022)

5 Global Testing and Commissioning Market Share, By Sourcing Type (2022)

6 Global Testing and Commissioning Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Testing and Commissioning Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Testing and Commissioning Market

11 Impact Of Challenges On The Global Testing and Commissioning Market

12 Porter’s Five Forces Analysis

13 Global Testing and Commissioning Market: By Service Type Scope Key Takeaways

14 Global Testing and Commissioning Market, By Service Type Segment: Revenue Growth Analysis

15 Testing Market, By Region, 2020-2028 (USD Billion)

16 Commissioning Market, By Region, 2020-2028 (USD Billion)

17 Certification Market, By Region, 2020-2028 (USD Billion)

18 Global Testing and Commissioning Market: By End-use Industry Scope Key Takeaways

19 Global Testing and Commissioning Market, By End-use Industry Segment: Revenue Growth Analysis

20 Consumer Products Market, By Region, 2020-2028 (USD Billion)

21 Healthcare Market, By Region, 2020-2028 (USD Billion)

22 Oil and Gas Market, By Region, 2020-2028 (USD Billion)

23 Food and Agriculture Market, By Region, 2020-2028 (USD Billion)

24 Manufacturing Market, By Region, 2020-2028 (USD Billion)

25 Other Industries Market, By Region, 2020-2028 (USD Billion)

26 Global Testing and Commissioning Market: By Sourcing Type Scope Key Takeaways

27 Global Testing and Commissioning Market, By Sourcing Type Segment: Revenue Growth Analysis

28 Inhouse Market, By Region, 2020-2028 (USD Billion)

29 Outsourcing Market, By Region, 2020-2028 (USD Billion)

30 Regional Segment: Revenue Growth Analysis

31 Global Testing and Commissioning Market: Regional Analysis

32 North America Testing and Commissioning Market Overview

33 North America Testing and Commissioning Market, By Service Type

34 North America Testing and Commissioning Market, By End-use Industry

35 North America Testing and Commissioning Market, By Sourcing Type

36 North America Testing and Commissioning Market, By Country

37 U.S. Testing and Commissioning Market, By Service Type

38 U.S. Testing and Commissioning Market, By End-use Industry

39 U.S. Testing and Commissioning Market, By Sourcing Type

40 Canada Testing and Commissioning Market, By Service Type

41 Canada Testing and Commissioning Market, By End-use Industry

42 Canada Testing and Commissioning Market, By Sourcing Type

43 Mexico Testing and Commissioning Market, By Service Type

44 Mexico Testing and Commissioning Market, By End-use Industry

45 Mexico Testing and Commissioning Market, By Sourcing Type

46 Four Quadrant Positioning Matrix

47 Company Market Share Analysis

48 SGS SA: Company Snapshot

49 SGS SA: SWOT Analysis

50 SGS SA: Geographic Presence

51 ABB Group: Company Snapshot

52 ABB Group: SWOT Analysis

53 ABB Group: Geographic Presence

54 ALS Group: Company Snapshot

55 ALS Group: SWOT Analysis

56 ALS Group: Geographic Presence

57 Applus+: Company Snapshot

58 Applus+: Swot Analysis

59 Applus+: Geographic Presence

60 BSI Group: Company Snapshot

61 BSI Group: SWOT Analysis

62 BSI Group: Geographic Presence

63 Intertek Group Plc.: Company Snapshot

64 Intertek Group Plc.: SWOT Analysis

65 Intertek Group Plc.: Geographic Presence

66 Bureau Veritas S.A. : Company Snapshot

67 Bureau Veritas S.A. : SWOT Analysis

68 Bureau Veritas S.A. : Geographic Presence

69 Dekra: Company Snapshot

70 Dekra: SWOT Analysis

71 Dekra: Geographic Presence

72 Eurofins, Inc.: Company Snapshot

73 Eurofins, Inc.: SWOT Analysis

74 Eurofins, Inc.: Geographic Presence

75 Other Companies: Company Snapshot

76 Other Companies: SWOT Analysis

77 Other Companies: Geographic Presence

The Global Testing and Commissioning Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Testing and Commissioning Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS