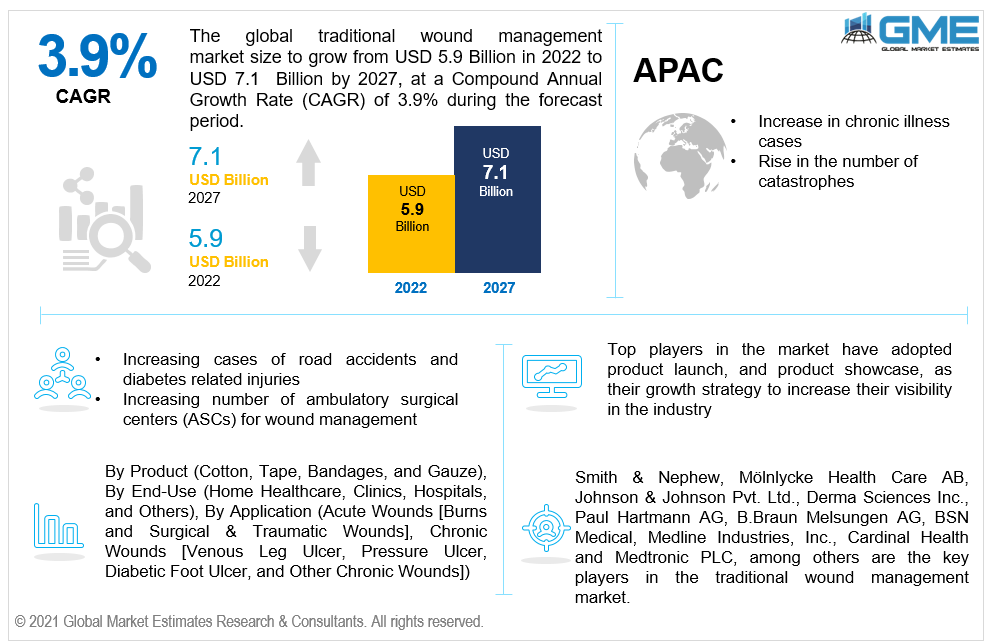

Global Traditional Wound Management Market Size, Trends & Analysis - Forecasts to 2027 By Product (Cotton, Tape, Bandages, and Gauze), By End-Use (Home Healthcare, Clinics, Hospitals, and Others), By Application (Acute Wounds [Burns and Surgical & Traumatic Wounds], Chronic Wounds [Venous Leg Ulcer, Pressure Ulcer, Diabetic Foot Ulcer, and Other Chronic Wounds]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The global traditional wound management market is projected to grow from USD 5.9 billion in 2022 to USD 7.1 billion by 2027 at a CAGR value of 3.9% from 2022 to 2027.

Traditional wound dressing products are used most often as primary or secondary dressings to protect the wound from contamination. These products include gauze, lint, plasters, bandages (natural or synthetic), and cotton wool. Protecting wound fluids, preventing disease, regulating biomechanical impacts, and affecting gelatin development are all part of traditional wound treatment.

The market is expected to rise due to an increase in the number of road accidents, the increase in ambulatory surgical centers (ASCs), and the prevalence of chronic diseases around the globe.

The rising prevalence of cutaneous inflammation like burning and fractures, as well as wound infections associated with diabetes complications, varicose veins, pressure sores, and artery ulcers, are driving the traditional wound care market growth. Other drivers influencing the market growth during the forecast period, includes the usage of traditional wound care products for a variety of surgical site clubbed with rising geriatric population.

Moreover, the traditional wound care market is rapidly rising due to increasing number of sports - related injuries and rapidly rising awareness regarding the value of faster wound healing among patients and healthcare professionals.

The market is expected to be driven by an increment in the number of catastrophes such as automobile accidents, wounds, and traumatic events occurring around the globe. According to WHO (2019), over 1,000,000 individuals were moderately or highly scorched in India each year. Additionally, as per the American Association for the Surgery of Trauma, approximately 1.2 million people have died in road accidents globally in 2020, amounting for 3,242 fatalities per day. As a result, such occurrences are projected to augment for traditional wound treatment technologies, boosting the market forward.

During the first half of the forecast period, the COVID-19 epidemic had a negative influence on the wound care market. Due to various state-wide lockdown, shutdown of wound care services, cancelled or delayed elective procedures, the wound care market had slowed down. Nevertheless, demand for wound dressings is predicted to soar in the second quarter of the forecast period.

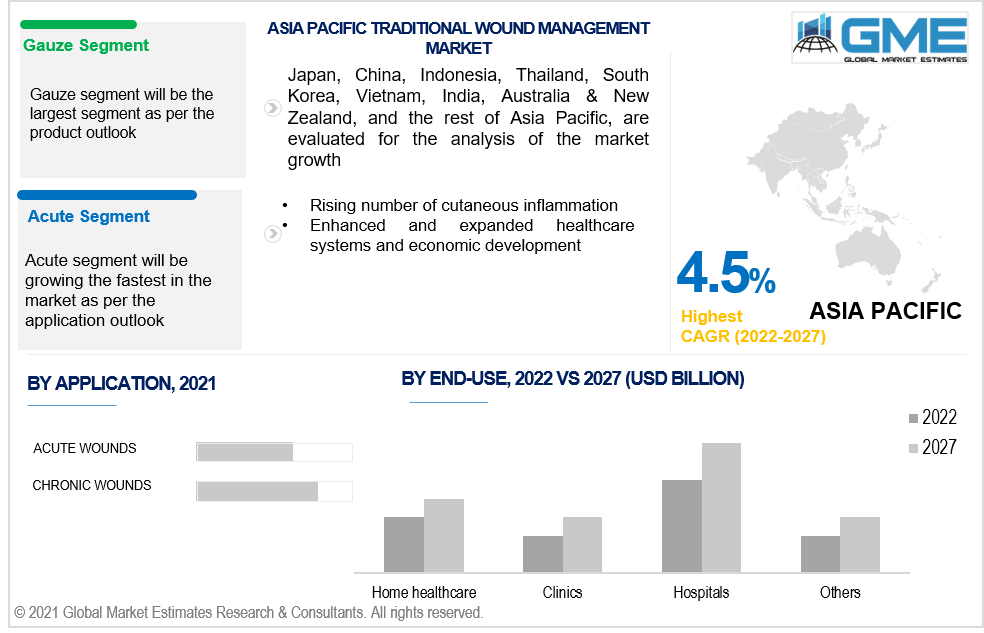

Based on the product, the market is segmented into cotton, tape, bandages, and gauze. The market for gauze segment is expected to be the largest shareholder of the market from 2022 to 2027. Gauze is more popular than other products mainly due to features of being elastic, lightweight, and transparent, all of which aid faster in the wound healing process.

Based on the end-use, the market is segmented into home healthcare, clinics, hospitals, and others. The market for hospitals segment is expected to be the largest shareholder of the market from 2022 to 2027. The primary driving factors for the segment are the rising cases of diabetes complications and increasing prevalence of varicose veins. Furthermore, the segment's expansion is being fuelled by the rising number of postoperative wounds as a result of the number of interventions.

Based on the application, the market is segmented into acute wounds and chronic wounds. The market for acute wounds segment is expected to be the largest shareholder of the market from 2022 to 2027. The major factors propelling the growth of the segment are the growing frequency of burn injuries, road accidents, diabetes related issues and increasing cases of traumatic injuries around the world are boosting the need for this segment. During the forecast period, chronic wounds are expected to rise at the sharpest rate. The increased incidence of chronic diseases, particularly diabetes, and the rising geriatric population are the primary drivers of the category growth.

As per the geographical analysis, the market for traditional wound management can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the traditional wound management market from 2022 to 2027. The factors driving the region's growth include an increasing chronic illness cases, a rise in the number of catastrophes, a spike in the proportion of outpatient settings, and an uptick in the level of sports casualties.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest growing segment in the traditional wound management market during the forecast period due to a rising occurrence of cutaneous inflammation such as burns and injuries, as well as traumatic injuries. Furthermore, rising incidence of chronic diseases, particularly diabetes, as a result of obesity and a sedentary lifestyle, is likely to fuel market expansion throughout the forecast period. Additionally, Asia-Pacific is predicted to have the quickest market growth throughout the forecast period due to enhanced and expanded healthcare systems and rapid economic development.

Smith & Nephew, Mölnlycke Health Care AB, Johnson & Johnson Pvt. Ltd., Derma Sciences Inc., Paul Hartmann AG, B.Braun Melsungen AG, BSN Medical, Medline Industries, Inc., Cardinal Health and Medtronic PLC, among others are the key players in the traditional wound management market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Traditional Wound Management Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Traditional Wound Management Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The rising prevalence of cutaneous inflammation like burning and fractures

3.3.2 Application Challenges

3.3.2.1 High costs connected with product attributes

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Application Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Traditional Wound Management Market, By Product

4.1 Product Outlook

4.2 Cotton

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Tape

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Bandages

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Traditional Wound Management Market, By Application

5.1 Application Outlook

5.2 Acute Wounds

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Chronic Wounds

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Traditional Wound Management Market, By End-User

6.1 Home Healthcare

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Clinics

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Hospitals

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Nuclear Imaging Equipment Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Billion)

7.2.2 Market Size, By Product, 2022-2027 (USD Billion)

7.2.3 Market Size, By End-User, 2022-2027 (USD Billion)

7.2.4 Market Size, By Application, 2022-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Product , 2022-2027 (USD Billion)

7.2.4.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.2.4.3 Market Size, By Application, 2022-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.2.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.2.7.3 Market Size, By Application, 2022-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Billion)

7.3.2 Market Size, By Product , 2022-2027 (USD Billion)

7.3.3 Market Size, By End-User , 2022-2027 (USD Billion)

7.3.4 Market Size, By Application, 2022-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product , 2022-2027 (USD Billion)

7.3.6.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.3.6.3 Market Size, By Application, 2022-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.3.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Application, 2022-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.3.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Application, 2022-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product , 2022-2027 (USD Billion)

7.3.9.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.3.9.3 Market Size, By Application, 2022-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product , 2022-2027 (USD Billion)

7.3.10.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.3.10.3 Market Size, By Application, 2022-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product , 2022-2027 (USD Billion)

7.3.11.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.3.11.3 Market Size, By Application, 2022-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Billion)

7.4.2 Market Size, By Product , 2022-2027 (USD Billion)

7.4.3 Market Size, By End-User , 2022-2027 (USD Billion)

7.4.4 Market Size, By Application, 2022-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product , 2022-2027 (USD Billion)

7.4.6.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.4.6.3 Market Size, By Application, 2022-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.4.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Application, 2022-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.4.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Application, 2022-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product , 2022-2027 (USD Billion)

7.4.9.2 Market size, By End-User , 2022-2027 (USD Billion)

7.4.9.3 Market Size, By Application, 2022-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product , 2022-2027 (USD Billion)

7.4.10.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.4.10.3 Market Size, By Application, 2022-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Billion)

7.5.2 Market Size, By Product , 2022-2027 (USD Billion)

7.5.3 Market Size, By End-User , 2022-2027 (USD Billion)

7.5.4 Market Size, By Application, 2022-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product , 2022-2027 (USD Billion)

7.5.6.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.5.6.3 Market Size, By Application, 2022-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.5.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Application, 2022-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.5.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Application, 2022-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Billion)

7.6.2 Market Size, By Product , 2022-2027 (USD Billion)

7.6.3 Market Size, By End-User , 2022-2027 (USD Billion)

7.6.4 Market Size, By Application, 2022-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product , 2022-2027 (USD Billion)

7.6.6.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.6.6.3 Market Size, By Application, 2022-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.6.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Application, 2022-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product , 2022-2027 (USD Billion)

7.6.7.2 Market Size, By End-User , 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Application, 2022-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2022

8.2 Smith & Nephew

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Mölnlycke Health Care AB

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Johnson & Johnson Pvt. Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Derma Sciences Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Paul Hartmann AG

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 B.Braun Melsungen AG

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 BSN Medical

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Medline Industries, Inc

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Cardinal Health

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

The Global Traditional Wound Management Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Traditional Wound Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS