Global Trade Surveillance System Market Size, Trends & Analysis - Forecasts to 2029 By Component (Solutions and Services), By Deployment Model (On-Premise and Cloud-based), By Enterprise Size (Large Enterprises and SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

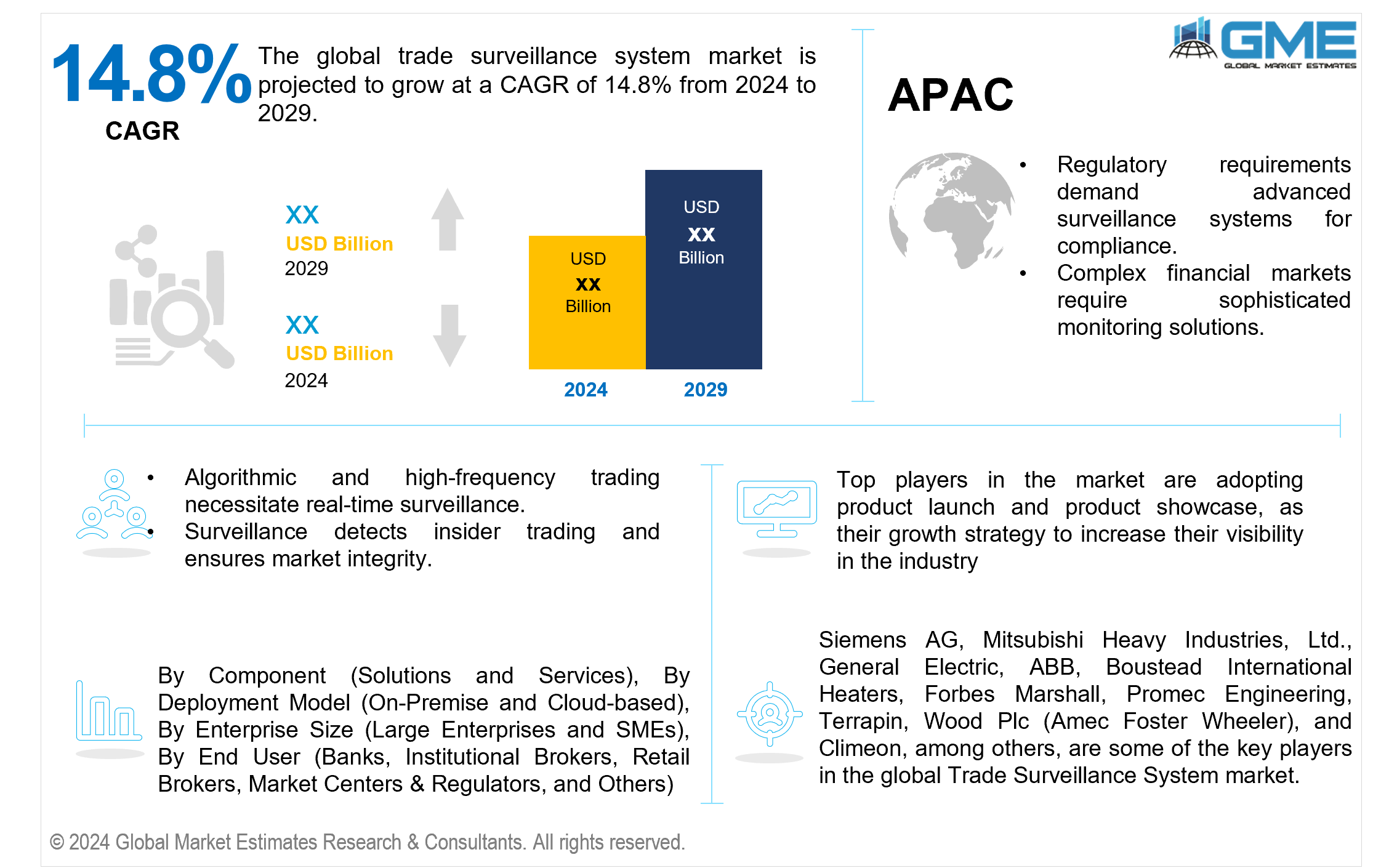

The global trade surveillance system market is projected to grow at a CAGR of 14.8% from 2024 to 2029.

The trade surveillance systems market growth is being driven by an increasing number of compliance requirements and regulations. These regulations necessitate the utilization of financial market surveillance systems for monitoring and reporting trading activities, thus contributing to their widespread adoption.

Instance of market abuse, insider trading, and other illicit practices in financial markets have prompted regulatory compliance in trading to implement stricter measures for insider trading detection and market abuse detection. Therefore, trade surveillance systems play an important role in preventing and finding market manipulation.

Moreover, advancements in technology, such as the integration of artificial intelligence (AI) have improved the functions of electronic trading surveillance systems. These advancements allow for more advanced pattern recognition, anomaly detection, and predictive analytics for trade surveillance. As a result, they enhance the precision in identifying suspicious trading activities.

Nevertheless, the market also faces certain challenges, such as the risk of cyberattacks, given the presence of sensitive financial data within these systems. Therefore, ensuring the security of these systems remains a critical concern.

Based on component, the market is segmented into solutions and services. Solutions segment is expected to hold the largest share in the market, owing to the fact that the businesses are under pressure to establish policies and procedures for their trading operations, due to the heightened regulatory demands and risks. Financial institutions are embracing advanced technologies, such as AI/ML, to detect suspicious activities and market manipulation while maintaining vigilant oversight of their data. To address alerts swiftly, surveillance teams must have the capability to link pertinent data points and rapidly evaluate potential risks.

Surveillance and analytics segment is expected to be the fastest-growing segment in the market from 2024-2029. This growth is driven by advantages such as the methodical gathering and examination of results derived from collected data, which is employed in the development, assessment, and execution of compliance monitoring systems, policies and practices. Additionally, it contributes to enhancing the current surveillance procedures, thereby leading to improved efficiency and precision.

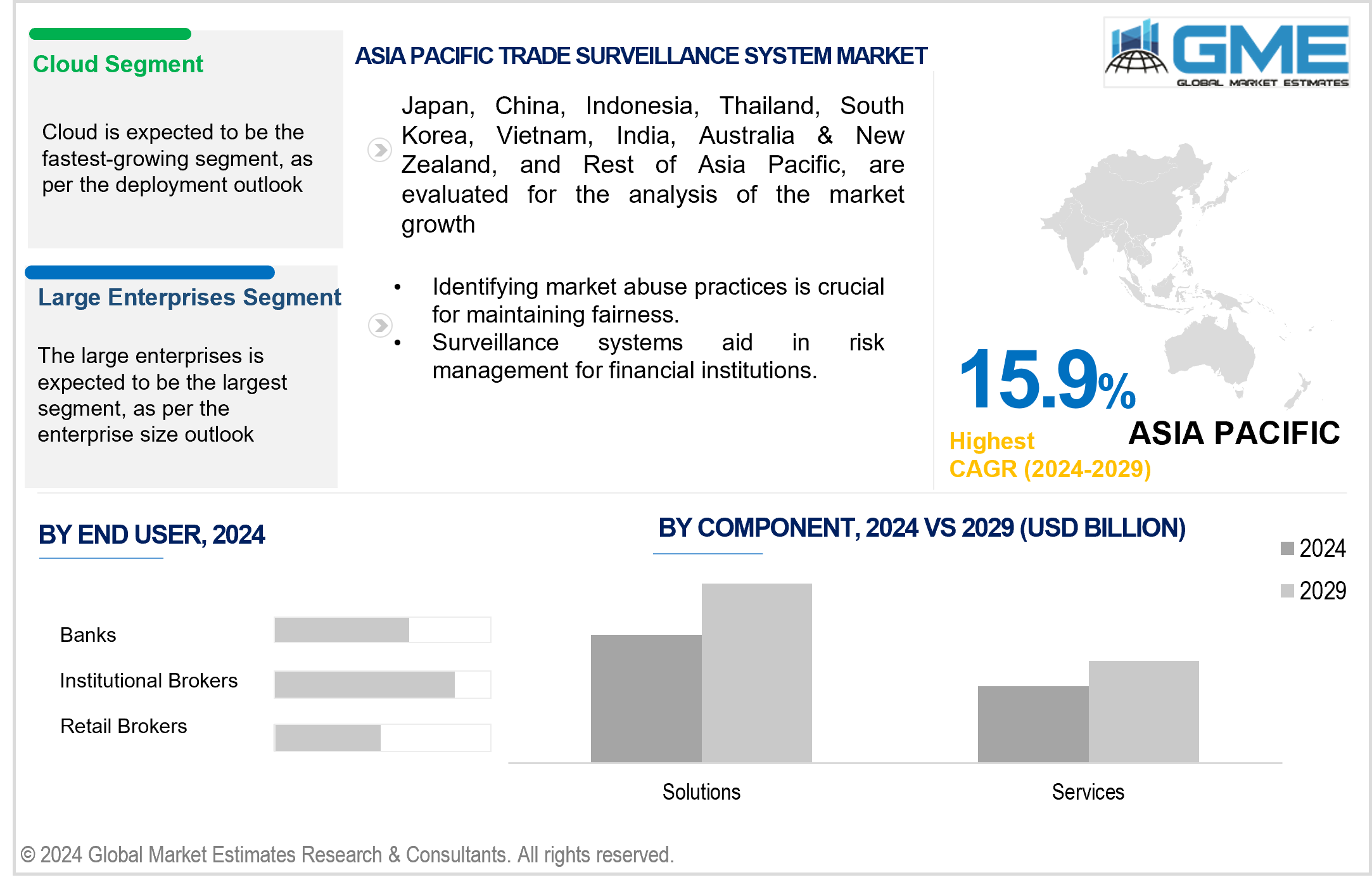

Cloud is anticipated to be the fastest-growing segment in the market from 2024-2029. Cloud-based trading activities are increasing due to the accessibility and convenience they provide. As financial markets increasingly using digitalization, more trading activities are conducted in the cloud. This shift towards digital platforms eventually increases the demand for cloud-based trade surveillance systems to monitor and regulate these activities

On-premises segment is expected to hold the largest share of the market. This was primarily due to the advantages it offers, including seamless integration with an organization's existing IT infrastructure and a higher level of data security compared to cloud-based trade surveillance systems. On-premises trade surveillance systems enhance data security by conducting pre-trading monitoring, which involves pattern recognition and behavioural analysis.

The SMEs segment is anticipated to be the fastest-growing segment in the market from 2024-2029, owing to the increasing regulatory demands imposed by governing bodies. SMEs, these organization are recognizing the need to invest in trade surveillance solutions. These solutions help SMEs effectively monitor and manage their trade transactions across the organization, ensuring compliance with the expanding regulatory landscape.

The large enterprises segment holds the largest share of the market. Large enterprises are typically defined as those with over a thousand employees. These companies have been quick to adopt trade surveillance systems due to their requirement for a contemporary and comprehensive approach to trade surveillance, extensive functional and regulatory coverage, and the adaptability necessary to meet the demands of today's intricate business landscape.

The retail broker segment is anticipated to be the fastest-growing segment in the market from 2024-2029. This growth is driven by the increasing adoption of trade surveillance solutions by retail brokers to ensure compliance, enhance transparency, and monitor trading activities effectively in response to evolving regulatory requirements.

The institutional broker segment is expected to hold the largest share of the market. The factor driving the adoption of trade monitoring technologies by investment firms and an increasing need for around-the-clock web access to trade data among investment professionals. The uptick in market manipulation and anomalies in corporate trading activities results in a significant amount of unstructured data, emphasizing the crucial role of trade surveillance systems in this sector.

North America is expected to be the largest region in the market. The key reasons boosting the market growth in this region include increasing risk of fraudulent activities and market manipulation, with this the region is also significantly adopting new technologies related to trade surveillance system. As an example, in 2021, IBM's partner ecosystem introduced hybrid cloud services through IBM Cloud Satellite, enabling organizations to deploy and manage applications as a service across various environments, including on-premises, public clouds, and edge computing.

Asia Pacific is predicted to witness rapid growth during the forecast period. This region is experiencing rapid development and presents a highly lucrative opportunity for the trade surveillance systems market. The anticipated growth can be attributed to several factors, including the swift economic advancements, globalization, increased digitalization, and the widespread use of smartphones.

ACA Group, Aquis Exchange, b-next, Cinnober, CRISIL LIMITED, FIS, IBM Corporation,IPC Systems Inc., NICE, and SIA S.P.A., among others, are some of the key players operating in the global trade surveillance system market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2022, ACA Group, a prominent governance, risk, and compliance (GRC) advisor in the financial services industry, introduced several new capabilities to its integrated regulatory technology (RegTech) solution platform called ComplianceAlpha.

In February 2022, Aquis Technologies entered into a partnership with Investre, a neo-exchange focused on value-driven investment funds. The primary aim of the partnership between Aquis Technologies and Investre is to establish a fully cloud-native exchange that facilitates the trading of value-driven investment funds.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & AtCinnoberness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market AtCinnoberness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL TRADE SURVEILLANCE SYSTEM MARKET, BY END USER

4.1 Introduction

4.2 Trade Surveillance System Market: End User Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Banks

4.4.1 Banks Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Institutional Brokers

4.5.1 Institutional Brokers Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Retail Brokers

4.6.1 Retail Brokers Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Market Centers & Regulators

4.7.1 Market Centers & Regulators Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Others

4.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL TRADE SURVEILLANCE SYSTEM MARKET, BY COMPONENT

5.1 Introduction

5.2 Trade Surveillance System Market: Component Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Solutions

5.4.1 Solutions Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Services

5.5.1 Services Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT MODEL

6.1 Introduction

6.2 Trade Surveillance System Market: Deployment Model Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 On-premise

6.4.1 On-premise Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Cloud

6.5.1 Cloud Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL TRADE SURVEILLANCE SYSTEM MARKET, BY ENTERPRISE SIZE

7.1 Introduction

7.2 Trade Surveillance System Market: Enterprise Size Scope Key Takeaways

7.3 Revenue Growth Analysis, 2023 & 2029

7.4 Large Enterprises

7.4.1 Large Enterprises Market Estimates and Forecast, 2021-2029 (USD Million)

7.5 SMEs

7.5.1 SMEs Market Estimates and Forecast, 2021-2029 (USD Million)

8 GLOBAL TRADE SURVEILLANCE SYSTEM MARKET, BY REGION

8.1 Introduction

8.2 North America Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.1 By End User

8.2.2 By Component

8.2.3 By Deployment Model

8.2.4 By Enterprise Size

8.2.5 By Country

8.2.5.1 U.S. Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.5.1.1 By End User

8.2.5.1.2 By Component

8.2.5.1.3 By Deployment Model

8.2.5.1.4 By Enterprise Size

8.2.5.2 Canada Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.5.2.1 By End User

8.2.5.2.2 By Component

8.2.5.2.3 By Deployment Model

8.2.5.2.4 By Enterprise Size

8.2.5.3 Mexico Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.5.3.1 By End User

8.2.5.3.2 By Component

8.2.5.3.3 By Deployment Model

8.2.5.3.4 By Enterprise Size

8.3 Europe Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.1 By End User

8.3.2 By Component

8.3.3 By Deployment Model

8.3.4 By Enterprise Size

8.3.5 By Country

8.3.5.1 Germany Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.1.1 By End User

8.3.5.1.2 By Component

8.3.5.1.3 By Deployment Model

8.3.5.1.4 By Enterprise Size

8.3.5.2 U.K. Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.2.1 By End User

8.3.5.2.2 By Component

8.3.5.2.3 By Deployment Model

8.3.5.2.4 By Enterprise Size

8.3.5.3 France Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.3.1 By End User

8.3.5.3.2 By Component

8.3.5.3.3 By Deployment Model

8.3.5.3.4 By Enterprise Size

8.3.5.4 Italy Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.4.1 By End User

8.3.5.4.2 By Component

8.3.5.4.3 By Deployment Model

8.3.5.4.4 By Enterprise Size

8.3.5.5 Spain Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.5.1 By End User

8.3.5.5.2 By Component

8.3.5.5.3 By Deployment Model

8.3.5.5.4 By Enterprise Size

8.3.5.6 Netherlands Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.6.1 By End User

8.3.5.6.2 By Component

8.3.5.6.3 By Deployment Model

8.3.5.6.4 By Enterprise Size

8.3.5.7 Rest of Europe Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.3.5.7.1 By End User

8.3.5.7.2 By Component

8.3.5.7.3 By Deployment Model

8.3.5.7.4 By Enterprise Size

8.4 Asia Pacific Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.1 By End User

8.4.2 By Component

8.4.3 By Deployment Model

8.4.4 By Enterprise Size

8.4.5 By Country

8.4.5.1 China Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.1.1 By End User

8.4.5.1.2 By Component

8.4.5.1.3 By Deployment Model

8.4.5.1.4 By Enterprise Size

8.4.5.2 Japan Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.2.1 By End User

8.4.5.2.2 By Component

8.4.5.2.3 By Deployment Model

8.4.5.2.4 By Enterprise Size

8.4.5.3 India Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.3.1 By End User

8.4.5.3.2 By Component

8.4.5.3.3 By Deployment Model

8.4.5.3.4 By Enterprise Size

8.4.5.4 South Korea Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.4.1 By End User

8.4.5.4.2 By Component

8.4.5.4.3 By Deployment Model

8.4.5.4.4 By Enterprise Size

8.4.5.5 Singapore Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.5.1 By End User

8.4.5.5.2 By Component

8.4.5.5.3 By Deployment Model

8.4.5.5.4 By Enterprise Size

8.4.5.6 Malaysia Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.6.1 By End User

8.4.5.6.2 By Component

8.4.5.6.3 By Deployment Model

8.4.5.6.4 By Enterprise Size

8.4.5.7 Thailand Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.7.1 By End User

8.4.5.7.2 By Component

8.4.5.7.3 By Deployment Model

8.4.5.7.4 By Enterprise Size

8.4.5.8 Indonesia Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.8.1 By End User

8.4.5.8.2 By Component

8.4.5.8.3 By Deployment Model

8.4.5.8.4 By Enterprise Size

8.4.5.9 Vietnam Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.9.1 By End User

8.4.5.9.2 By Component

8.4.5.9.3 By Deployment Model

8.4.5.9.4 By Enterprise Size

8.4.5.10 Taiwan Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.10.1 By End User

8.4.5.10.2 By Component

8.4.5.10.3 By Deployment Model

8.4.5.10.4 By Enterprise Size

8.4.5.11 Rest of Asia Pacific Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.4.5.11.1 By End User

8.4.5.11.2 By Component

8.4.5.11.3 By Deployment Model

8.4.5.11.4 By Enterprise Size

8.5 Middle East and Africa Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.1 By End User

8.5.2 By Component

8.5.3 By Deployment Model

8.5.4 By Enterprise Size

8.5.5 By Country

8.5.5.1 Saudi Arabia Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.5.1.1 By End User

8.5.5.1.2 By Component

8.5.5.1.3 By Deployment Model

8.5.5.1.4 By Enterprise Size

8.5.5.2 U.A.E. Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.5.2.1 By End User

8.5.5.2.2 By Component

8.5.5.2.3 By Deployment Model

8.5.5.2.4 By Enterprise Size

8.5.5.3 Israel Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.4.3.1 By End User

8.5.4.3.2 By Component

8.5.4.3.3 By Deployment Model

8.5.5.3.4 By Enterprise Size

8.5.5.4 South Africa Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.5.4.1 By End User

8.5.5.4.2 By Component

8.5.5.4.3 By Deployment Model

8.5.5.4.4 By Enterprise Size

8.5.5.5 Rest of Middle East and Africa Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.5.5.5.1 By End User

8.5.5.5.2 By Component

8.5.5.5.2 By Deployment Model

8.5.5.5.4 By Enterprise Size

8.6 Central and South America Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.1 By End User

8.6.2 By Component

8.6.3 By Deployment Model

8.6.4 By Enterprise Size

8.6.5 By Country

8.6.5.1 Brazil Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.5.1.1 By End User

8.6.5.1.2 By Component

8.6.5.1.3 By Deployment Model

8.6.5.1.4 By Enterprise Size

8.6.5.2 Argentina Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.5.2.1 By End User

8.6.5.2.2 By Component

8.6.5.2.3 By Deployment Model

8.6.5.2.4 By Enterprise Size

8.6.5.3 Chile Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.5.3.1 By End User

8.6.5.3.2 By Component

8.6.5.3.3 By Deployment Model

8.6.5.5.4 By Enterprise Size

8.6.5.4 Rest of Central and South America Trade Surveillance System Market Estimates and Forecast, 2021-2029 (USD Million)

8.6.5.4.1 By End User

8.6.5.4.2 By Component

8.6.5.4.3 By Deployment Model

8.6.5.4.4 By Enterprise Size

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 ACA Group

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Aquis Exchange

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 b-next

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 CRISIL LIMITED

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Cinnober

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 IBM Corporation

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 FIS

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 IPC Systems Inc.

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 NICE

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 SIA S.P.A.

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Trade Surveillance System Market, By End User, 2021-2029 (USD Mllion)

2 Banks Market, By Region, 2021-2029 (USD Mllion)

3 Institutional Brokers Market, By Region, 2021-2029 (USD Mllion)

4 Retail Brokers Market, By Region, 2021-2029 (USD Mllion)

5 Market Centers & RegulatorsMarket, By Region, 2021-2029 (USD Mllion)

6 Others Market, By Region, 2021-2029 (USD Mllion)

7 Global Trade Surveillance System Market, By Component, 2021-2029 (USD Mllion)

8 Solutions Market, By Region, 2021-2029 (USD Mllion)

9 Services Market, By Region, 2021-2029 (USD Mllion)

10 Global Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Mllion)

11 On-premise Market, By Region, 2021-2029 (USD Mllion)

12 Cloud Market, By Region, 2021-2029 (USD Mllion)

13 Global Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Mllion)

14 Large Enterprises Market, By Region, 2021-2029 (USD Mllion)

15 SMEs Market, By Region, 2021-2029 (USD Mllion)

16 Regional Analysis, 2021-2029 (USD Mllion)

17 North America Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

18 North America Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

19 North America Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

20 North America Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

21 North America Trade Surveillance System Market, By Country, 2021-2029 (USD Million)

22 U.S Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

23 U.S Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

24 U.S Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

25 U.S Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

26 Canada Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

27 Canada Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

28 Canada Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

29 CANADA Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

30 Mexico Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

31 Mexico Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

32 Mexico Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

33 mexico Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

34 Europe Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

35 Europe Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

36 Europe Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

37 europe Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

38 europe Trade Surveillance System Market, By country, 2021-2029 (USD Million)

39 Germany Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

40 Germany Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

41 Germany Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

42 germany Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

43 U.K Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

44 U.K Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

45 U.K Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

46 U.kTrade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

47 France Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

48 France Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

49 France Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

50 france Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

51 Italy Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

52 Italy Trade Surveillance System Market, By Component Type, 2021-2029 (USD Million)

53 Italy Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

54 italy Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

55 Spain Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

56 Spain Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

57 Spain Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

58 spain Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

59 Rest Of Europe Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

60 Rest Of Europe Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

61 Rest of Europe Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

62 REST OF EUROPE Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

63 Asia Pacific Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

64 Asia Pacific Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

65 Asia Pacific Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

66 asia Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

67 Asia Pacific Trade Surveillance System Market, By Country, 2021-2029 (USD Million)

68 China Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

69 China Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

70 China Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

71 china Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

72 India Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

73 India Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

74 India Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

75 india Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

76 Japan Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

77 Japan Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

78 Japan Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

79 japan Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

80 South Korea Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

81 South Korea Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

82 South Korea Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

83 south korea Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

84 Indonesia Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

85 Indonesia Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

86 Indonesia Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

87 Indonesia Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

88 Vietnam Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

89 Vietnam Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

90 Vietnam Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

91 Vietnam Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

92 Taiwan Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

93 Taiwan Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

94 Taiwan Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

95 Taiwan Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

96 Rest of Asia Pacific Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

97 Rest of Asia Pacific Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

98 Rest of Asia Pacific Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

99 Rest of Asia Pacific Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

100 Middle East and Africa Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

101 Middle East and Africa Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

102 Middle East and Africa Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

103 MIDDLE EAST and AFRICA Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

104 Middle East and Africa Trade Surveillance System Market, By Country, 2021-2029 (USD Million)

105 Saudi Arabia Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

106 Saudi Arabia Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

107 Saudi Arabia Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

108 saudi arabia Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

109 UAE Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

110 UAE Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

111 UAE Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

112 uae Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

113 South Africa Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

114 South Africa Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

115 South Africa Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

116 South Africa Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

117 Rest of Middle East and Africa Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

118 Rest of Middle East and Africa Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

119 Rest of Middle East and Africa Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

120 Rest of Middle East and Africa Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

121 Central and South America Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

122 Central and South America Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

123 Central and South America Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

124 CENTRAL and SOUTH AMERICA Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

125 Central and South America Trade Surveillance System Market, By Country, 2021-2029 (USD Million)

126 Brazil Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

127 Brazil Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

128 Brazil Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

129 brazil Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

130 Chile Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

131 Chile Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

132 Chile Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

133 Chile Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

134 Rest of Central and South America Trade Surveillance System Market, By End User, 2021-2029 (USD Million)

135 Rest of Central and South America Trade Surveillance System Market, By Component, 2021-2029 (USD Million)

136 Rest of Central and South America Trade Surveillance System Market, By Deployment Model, 2021-2029 (USD Million)

137 Rest of Central and South America Trade Surveillance System Market, By Enterprise Size, 2021-2029 (USD Million)

138 ACA GROUP: Products & Services Offering

139 Aquis Exchange: Products & Services Offering

140 B-next: Products & Services Offering

141 CRISIL LIMITED: Products & Services Offering

142 Cinnober: Products & Services Offering

143 IBM CORPORATION: Products & Services Offering

144 FIS : Products & Services Offering

145 IPC Systems Inc.: Products & Services Offering

146 NICE, Inc: Products & Services Offering

147 SIA S.P.A.: Products & Services Offering

148 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Trade Surveillance System Market Overview

2 Global Trade Surveillance System Market Value From 2021-2029 (USD Mllion)

3 Global Trade Surveillance System Market Share, By End User (2023)

4 Global Trade Surveillance System Market Share, By Component (2023)

5 Global Trade Surveillance System Market Share, By Deployment Model (2023)

6 Global Trade Surveillance System Market Share, By Enterprise Size (2023)

7 Global Trade Surveillance System Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Trade Surveillance System Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Trade Surveillance System Market

12 Impact Of Challenges On The Global Trade Surveillance System Market

13 Porter’s Five Forces Analysis

14 Global Trade Surveillance System Market: By End User Scope Key Takeaways

15 Global Trade Surveillance System Market, By End User Segment: Revenue Growth Analysis

16 Banks Market, By Region, 2021-2029 (USD Mllion)

17 Institutional Brokers Market, By Region, 2021-2029 (USD Mllion)

18 Retail Brokers Market, By Region, 2021-2029 (USD Mllion)

19 Market Centers & Regulators Market, By Region, 2021-2029 (USD Mllion)

20 Others Market, By Region, 2021-2029 (USD Mllion)

21 Global Trade Surveillance System Market: By Component Scope Key Takeaways

22 Global Trade Surveillance System Market, By Component Segment: Revenue Growth Analysis

23 Solutions Market, By Region, 2021-2029 (USD Mllion)

24 Services Market, By Region, 2021-2029 (USD Mllion)

25 Global Trade Surveillance System Market: By Deployment Model Scope Key Takeaways

26 Global Trade Surveillance System Market, By Deployment Model Segment: Revenue Growth Analysis

27 On-premise Market, By Region, 2021-2029 (USD Mllion)

28 Cloud Market, By Region, 2021-2029 (USD Mllion)

29 Global Trade Surveillance System Market: By Enterprise Size Scope Key Takeaways

30 Global Trade Surveillance System Market, By Enterprise Size Segment: Revenue Growth Analysis

31 Large Enterprises Market, By Region, 2021-2029 (USD Mllion)

32 SMEs Market, By Region, 2021-2029 (USD Mllion)

33 Regional Segment: Revenue Growth Analysis

34 Global Trade Surveillance System Market: Regional Analysis

35 North America Trade Surveillance System Market Overview

36 North America Trade Surveillance System Market, By End User

37 North America Trade Surveillance System Market, By Component

38 North America Trade Surveillance System Market, By Deployment Model

39 North America Trade Surveillance System Market, By Enterprise Size

40 North America Trade Surveillance System Market, By Country

41 U.S. Trade Surveillance System Market, By End User

42 U.S. Trade Surveillance System Market, By Component

43 U.S. Trade Surveillance System Market, By Deployment Model

44 U.S. Trade Surveillance System Market, By Enterprise Size

45 Canada Trade Surveillance System Market, By End User

46 Canada Trade Surveillance System Market, By Component

47 Canada Trade Surveillance System Market, By Deployment Model

48 Canada Trade Surveillance System Market, By Enterprise Size

49 Mexico Trade Surveillance System Market, By End User

50 Mexico Trade Surveillance System Market, By Component

51 Mexico Trade Surveillance System Market, By Deployment Model

52 Mexico Trade Surveillance System Market, By Enterprise Size

53 Four Quadrant Positioning Matrix

54 Company Market Share Analysis

55 ACA Group: Company Snapshot

56 ACA Group: SWOT Analysis

57 ACA Group: Geographic Presence

58 Aquis Exchange: Company Snapshot

59 Aquis Exchange: SWOT Analysis

60 Aquis Exchange: Geographic Presence

61 b-next: Company Snapshot

62 b-next: SWOT Analysis

63 b-next: Geographic Presence

64 CRISIL LIMITED: Company Snapshot

65 CRISIL LIMITED: Swot Analysis

66 CRISIL LIMITED: Geographic Presence

67 Cinnober: Company Snapshot

68 Cinnober: SWOT Analysis

69 Cinnober: Geographic Presence

70 IBM Corporation: Company Snapshot

71 IBM Corporation: SWOT Analysis

72 IBM Corporation: Geographic Presence

73 FIS : Company Snapshot

74 FIS : SWOT Analysis

75 FIS : Geographic Presence

76 IPC Systems Inc.: Company Snapshot

77 IPC Systems Inc.: SWOT Analysis

78 IPC Systems Inc.: Geographic Presence

79 NICE, Inc.: Company Snapshot

80 NICE, Inc.: SWOT Analysis

81 NICE, Inc.: Geographic Presence

82 SIA S.P.A.: Company Snapshot

83 SIA S.P.A.: SWOT Analysis

84 SIA S.P.A.: Geographic Presence

85 Other Companies: Company Snapshot

86 Other Companies: SWOT Analysis

87 Other Companies: Geographic Presence

The Global Trade Surveillance Systems Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Trade Surveillance Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS