Global Toy Licensing Market Size, Trends & Analysis - Forecasts to 2027 By Type of Toys (Non-Electric Toys, Electric Toys, Video Games, and Others), By Application (Substantial Media Impact, Strong Brand Image, Longevity, Toyetic, and Profitable Terms), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global toy licensing market is projected to grow at a high CAGR value from 2022 to 2027. The growing demand for toys owing to the growing youth population, increasing innovation in toy manufacturing, and the growing number of hobby enthusiasts are all expected to increase the demand for toy licensing. The growing number of toys for children, young adults, and adults alike are becoming available in the market and the variations in the products of different manufacturers have increased the need for protection against counterfeit products and copyright infringement.

Technological developments have also played a crucial role in the growth of the toy licensing market. The adoption of new technologies like IoT, cloud technology, machine learning, and analytics, among others in manufacturing processes and improving toy functionalities are expected to increase the demand for toy licensing. With increased functionality, toys are becoming increasingly life-like and exude more features that make them very close to their inspirations. The growing consumption of digital media through platforms such as Netflix, Disney+, YouTube, and other streaming platforms is increasing awareness among the public on digital content and their merchandise. With children and adults looking to acquire acting figurines, toys, and other merchandise to show their support and showcase their interest in media content, have driven up the demand for toy licensing.

Toy manufacturers have realized the potential in producing toys that can be sold under copyrighted animation characters and video game characters. This has increased the demand for toy licensing from manufacturers across the globe as they look to be the first or become the exclusive manufacturer of beloved digital media content merchandise.

The growing adoption of technologies such as cloud technology and IoT offers lucrative new avenues for creating smart toys and merchandise. Parents looking to purchase toys that help the cognitive development of their child while maintaining a healthy control over the content they consume are expected to increase the demand for such smart toys. As these toys are being increasingly marketed through animated characters and digital content creators, the toy licensing market is expected to witness rapid growth during the forecast period.

The growing number of influencers and digital content creators on social media platforms have increased awareness of toys, figurines, and other merchandise. They have also played a role in the growing demand for toy licensing as these content creators look to promote other products and look to sell their image rights to toy manufacturers thereby increasing the demand for toy licensing.

The market’s growth is restrained by the growing number of counterfeit products available in the market. The lack of adequate legal recourse in many developing countries and regions has also limited the potential for licensing and threatened the market. The cost of acquiring licensing, stringent regulations, and extensive procedures to attain licenses are also expected to restrain the growth of the market during the forecast period.

The COVID-19 pandemic has resulted in supply chain restrictions, limited the launch of new products, and restrained the development of new products. The forced shutdown of manufacturing and limitations on production capacity has hampered growth during the pandemic. The market is expected to bounce back during the forecast period.

The toy licensing market is largely driven by the growing demand for media-inspired toys, increased demand for popular animated characters and other media characters-inspired merchandise and toys, adoption of new technologies, and exploration of new revenue models by manufacturers.

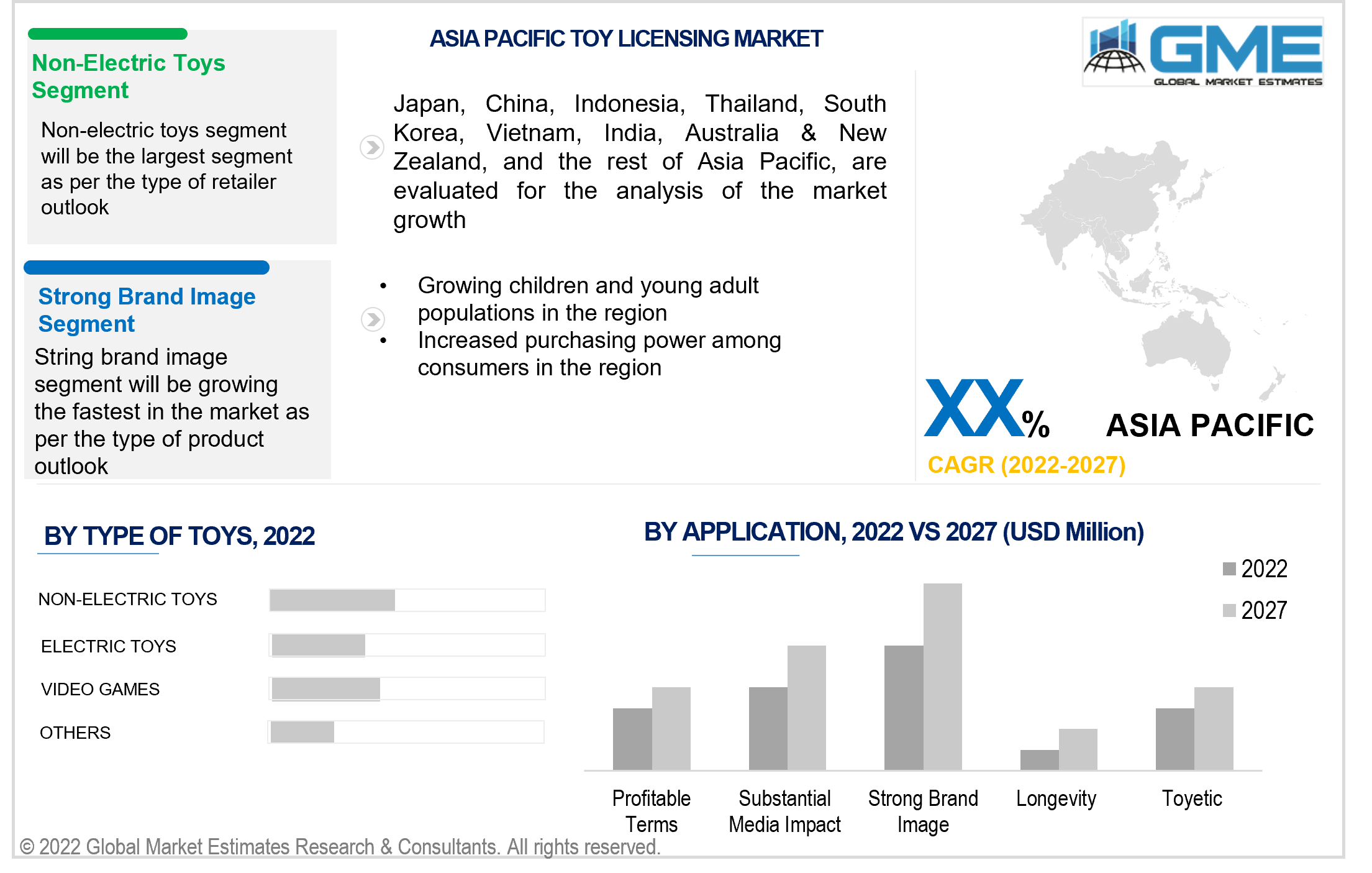

Based on the type of retailer, the toy licensing market is segmented into non-electric toys, electric toys, video games, and others. The electric toys segment is expected to hold the largest piece of the market during the forecast period. The large demand for figurines, collectibles, and other non-electric toys has dominated the market traditionally. The growing number of mobile platforms and gaming consoles are expected to result in the video segment showcasing the fastest-growth rate among all segments.

Based on the various application in toy licensing, the market is segmented into substantial media impact, strong brand image, longevity, toyetic, and profitable terms. The strong brand image segment held the lion’s share of the market. The growing demand for toys based on characters on animation, television shows, movies, and other digital media has resulted in the dominance of this segment. The growing number of platforms and increased consumption of digital media are expected to result in this segment showcasing the fastest-growth rate.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions. The North American region is expected to be the dominant force in the market during the forecast period. The region’s strong licensing laws, greater spending on research and development of new products, the large consumption of digital media, and greater spending power of consumers have resulted in the dominance of this region.

The APAC region is expected to showcase the fastest growth rate among all regions. The growing number of toy manufacturers, outsourcing of toy manufacturing to this region, growing young population in the region, and the growing number of regulations to protect intellectual property are the major factors of growth in the region.

WHP GLOBAL, The Walt Disney Company, Hasbro, Universal Brand Development, The Pokemon Company, ViacomCBS Consumer Products, Sanrio, Rainbow, BBC Studios, The Hershey Company, Sesame Workshop, Hearst, Alpha Group, Pinkfong, The Emoji Company, The World of Eric Carle, Sega, Game Workshop Group, Acamar Films, and SilverGate Media, among others are the key players in the toy licensing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Toy Licensing Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type of Toys Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Toy Licensing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for toys-inspired by media characters

3.3.2 Industry Challenges

3.3.2.1 Growing number of counterfeit products available in the market

3.4 Prospective Growth Scenario

3.4.1 Type of Toys Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Toy Licensing Market, By Type of Toys

4.1 Type of Toys Outlook

4.2 Non-Electric Toys

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Electric Toys

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Video Games

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Other

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Toy Licensing Market, By Application

5.1 Application Outlook

5.2 Substantial Media Impact

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Strong Brand Image

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Longevity

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Toyetic

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Profitable Terms

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Toy Licensing Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.2.3 Market Size, By Application, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.3.3 Market Size, By Application, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.4.3 Market Size, By Application, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.4.7.2 Market size, By Application, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.5.3 Market Size, By Application, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.6.3 Market Size, By Application, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type of Toys, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 WHP GLOBAL

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 The Walt Disney Company

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Hasbro

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 The Pokemon Company

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Universal Brand Development

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 ViacomCBS Consumer Products

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Sanrio

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Rainbow

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Toy Licensing Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Toy Licensing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS