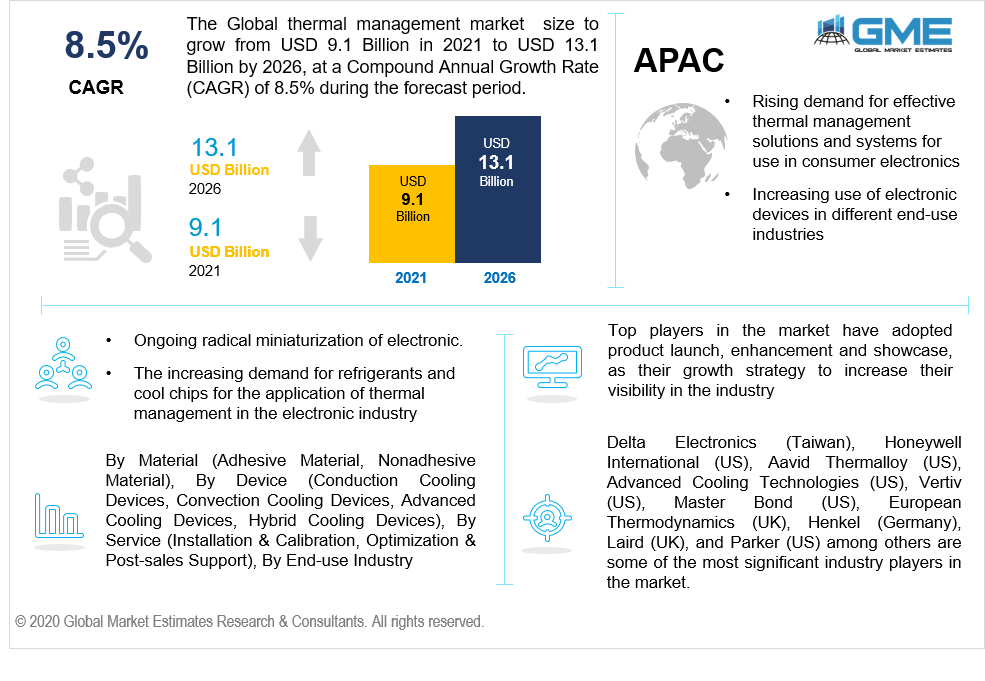

Global Thermal Management Market Size, Trends, and Analysis - Forecasts to 2026 By Material (Adhesive Material, Nonadhesive Material), By Device (Conduction Cooling Devices, Convection Cooling Devices, Advanced Cooling Devices, Hybrid Cooling Devices), By Service (Installation & Calibration, Optimization & Post-sales Support), By End-use Industry (Aerospace & Defense, Automotive, Servers & Data Centers, Consumer Electronics, Enterprises, Healthcare, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The global thermal management market is projected to grow from USD 9.1 billion in 2021 and is analyzed to reach USD 13.1 billion by 2026 at CAGR of 8.5%. The growth of the thermal management market is fueled by rising demand for effective thermal management solutions and systems for use in consumer electronics, increasing use of electronic devices in different end-use industries, and ongoing radical miniaturization of electronic.

Most of the industries are adopting electronic devices in their regular process management. These electronic devices range from essential devices used at a individual level to large-scale devices used in industries and manufacturing businesses. These devices generate tremendous heat once put to use. In case of excessive generation of heat, the devices are at a risk of failures or breakdowns. That is when the thermal management is required to prevent the electronics from these failures and ensure reliability.

The growing demand for electronic devices is one of the biggest promoters of thermal management market. Besides the electronic devices, other industries with electrical coverage and outlets are also at high risks of over heating of control panels, which need intense regulations under the assistance of thermal management. Lack of adequate thermal assistance or management has incurred many losses and risks in industries with electronic control systems. The awareness and necessity of industry maintenance have made the end users adopt thermal solutions.

Due to the COVID-19 lockdown norms, most of the industrial and manufacturing sites were shut all across the globe. This has greatly affected the thermal management market in a negative way. Moreover, the disturbance in electronic device supply chain has challenged the market’s growth. However, due to ease in the lockdown norms in the late 2020, the market is likely to pick up the pace and grow rapidly.

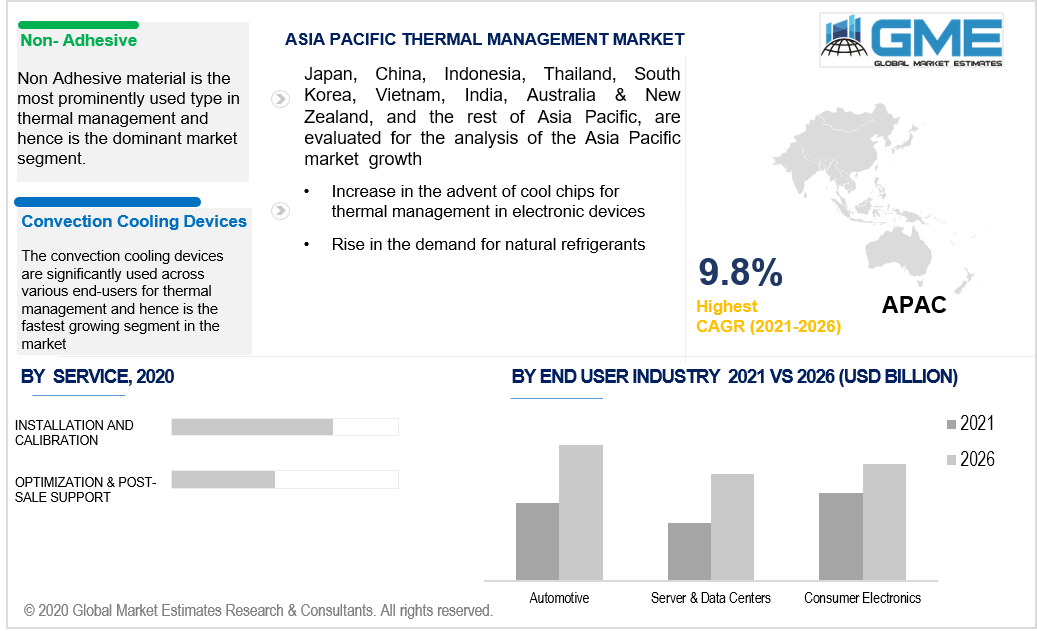

On the basis of material, the market is segmented into adhesive and, nonadhesive materials. Non Adhesive material is the most prominently used type in thermal management and hence is the dominant market segment. These types of materials are significantly less vulnerable to high electrical currents and are highly efficient in controlling and regulating the temperature of the electronics in which they are applied in. The non-adhesive material is also very proficient in handling mechanical shocks and absorption, thus providing more security and reliability to the users. Like thermal pads or other applicants like gap fillers have the ability to structure their physical characteristics according to the requirements in electronic devices. Besides thermal pads, thermals pastes are also used in various electronic applications due to their non adhesive, easy adaptability, temperature control, and air gap filling nature.

Based on the device, the market is segmented into conduction cooling devices, convection cooling devices, advanced cooling devices, and hybrid cooling devices. The convection cooling devices are significantly used across various end-users for thermal management and hence is the fastest growing segment in the market. The convection cooling mechanism utilizes the fluid flows that surround the heated devices. These cooling agents can be fluids or air, which carry the heated thermal energies with its flow and effectively transfer the heat or thermal energy from the heated electronic device to the surrounding air. The heat present in the devices results in the thermal expansion of the fluids passed down through convection cooling devices.

Based on the service, the market is segmented into installation & calibration, optimization & post-sales support. The installation and calibration service is the most essential and utilized service in the thermal management market and hence has bagged the top position in the market. These services enable the end users and the manufacturing companies of the electronic devices to detect and deviations or inaccurate readings in the working of convection cooling devices or the advanced cooling devices. This service ensures the manufacturers and end users to supervise whether the thermal management systems are efficiently installed in the electronic devices.

Aerospace & defense, automotive, servers & data centers, consumer electronics, enterprises, healthcare, others are the segments of the market based on the end-user industry outlook. The automotive industry is the largest end user industry for thermal management and is analyzed to be the top market segment as of 2020. The automotive industry is one of the biggest sources of electronic systems. Right from engines, ignition to a wide range of entertainment systems installed inside vehicles, automotive are the most prominent electronic systems users. With these heavy duty engines and electronic devices installed in the vehicles, they are most likely to generate excessive heat, leading to risky errors and operation failures under lack of thermal management.

As per the geographical analysis, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Central & South America. North America holds the largest share in the market. The presence of large enterprises in countries like the USA and Canada has enabled the North American region to sustain its dominant share in the market.

The Asia-Pacific region is known for its high contribution to various end user industries like electronics, automobiles, servers, and data centers. Attributing to their high share in these end user industries, their demand for thermal management systems is also significantly high compared to the rest of the world. The countries like China and India are a massive center of manufacturers for advanced cooling and convection cooling devices. The increasing usage of electronic devices among consumers has also witnessed a sudden surge in demand, thus increasing the need for more investments in thermal management systems.

Delta Electronics (Taiwan), Honeywell International (US), Aavid Thermalloy (US), Advanced Cooling Technologies (US), Vertiv (US), Master Bond (US), European Thermodynamics (UK), Henkel (Germany), Laird (UK), and Parker (US) among others are some of the most significant industry players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2020, Laird Thermal Systems announced the launch of a new UltraTEC UTX Series thermoelectric cooler that ensures better and higher efficiency than the regular thermoelectric coolers.

In February 2020, Honeywell introduced a new platform into the market called Solstice E-Cooling that more efficiently and effectively cools down the high-performance electronics compared to traditional methods.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Thermal Management Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Device Overview

2.1.3 Service Overview

2.1.4 End-User Overview

2.1.5 Materials Overview

2.1.6 Regional Overview

Chapter 3 Thermal Management Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in thermal management solutions

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Device Growth Scenario

3.4.2 Service Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Materials Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Materials Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Thermal Management Market, By Device

4.1 Device Outlook

4.2 Conduction Cooling Devices

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Mechanical Tubes

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Convection Cooling Devices

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Advanced Cooling Devices

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Hybrid Cooling Devices

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Thermal Management Market, By End-User

5.1 End-User Outlook

5.2 Aerospace & Defense

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Automotive

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Servers & Data Centers

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Consumer Electronics

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Enterprises

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Healthcare

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Thermal Management Market, By Service

6.1 Installation & Calibration

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Optimization & Post-sales Support

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Thermal Management Market, By Materials

7.1 Adhesive Material

7.1.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 Non-adhesive Material

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Thermal Management Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Device, 2016-2026 (USD Million)

8.2.3 Market Size, By Service, 2016-2026 (USD Million)

8.2.4 Market Size, By End-User, 2016-2026 (USD Million)

8.2.5 Market Size, By Materials, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Device, 2016-2026 (USD Million)

8.2.4.2 Market Size, By Service, 2016-2026 (USD Million)

8.2.4.3 Market Size, By End-User, 2016-2026 (USD Million)

Market Size, By Materials, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Device, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Service, 2016-2026 (USD Million)

8.2.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Device, 2016-2026 (USD Million)

8.3.3 Market Size, By Service, 2016-2026 (USD Million)

8.3.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.5 Market Size, By Materials, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Device, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Service, 2016-2026 (USD Million)

8.3.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Device, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Service, 2016-2026 (USD Million)

8.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Device, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Service, 2016-2026 (USD Million)

8.3.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Device, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Service, 2016-2026 (USD Million)

8.3.9.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Device, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Service, 2016-2026 (USD Million)

8.3.10.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Device, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Service, 2016-2026 (USD Million)

8.3.11.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Device, 2016-2026 (USD Million)

8.4.3 Market Size, By Service, 2016-2026 (USD Million)

8.4.4 Market Size, By End-User, 2016-2026 (USD Million)

8.4.5 Market Size, By Materials, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Device, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Service, 2016-2026 (USD Million)

8.4.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Device, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Service, 2016-2026 (USD Million)

8.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Device, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Service, 2016-2026 (USD Million)

8.4.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Device, 2016-2026 (USD Million)

8.4.9.2 Market size, By Service, 2016-2026 (USD Million)

8.4.9.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.9.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Device, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Service, 2016-2026 (USD Million)

8.4.10.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Materials, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Device, 2016-2026 (USD Million)

8.5.3 Market Size, By Service, 2016-2026 (USD Million)

8.5.4 Market Size, By End-User, 2016-2026 (USD Million)

8.5.5 Market Size, By Materials, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Device, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Service, 2016-2026 (USD Million)

8.5.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Materials, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Device, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Service, 2016-2026 (USD Million)

8.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Device, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Service, 2016-2026 (USD Million)

8.5.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Materials, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Device, 2016-2026 (USD Million)

8.6.3 Market Size, By Service, 2016-2026 (USD Million)

8.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.6.5 Market Size, By Materials, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Device, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Service, 2016-2026 (USD Million)

8.6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Materials, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Device, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Service, 2016-2026 (USD Million)

8.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Device, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Service, 2016-2026 (USD Million)

8.6.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Materials, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Delta Electronics

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Honeywell International

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Aavid Thermalloy

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Advanced Cooling Technologies

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Vertiv

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Master Bond

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 European Thermodynamics

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Henkel

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Laird

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Thermal Management Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Thermal Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS