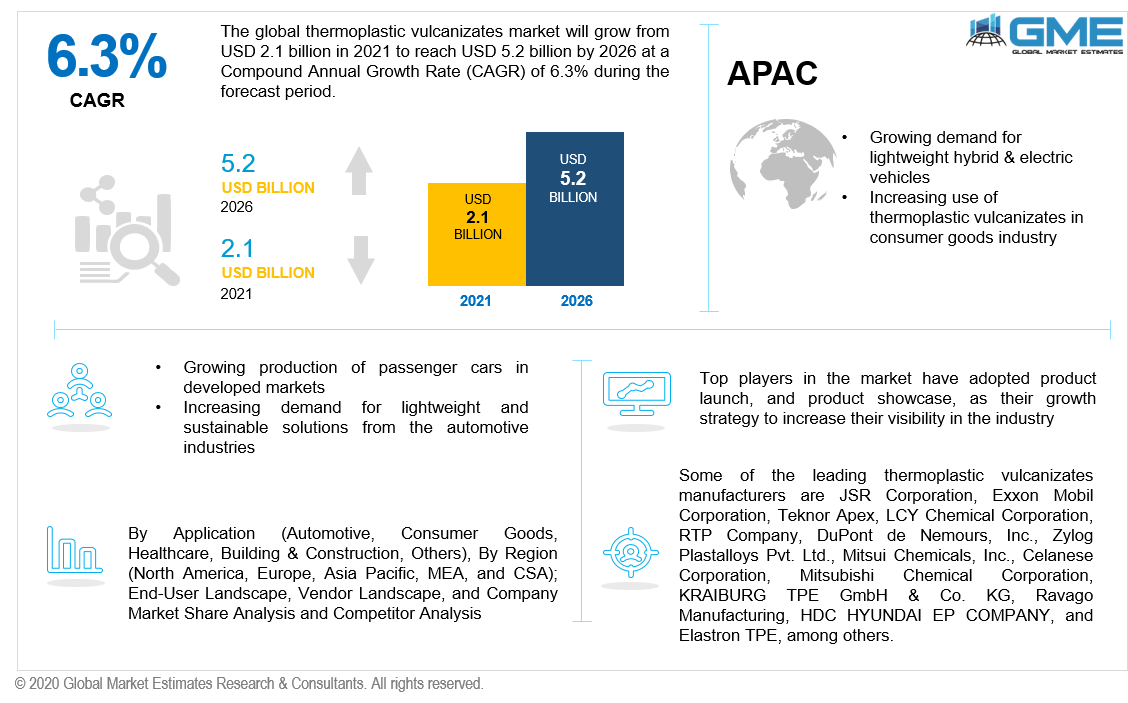

Global Thermoplastic Vulcanizates Market Size, Trends & Analysis - Forecasts to 2026 By Application (Automotive, Consumer Goods, Healthcare, Building & Construction, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

The global thermoplastic vulcanizates market will grow from USD 2.1 billion in 2021 to reach USD 5.2 billion in 2026, with a CAGR value of 6.3%.

Thermoplastic vulcanizates (TPVs) are thermoplastic elastomers that dynamically vulcanize during the melt mixing procedure reaching a semicrystalline thermoplastic matrix phase at an extreme temperature point. The rising demand for thermoplastic vulcanizates and increasing demand for lightweight materials from the automotive and healthcare industries are expected to drive the market growth during the forecast period. Due to strict regulations imposed regarding the use of PVC in the automotive sector, thermoplastic vulcanizate is being utilized as a substitute for PVC plastic, which is ultimately expected to boost product demand during the forecast period.

Furthermore, thermoplastic vulcanizates are high-performance elastomers with high durability, exceptional flexibility, offers manufacturing ease, and possess high resistance to heat, fluids, and other companion chemicals. These characteristics make them an excellent candidate for the fabrication of lightweight automotive parts such as car doors, under-the-hood components, and weather seals. Hence, these factors are likely to support the growth of the market. Moreover, the growing adoption of TPV in the healthcare industry is also projected to be a major growth driver for the market.

Favorable government laws on carbon emissions imposed by various agencies, such as the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA), as well as EU initiatives to develop TPV applications for the creation of lightweight and fuel-efficient cars, are expected to boost the global TPV market growth. Moreover, increasing use of thermoplastic vulcanizate across consumers and fluid handling are the leading drivers of the thermoplastic vulcanizates market.

The most significant benefit of using TPV is cost, i.e. thermoplastic vulcanizates cost around 10-30% lesser than EPDM. Also, this material has a lower molecular weight, high design flexibility, and high recyclability nature. These features allow the material to be used in fuel-efficient automobile production. It is anticipated that every 10% reduction in vehicle weight results in a 5-7 percent reduction in fuel consumption. Hence, these factors will help the TPV market grow rapidly.

Furthermore, the global COVID-19 pandemic has created a dramatic slowdown in the automobile and manufacturing industries owing to the implementation of countrywide lockdown to prevent the spread of coronavirus. This is likely to further impede the market growth during the next 2 quarters of 2021.

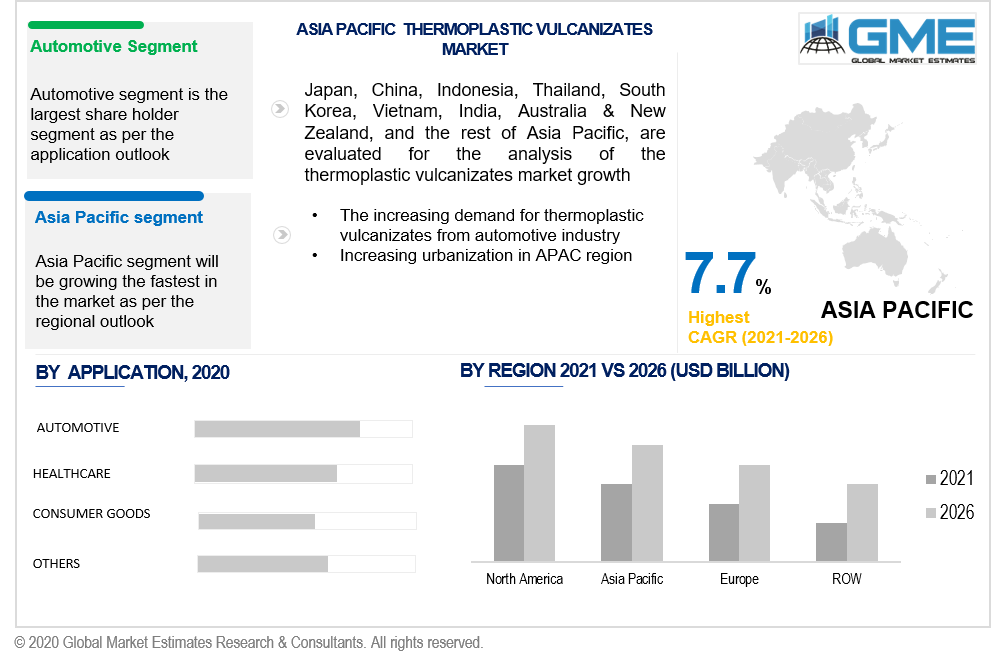

Automotive, consumer goods, healthcare, building & construction, and other applications are the major application segments of the thermoplastic vulcanizates market. The automotive application is expected to hold the largest share of the market in terms of revenue from 2021 to 2026 owing to its high-performance and lightweight characteristic for the automotive sector.

Furthermore, owing to the growing demand for premium, low-emission, safe, and high-performance vehicles the TPV market is likely to grow rapidly during the forecast period.

As per the geographical analysis, the thermoplastic vulcanizates market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The largest share of the North American region is mainly due to the presence of key competitors in the U.S. market, the increasing number of passenger car production in the U.S., and the increasing use of hybrid vehicles on road. Furthermore, growth in the building & construction and automobile industry, along with the rising use of thermoplastic vulcanizates in the aforementioned industries, are likely to be the primary factors driving industry growth throughout the forecast period.

Celanese Corporation is one of the major players in the market which is predominately distributing thermoplastic vulcanizates i.e., forprene TPV product exclusively in the U.S. and worldwide making it one of the top players in the market.

Furthermore, the Asia Pacific region will grow with the highest CAGR rate in the market. The presence of substantial consumer goods manufacturing business in India, and China, as well as growing government attempts to boost electric vehicle production, is likely to fuel market expansion throughout the forecast period.

Moreover, China is focusing its efforts on enhancing electric vehicle manufacturing and sales. The country intends to increase electric vehicle (EV) production to 2 million per year by 2021 and 7 million per year by 2025 to achieve this goal. If achieved, China's electric vehicle output could reach 20% of total new vehicle production by 2025. Tokyo, among the rest of the major cities in the region, emerged as the top market for investments and development potential. Hence the Asia Pacific region will be growing the fastest in the market with the highest CAGR value.

Some of the leading thermoplastic vulcanizates manufacturers are JSR Corporation, Exxon Mobil Corporation, Teknor Apex, LCY Chemical Corporation, RTP Company, DuPont de Nemours, Inc., Zylog Plastalloys Pvt. Ltd., Mitsui Chemicals, Inc., Celanese Corporation, KUMHO POLYCHEM, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, KRAIBURG TPE GmbH & Co. KG, Ravago Manufacturing, HDC HYUNDAI EP COMPANY, and Elastron TPE, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2019, ExxonMobil Corporation, a market leader in thermoplastic vulcanizates, established its 90,000-tonne-per-year resins facility and a 140,000-tonne-per-year butyl plant in Singapore.

In September 2018, DuPont, a major player in the thermoplastic vulcanizates market, invested more than USD 80 million in the construction program for building a new manufacturing facility in East China.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Thermoplastic Vulcanizates Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Regional Overview

Chapter 3 Global Thermoplastic Vulcanizates Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing use of thermoplastic vulcanizates in the healthcare sector

3.3.2 Industry Challenges

3.3.2.1 Sudden loss in the automotive industry in major countries

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Thermoplastic Vulcanizates Market, By Application

4.1 Application Outlook

4.2 Automotive

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Consumer Goods

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Healthcare

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Building & Construction

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Thermoplastic Vulcanizates Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market Size, By Country 2020-2026 (USD Billion)

5.2.2 Market Size, By Application, 2020-2026 (USD Billion)

5.2.3 U.S.

5.2.3.1 Market Size, By Application, 2020-2026 (USD Billion)

5.2.4 Canada

5.2.4.1 Market Size, By Application, 2020-2026 (USD Billion)

5.3 Europe

5.3.1 Market Size, By Country 2020-2026 (USD Billion)

5.3.2 Market Size, By Application, 2020-2026 (USD Billion)

5.3.4 Germany

5.3.4.1 Market Size, By Application, 2020-2026 (USD Billion)

5.3.5 UK

5.3.5.1 Market Size, By Application, 2020-2026 (USD Billion)

5.3.6 France

5.3.6.1 Market Size, By Application, 2020-2026 (USD Billion)

5.3.7 Italy

5.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

5.3.8 Spain

5.3.8.1 Market Size, By Application, 2020-2026 (USD Billion)

5.3.9 Russia

5.3.9.1 Market Size, By Application, 2020-2026 (USD Billion)

5.4 Asia Pacific

5.4.1 Market Size, By Country 2020-2026 (USD Billion)

5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

5.4.3 China

5.4.4.1 Market Size, By Application, 2020-2026 (USD Billion)

5.4.4 India

5.4.5.1 Market Size, By Application, 2020-2026 (USD Billion)

5.4.5 Japan

5.4.5.1 Market Size, By Application, 2020-2026 (USD Billion)

5.4.6 Australia

5.4.6.1 Market Size, By Application, 2020-2026 (USD Billion)

5.4.7 South Korea

5.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

5.5 Latin America

5.5.1 Market Size, By Country 2020-2026 (USD Billion)

5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

5.5.3 Brazil

5.5.3.1 Market Size, By Application, 2020-2026 (USD Billion)

5.5.4 Mexico

5.5.4.1 Market Size, By Application, 2020-2026 (USD Billion)

5.5.5 Argentina

5.5.5.1 Market Size, By Application, 2020-2026 (USD Billion)

5.5 MEA

5.5.1 Market Size, By Country 2020-2026 (USD Billion)

5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

5.5.3 Saudi Arabia

5.5.3.1 Market Size, By Application, 2020-2026 (USD Billion)

5.5.4 UAE

5.5.4.1 Market Size, By Application, 2020-2026 (USD Billion)

5.5.5 South Africa

5.5.5.1 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 6 Company Landscape

6.1 Competitive Analysis, 2020

6.2 LCY Chemical Corporation

6.2.1 Company Overview

6.2.2 Financial Analysis

6.2.3 Strategic Positioning

6.2.4 Info-Graphic Analysis

6.3 JSR Corporation

6.3.1 Company Overview

6.3.2 Financial Analysis

6.3.3 Strategic Positioning

6.3.4 Info-Graphic Analysis

6.4 DuPont de Nemours, Inc

6.4.1 Company Overview

6.4.2 Financial Analysis

6.4.3 Strategic Positioning

6.4.4 Info-Graphic Analysis

6.5 Exxon Mobil Corporation

6.5.1 Company Overview

6.5.2 Financial Analysis

6.5.3 Strategic Positioning

6.5.4 Info-Graphic Analysis

6.6 Teknor Apex

6.6.1 Company Overview

6.6.2 Financial Analysis

6.6.3 Strategic Positioning

6.6.4 Info-Graphic Analysis

6.7 Mitsui Chemicals, Inc

6.7.1 Company Overview

6.7.2 Financial Analysis

6.7.3 Strategic Positioning

6.7.4 Info-Graphic Analysis

6.8 Celanese Corporation

6.8.1 Company Overview

6.8.2 Financial Analysis

6.8.3 Strategic Positioning

6.8.4 Info-Graphic Analysis

6.9 LyondellBasell Industries Holdings B.V.

6.9.1 Company Overview

6.9.2 Financial Analysis

6.9.3 Strategic Positioning

6.9.4 Info-Graphic Analysis

6.10 Mitsubishi Chemical Corporation

6.10.1 Company Overview

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info-Graphic Analysis

6.11 KUMHO POLYCHEM

6.11.1 Company Overview

6.11.2 Financial Analysis

6.11.3 Strategic Positioning

6.11.4 Info-Graphic Analysis

6.12 Other Companies

6.12.1 Company Overview

6.12.2 Financial Analysis

6.12.3 Strategic Positioning

6.12.4 Info-Graphic Analysis

The Global Thermoplastic Vulcanizates Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Thermoplastic Vulcanizates Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS