Global Thrombosis and Hemostasis Biomarkers Market Size, Trends & Analysis - Forecasts to 2028 By Product (Analysers, Reagents & Consumables), By Application (Deep Vein Thrombosis, Pulmonary Embolism, Disseminated Intravascular Coagulation), By End-Use (Hospitals & Clinics, Academic & Research Institutes, Diagnostic Centres), By Test Location (Clinical Laboratory Tests, Point-of-Care Tests), By Test Type (PT, Fibrinogen, D-Dimer, Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

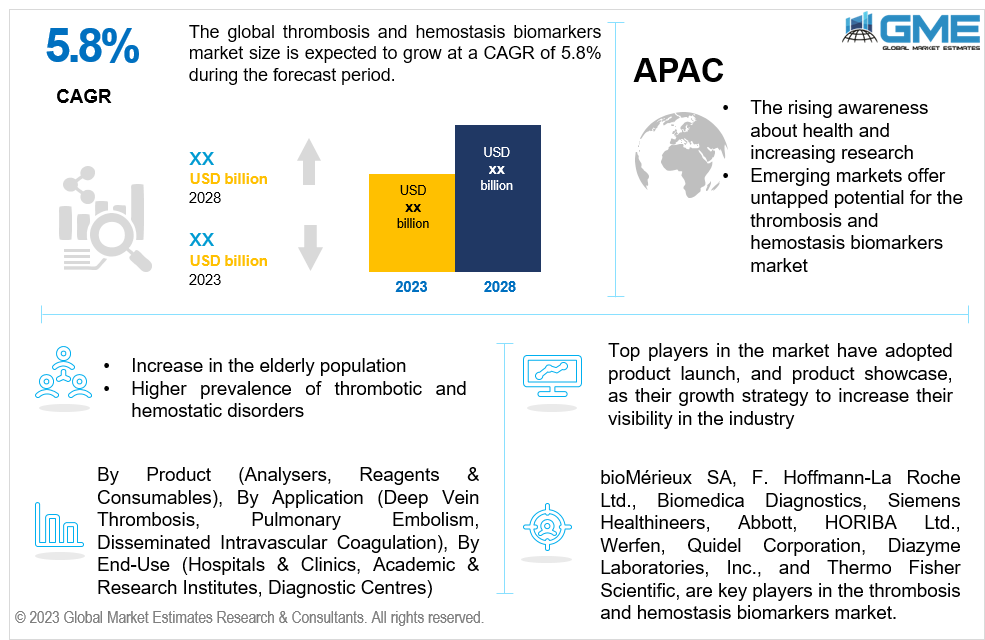

The global thrombosis and hemostasis biomarkers market is projected to grow at a CAGR of 5.8% from 2023 to 2028. Thrombosis and hemostasis biomarkers are specific molecules or indicators present in the body that can be measured and analysed to assess the risk, diagnosis, progression, and treatment response of thrombotic disorders and hemostatic abnormalities. Thrombosis refers to the formation of blood clots within blood vessels, which can lead to serious conditions such as deep vein thrombosis, pulmonary embolism, stroke, and heart attack. Hemostasis, on the other hand, refers to the complex process of blood clot formation and dissolution to maintain a delicate balance between preventing bleeding and promoting clotting.

The growth and significance of the global thrombosis and hemostasis biomarker market are influenced by several factors. One primary driver is the rising occurrence of thrombotic disorders and hemostatic abnormalities worldwide, such as deep vein thrombosis (DVT), pulmonary embolism, and bleeding disorders. These conditions pose significant health risks and necessitate accurate diagnosis and monitoring. Thrombosis and hemostasis biomarkers play a vital role in the identification and assessment of these conditions, enabling timely intervention and personalised treatment strategies.

Another important driving factor in the market is the increasing demand for precise and targeted therapies. Biomarkers provide valuable insights into the underlying mechanisms of thrombosis and hemostasis, aiding in the development of innovative therapeutic approaches. They assist healthcare professionals in identifying patients at higher risk of thrombotic events or bleeding complications, facilitating personalised treatment decisions, and optimising patient outcomes.

Technological advancements in biomarker discovery and diagnostic techniques are also propelling market growth. The introduction of high-throughput screening methods, next-generation sequencing, and molecular diagnostics has streamlined the identification and validation of novel thrombosis and hemostasis biomarkers. These advancements enhance the accuracy, sensitivity, and specificity of biomarker detection, resulting in improved diagnostic capabilities and better patient management.

Furthermore, the ongoing research and development activities focused on biomarker identification and validation contribute to market expansion. Academic institutions, research organisations, and biotechnology companies actively explore the complex mechanisms involved in thrombosis and hemostasis. The aim of this research is to identify reliable biomarkers that serve as indicators of disease progression, treatment response, and risk assessment.

The growing adoption of biomarker-based diagnostic approaches by healthcare providers is another driving force behind market growth. Biomarker testing allows for early detection, risk stratification, and monitoring of thrombotic and hemostatic disorders, leading to improved patient management and outcomes. Recognising the value of biomarkers in optimising patient care, healthcare systems are increasingly incorporating thrombosis and hemostasis biomarker assays into their practises.

Overall, the growth of the global thrombosis and hemostasis biomarkers market is driven by the increasing prevalence of related disorders, the demand for targeted therapies, technological advancements, research and development activities, and the adoption of biomarker-based diagnostic approaches. These drivers collectively contribute to the advancement of diagnostic capabilities, personalised medicine, and improved patient outcomes in the field of thrombosis and hemostasis.

Furthermore, the growing demand for individualised therapies is predicted to drive the market for thrombosis and hemostasis biomarkers.

The biomarkers enable medical professionals to create individualised treatment programmes that are both more efficient and secure for each patient. The idea behind personalised medicine is to provide each patient with a specific course of treatment based on their genetic makeup and medical background. As a result, thrombosis and hemostasis biomarkers are used to identify patients who are more likely to develop blood clots. Researchers from Tohoku University in Japan claim that a recently discovered combination of genetic markers can be used to prevent blood clots in people with IBD, or inflammatory bowel disease. In Japan right now, this illness affects as many as 2,10,000 people.

The British Cardiac Foundation has provided funding for research into the field of transforming cardiac treatments, considering the promise of biomarkers and personalised therapy. Its article states that additional funding for personalised medicine can revolutionise heart therapy in four important ways. These include making personalised pacemakers, preventing heart attacks and strokes using personalised medicine, and anticipating the effects of chemotherapy on the heart, in addition to developing digital hearts to forecast treatment effectiveness.

The deep vein thrombosis segment is expected to witness the largest share in the global thrombosis and hemostasis biomarkers market during the forecast period of 2023-2028. Deep vein thrombosis refers to the formation of blood clots in the deep veins, usually in the legs or pelvis. It is a significant medical condition that can lead to complications such as pulmonary embolism if not diagnosed and treated promptly.

The pulmonary embolism segment is expected to grow the fastest during 2023-2028. Pulmonary embolism occurs when a blood clot, usually originating from deep veins in the legs (DVT), travels to the lungs and blocks the blood vessels, potentially leading to severe complications or even death. The pulmonary embolism is a critical and life-threatening condition that requires timely diagnosis and intervention. The awareness of this condition has been increasing among healthcare professionals and the general population, leading to a higher demand for effective diagnostic tools and biomarkers.

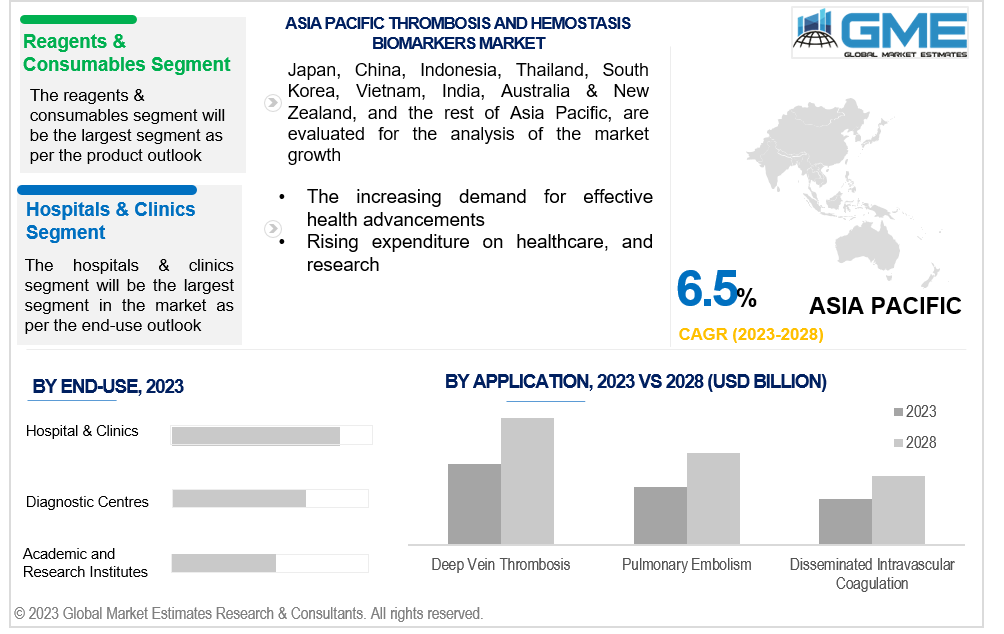

The reagents & consumables segment is expected to witness the largest share in the global thrombosis and hemostasis biomarkers market during the forecast period of 2023-2028. The increasing need for diagnostic tools, the rising prevalence of bleeding and coagulation disorders, and recent product introductions are all factors that contributed to the segment's dominant market dominance. For instance, Yumizen G's instrument range will be compatible with the product introduction of a certain D-dimer parameter announced by HORIBA UK Ltd in March 2019.

The analyser segment is expected to grow the fastest during 2023-2028. The is mainly due to the rising prevalence of coagulation and bleeding diseases as well as technological developments in diagnostic equipment industry.

The clinical laboratory segment is expected to witness the largest share in the global thrombosis and hemostasis biomarkers market during the forecast period of 2023-2028. Clinical laboratory tests are used to evaluate the severity of the illness, uncover anomalies in the blood clotting process, and offer personalized therapy choices. Moreover, the grwoth of the clinical laboratory tests segment is also being fuelled by the rising investment in healthcare infrastructure, particularly in emerging nations.

The point-of-care tests segment is expected to grow the fastest during 2023-2028. Because POC tests can deliver answers in just a few minutes, they are convenient for healthcare practitioners, which contributes to their growth in the market. POCT enables diagnostic tests to be conducted outside of traditional clinical laboratory settings, such as doctor's offices, ERs, or even patients' homes. Additionally, market participants' regional development will aid in fostering demand for the POC tests.

The PT segment is expected to witness the largest share in the global thrombosis and hemostasis biomarkers market during the forecast period of 2023-2028. The test enables the monitoring of anticoagulant drugs like warfarin, which are used to stop blood clots. It is also used as a diagnostic tool to find liver problems or bleeding issues.

The diagnostic centre’s segment is expected to witness the largest share in the global thrombosis and hemostasis biomarkers market during the forecast period of 2023-2028. This is attributable to hospitals' increased reliance on diagnostic laboratories for testing and assessment. The expansion of government initiatives to provide top notch facilities, and presence of supportive reimbursement schemes for diagnostic testing, are some of the significant drivers anticipated to fuel the growth.

The North American segment is expected to witness the largest share in the global thrombosis and hemostasis biomarkers market during the forecast period of 2023-2028. The market in the region is primarily driven by increasing prevalence of thrombosis and hemostasis disorders, technological developments, and consistent R&D activities in thrombosis and hemostasis biomarkers.

Asia-Pacific is expected to grow the fastest in the global market. This is mainly due to increased R&D spending and strong presence of top diagnostic corporations. Additionally, the increasing aging population's and their increased susceptibility to disease as well as the rising prevalence of cardiovascular diseases and blood clotting disorders are some of the other drivers of the market.

bioMérieux SA, F. Hoffmann-La Roche Ltd., Biomedica Diagnostics, Siemens Healthineers, Abbott, HORIBA Ltd., Werfen, Quidel Corporation, Diazyme Laboratories, Inc., and Thermo Fisher Scientific, Inc., among others, are some of the key players in the thrombosis and hemostasis biomarkers market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL THROMBOSIS AND HEMOSTASIS BIOMARKERS MARKET, BY PRODUCT

4.2 Thrombosis and Hemostasis Biomarkers Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Reagents & Consumables Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Analysers Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL THROMBOSIS AND HEMOSTASIS BIOMARKERS MARKET, BY TEST LOCATION

5.2 Thrombosis and Hemostasis Biomarkers Market: Test Location Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Clinical Laboratory Tests Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Point-of-Care Tests Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL THROMBOSIS AND HEMOSTASIS BIOMARKERS MARKET, BY APPLICATION

6.2 Thrombosis and Hemostasis Biomarkers Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Deep Vein Thrombosis Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Pulmonary Embolism Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Disseminated Intravascular Coagulation

6.6.1 Disseminated Intravascular Coagulation Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL THROMBOSIS AND HEMOSTASIS BIOMARKERS MARKET, BY TEST TYPE

7.2 Thrombosis and Hemostasis Biomarkers Market: Test Type Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4.1 PT Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 Fibrinogen Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.1 D-Dimer Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL THROMBOSIS AND HEMOSTASIS BIOMARKERS MARKET, BY END USER

8.2 Thrombosis and Hemostasis Biomarkers Market: End User Scope Key Takeaways

8.3 Revenue Growth Analysis, 2022 & 2028

8.4.1 Hospitals & Clinics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5 Academic & Research Institutes

8.5.1 Academic & Research Institutes Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.1 Diagnostic Centres Market Estimates and Forecast, 2020-2028 (USD Million)

8.7.1 Other End Users Market Estimates and Forecast, 2020-2028 (USD Million)

9 GLOBAL THROMBOSIS AND HEMOSTASIS BIOMARKERS MARKET, BY REGION

9.3.6.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Million)

10.1 Company Market Share Analysis

10.2 Four Quadrant Positioning Matrix

10.4.1.1 Business Description & Financial Analysis

10.4.1.3 Poducts & Services Offered

10.4.1.4 Strategic Alliances between Business Partners

10.4.2 Thermo Fisher Scientific Inc.

10.4.2.1 Business Description & Financial Analysis

10.4.2.3 Poducts & Services Offered

10.4.2.4 Strategic Alliances between Business Partners

10.4.3.1 Business Description & Financial Analysis

10.4.3.3 Poducts & Services Offered

10.4.3.4 Strategic Alliances between Business Partners

10.4.4.1 Business Description & Financial Analysis

10.4.4.3 Poducts & Services Offered

10.4.4.4 Strategic Alliances between Business Partners

10.4.5.1 Business Description & Financial Analysis

10.4.5.3 Poducts & Services Offered

10.4.5.4 Strategic Alliances between Business Partners

10.4.6.1 Business Description & Financial Analysis

10.4.6.3 Poducts & Services Offered

10.4.6.4 Strategic Alliances between Business Partners

10.4.7.1 Business Description & Financial Analysis

10.4.7.3 Poducts & Services Offered

10.4.7.4 Strategic Alliances between Business Partners

10.4.8.1 Business Description & Financial Analysis

10.4.8.3 Poducts & Services Offered

10.4.8.4 Strategic Alliances between Business Partners

10.4.9.1 Business Description & Financial Analysis

10.4.9.3 Poducts & Services Offered

10.4.9.4 Strategic Alliances between Business Partners

10.4.10.1 Business Description & Financial Analysis

10.4.10.3 Poducts & Services Offered

10.4.10.4 Strategic Alliances between Business Partners

10.4.11.1 Business Description & Financial Analysis

10.4.11.3 Poducts & Services Offered

10.4.11.4 Strategic Alliances between Business Partners

11.1.2 Market Scope & SegAnalyserstation

11.2 Information ProcureAnalyserst

11.2.1.2 GMEs Internal Data Repository

11.2.1.3 Secondary Resources & Third Party Perspectives

11.2.1.4 Company Information Sources

11.2.2.1 Various Type of Respondents for Primary Interviews

11.2.2.2 Number of Interviews Conducted throughout the Research Process

11.2.2.4 Discussion Guide for Primary Participants

11.2.3.1 Expert Panels Across 30+ Industry

11.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

11.3.1.1 Macro-Economic Indicators Considered

11.3.1.2 Micro-Economic Indicators Considered

11.3.2.1 Company Share Analysis Approach

11.3.2.2 Estimation of Potential End User Sales

11.4.2 Time Series, Cross Sectional & Panel Data Analysis

11.5.1 Inhouse AI Based Real Time Analytics Tool

11.5.2 Output From Desk & Primary Research

11.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Mllion)

2 Reagents & Consumables Market, By Region, 2020-2028 (USD Mllion)

3 Analysers Market, By Region, 2020-2028 (USD Mllion)

4 Global Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Mllion)

5 Clinical Laboratory Tests Market, By Region, 2020-2028 (USD Mllion)

6 Point-of-Care Tests Market, By Region, 2020-2028 (USD Mllion)

7 Global Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Mllion)

8 Deep Vein Thrombosis Market, By Region, 2020-2028 (USD Mllion)

9 Pulmonary Embolism Market, By Region, 2020-2028 (USD Mllion)

10 Global Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Mllion)

11 PT Market, By Region, 2020-2028 (USD Mllion)

12 Fibrinogen Market, By Region, 2020-2028 (USD Mllion)

13 D-Dimer Market, By Region, 2020-2028 (USD Mllion)

14 Global Thrombosis and Hemostasis Biomarkers Market, By End User, 2020-2028 (USD Mllion)

15 Hospitals & Clinics Market, By Region, 2020-2028 (USD Mllion)

16 Academic & Research Institutes Market, By Region, 2020-2028 (USD Mllion)

17 Diagnostic Centres Market, By Region, 2020-2028 (USD Mllion)

18 Other End Users Market, By Region, 2020-2028 (USD Mllion)

19 Regional Analysis, 2020-2028 (USD Mllion)

20 North America Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

21 North America Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

22 North America Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

23 North America Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

24 North America Thrombosis and Hemostasis Biomarkers Market, By Country, 2020-2028 (USD Million)

25 North America Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

26 U.S Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

27 U.S Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

28 U.S Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

29 U.S Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

30 U.S America Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

31 Canada Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

32 Canada Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

33 Canada Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

34 Canada Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

35 Canada Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

36 Mexico Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

37 Mexico Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

38 Mexico Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

39 Mexico Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

40 Mexico Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

41 Europe Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

42 Europe Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

43 Europe Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

44 Europe Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

45 Europe Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

46 Germany Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

47 Germany Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

48 Germany Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

49 Germany Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

50 Germany Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

51 UK Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

52 UK Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

53 UK Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

54 U.K Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

55 U.K Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

56 France Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

57 France Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

58 France Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

59 France Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

60 France Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

61 Italy Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

62 Italy Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

63 Italy Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

64 Italy Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

65 Italy Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

66 Spain Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

67 Spain Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

68 Spain Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

69 Spain Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

70 Spain Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

71 Rest Of Europe Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

72 Rest Of Europe Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

73 Rest of Europe Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

74 Rest of Europe Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

75 Rest of Europe Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

76 Asia Pacific Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

77 Asia Pacific Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

78 Asia Pacific Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

79 Asia Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

80 Asia Pacific Thrombosis and Hemostasis Biomarkers Market, By Country, 2020-2028 (USD Million)

81 Asia Pacific Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

82 China Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

83 China Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

84 China Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

85 China Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

86 China Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

87 India Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

88 India Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

89 India Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

90 India Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

91 India Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

92 Japan Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

93 Japan Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

94 Japan Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

95 Japan Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

96 Japan Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

97 South Korea Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

98 South Korea Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

99 South Korea Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

100 South korea Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

101 SOUTH KOREA Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

102 Middle East & Africa Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

103 Middle East & Africa Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

104 Middle East & Africa Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

105 MIDDLE EAST & AFRICA Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

106 Middle East & Africa Thrombosis and Hemostasis Biomarkers Market, By Country, 2020-2028 (USD Million)

107 MIDDLE EAST & AFRICA Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

108 Saudi Arabia Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

109 Saudi Arabia Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

110 Saudi Arabia Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

111 Saudi arabia Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

112 SAUDI ARABIA Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

113 UAE Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

114 UAE Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

115 UAE Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

116 UAE Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

117 UAE Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

118 Central & South America Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

119 Central & South America Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

120 Central & South America Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

121 CENTRAL & SOUTH AMERICA Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

122 Central & South America Thrombosis and Hemostasis Biomarkers Market, By Country, 2020-2028 (USD Million)

123 CENTRAL & SOUTH AMERICA Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

124 Brazil Thrombosis and Hemostasis Biomarkers Market, By Product, 2020-2028 (USD Million)

125 Brazil Thrombosis and Hemostasis Biomarkers Market, By Test Location, 2020-2028 (USD Million)

126 Brazil Thrombosis and Hemostasis Biomarkers Market, By Application, 2020-2028 (USD Million)

127 Brazil Thrombosis and Hemostasis Biomarkers Market, By Test Type, 2020-2028 (USD Million)

128 BRAZIL Thrombosis and Hemostasis Biomarkers Market, By END USER, 2020-2028 (USD Million)

129 BioMerieux SA: PRODUCTS & SERVICES OFFERING

130 Thermo Fisher Scientific Inc.: PRODUCTS & SERVICES OFFERING

131 F.Hoffmann-La Roche: PRODUCTS & SERVICES OFFERING

132 Biomedica Diagnostics: PRODUCTS & SERVICES OFFERING

133 Siemens Healthineers: PRODUCTS & SERVICES OFFERING

134 HORIBA: PRODUCTS & SERVICES OFFERING

135 Abbott : PRODUCTS & SERVICES OFFERING

136 Werfen: PRODUCTS & SERVICES OFFERING

137 Quidel Corporation, Inc: PRODUCTS & SERVICES OFFERING

138 Diazyme Laboratories: PRODUCTS & SERVICES OFFERING

139 Other Companies: PRODUCTS & SERVICES OFFERING

LIST OF FIGURES

1 Global Thrombosis and Hemostasis Biomarkers Market Overview

2 Global Thrombosis and Hemostasis Biomarkers Market Value From 2020-2028 (USD Mllion)

3 Global Thrombosis and Hemostasis Biomarkers Market Share, By Product (2022)

4 Global Thrombosis and Hemostasis Biomarkers Market Share, By Test Location (2022)

5 Global Thrombosis and Hemostasis Biomarkers Market Share, By Application (2022)

6 Global Thrombosis and Hemostasis Biomarkers Market Share, By Test Type (2022)

7 Global Thrombosis and Hemostasis Biomarkers Market Share, By End User (2022)

8 Global Thrombosis and Hemostasis Biomarkers Market, By Region (Asia Pacific Market)

9 Technological Trends In Global Thrombosis and Hemostasis Biomarkers Market

10 Four Quadrant Competitor Positioning Matrix

11 Impact Of Macro & Micro Indicators On The Market

12 Impact Of Key Drivers On The Global Thrombosis and Hemostasis Biomarkers Market

13 Impact Of Challenges On The Global Thrombosis and Hemostasis Biomarkers Market

14 Porter’s Five Forces Analysis

15 Global Thrombosis and Hemostasis Biomarkers Market: By Product Scope Key Takeaways

16 Global Thrombosis and Hemostasis Biomarkers Market, By Product Segment: Revenue Growth Analysis

17 Reagents & Consumables Market, By Region, 2020-2028 (USD Mllion)

18 Analysers Market, By Region, 2020-2028 (USD Mllion)

19 Global Thrombosis and Hemostasis Biomarkers Market: By Test Location Scope Key Takeaways

20 Global Thrombosis and Hemostasis Biomarkers Market, By Test Location Segment: Revenue Growth Analysis

21 Clinical Laboratory Tests Market, By Region, 2020-2028 (USD Mllion)

22 Point-of-Care Tests Market, By Region, 2020-2028 (USD Mllion)

23 Cell-based Thrombosis and Hemostasis Biomarkers Market, By Region, 2020-2028 (USD Mllion)

24 Global Thrombosis and Hemostasis Biomarkers Market: By Application Scope Key Takeaways

25 Global Thrombosis and Hemostasis Biomarkers Market, By Application Segment: Revenue Growth Analysis

26 Deep Vein Thrombosis Market, By Region, 2020-2028 (USD Mllion)

27 Pulmonary Embolism Market, By Region, 2020-2028 (USD Mllion)

28 Global Thrombosis and Hemostasis Biomarkers Market: By Test Type Scope Key Takeaways

29 Global Thrombosis and Hemostasis Biomarkers Market, By Test Type Segment: Revenue Growth Analysis

30 PT Market, By Region, 2020-2028 (USD Mllion)

31 Fibrinogen Market, By Region, 2020-2028 (USD Mllion)

32 D-Dimer Market, By Region, 2020-2028 (USD Mllion)

33 Global Thrombosis and Hemostasis Biomarkers Market: By End User Scope Key Takeaways

34 Global Thrombosis and Hemostasis Biomarkers Market, By End User Segment: Revenue Growth Analysis

35 Hospitals & Clinics Market, By Region, 2020-2028 (USD Mllion)

36 Academic & Research Institutes Market, By Region, 2020-2028 (USD Mllion)

37 Diagnostic Centres Market, By Region, 2020-2028 (USD Mllion)

38 Other End Users Market, By Region, 2020-2028 (USD Mllion)

39 Regional Segment: Revenue Growth Analysis

40 Global Thrombosis and Hemostasis Biomarkers Market: Regional Analysis

41 North America Thrombosis and Hemostasis Biomarkers Market Overview

42 North America Thrombosis and Hemostasis Biomarkers Market, By Product

43 North America Thrombosis and Hemostasis Biomarkers Market, By Test Location

44 North America Thrombosis and Hemostasis Biomarkers Market, By Application

45 North America Thrombosis and Hemostasis Biomarkers Market, By Test Type

46 North America Thrombosis and Hemostasis Biomarkers Market, By End User

47 North America Thrombosis and Hemostasis Biomarkers Market, By Country

48 U.S. Thrombosis and Hemostasis Biomarkers Market, By Product

49 U.S. Thrombosis and Hemostasis Biomarkers Market, By Test Location

50 U.S. Thrombosis and Hemostasis Biomarkers Market, By Application

51 U.S. Thrombosis and Hemostasis Biomarkers Market, By Test Type

52 U.S. Thrombosis and Hemostasis Biomarkers Market, By End User

53 Canada Thrombosis and Hemostasis Biomarkers Market, By Product

54 Canada Thrombosis and Hemostasis Biomarkers Market, By Test Location

55 Canada Thrombosis and Hemostasis Biomarkers Market, By Application

56 Canada Thrombosis and Hemostasis Biomarkers Market, By Test Type

57 Canada Thrombosis and Hemostasis Biomarkers Market, By End User

58 Mexico Thrombosis and Hemostasis Biomarkers Market, By Product

59 Mexico Thrombosis and Hemostasis Biomarkers Market, By Test Location

60 Mexico Thrombosis and Hemostasis Biomarkers Market, By Application

61 Mexico Thrombosis and Hemostasis Biomarkers Market, By Test Type

62 Mexico Thrombosis and Hemostasis Biomarkers Market, By End User

63 Four Quadrant Positioning Matrix

64 Company Market Share Analysis

65 BioMerieux SA: Company Snapshot

66 BioMerieux SA: SWOT Analysis

67 BioMerieux SA: Geographic Presence

68 Thermo Fisher Scientific Inc.: Company Snapshot

69 Thermo Fisher Scientific Inc.: SWOT Analysis

70 Thermo Fisher Scientific Inc.: Geographic Presence

71 F.Hoffmann-La Roche: Company Snapshot

72 F.Hoffmann-La Roche: SWOT Analysis

73 F.Hoffmann-La Roche: Geographic Presence

74 Biomedica Diagnostics: Company Snapshot

75 Biomedica Diagnostics: Swot Analysis

76 Biomedica Diagnostics: Geographic Presence

77 Siemens Healthineers: Company Snapshot

78 Siemens Healthineers: SWOT Analysis

79 Siemens Healthineers: Geographic Presence

80 HORIBA: Company Snapshot

81 HORIBA: SWOT Analysis

82 HORIBA: Geographic Presence

83 Abbott : Company Snapshot

84 Abbott : SWOT Analysis

85 Abbott : Geographic Presence

86 Werfen: Company Snapshot

87 Werfen: SWOT Analysis

88 Werfen: Geographic Presence

89 Quidel Corporation, Inc.: Company Snapshot

90 Quidel Corporation, Inc.: SWOT Analysis

91 Quidel Corporation, Inc.: Geographic Presence

92 Diazyme Laboratories: Company Snapshot

93 Diazyme Laboratories: SWOT Analysis

94 Diazyme Laboratories: Geographic Presence

95 Other Companies: Company Snapshot

96 Other Companies: SWOT Analysis

97 Other Companies: Geographic Presence

The Global Thrombosis and Hemostasis Biomarkers Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Thrombosis and Hemostasis Biomarkers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS