Global Transformer Oil Market Size, Trends & Analysis - Forecasts to 2026 By Oil Type (Mineral Oil [Naphthenic Oil, Paraffinic Oil], Bio-Based Oil, Silicone Oil), By Application (Transformer, Reactor, Switchgear), By End-User (Transmission and Distribution, Railways & Metros, Power Generation, Others), By Region (By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

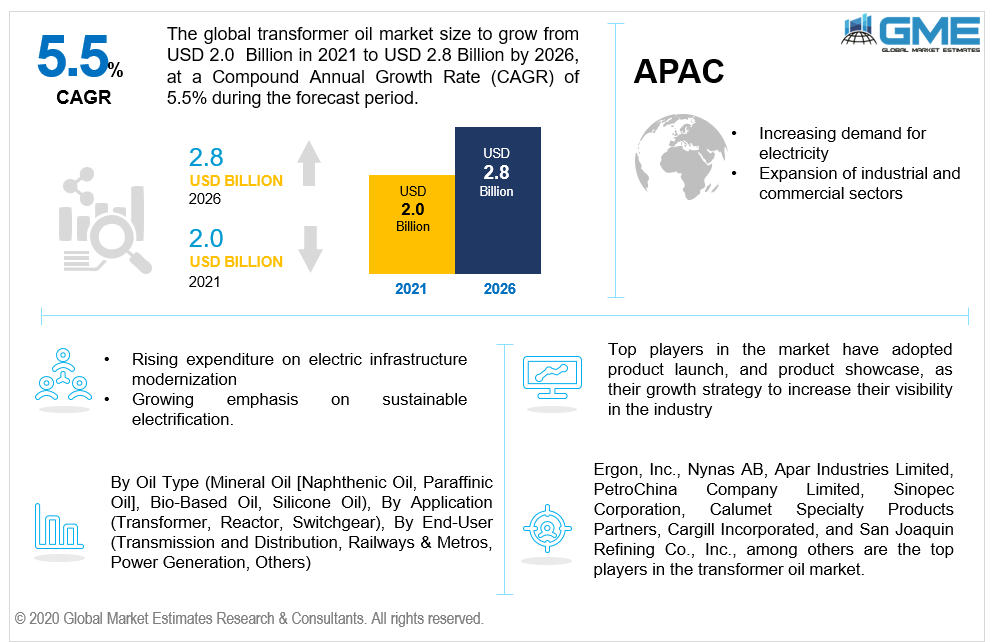

The global transformer oil market is projected to grow from USD 2.0 billion in 2021 and is expected to reach USD 2.8 billion by 2026 at a CAGR of 5.5% from 2021 to 2026.

Rust resistance is one of the major drivers responsible for the growth of the transformer oil market. The market is expected to be growing the fastest mostly due to massive development in the power generation sector to fulfil rising electricity consumption. Moreover, growing emphasis on sustainable electrification will also help the market grow.

The COVID-19 epidemic has had an inconsistent influence on specialized industrial chemicals. However, as a result of the supply chain disruption, manufacturers are experiencing procurement and shipping challenges. Furthermore, the fall in demand for transformer oils has increased storage demand for transformer oil makers, raising the cost of manufacturing and, as a result, the selling price of transformer oil. To adapt to these volatile market conditions, transformer oil manufacturers have implemented a variety of initiatives, including increased manufacturing efficiency and the development of refineries and storage depots.

Nevertheless, because transformer oil has the problems of low heat resistance, flammability, and aging, there are numerous specific criteria for using it as a cooling medium. Furthermore, concerns such as crude oil price instability and the increased use of dry transformers are projected to stymie industry expansion. Crude oil is the most vital energy resource for carrying out economic operations, and the volatility of crude oil prices has a substantial impact on the market.

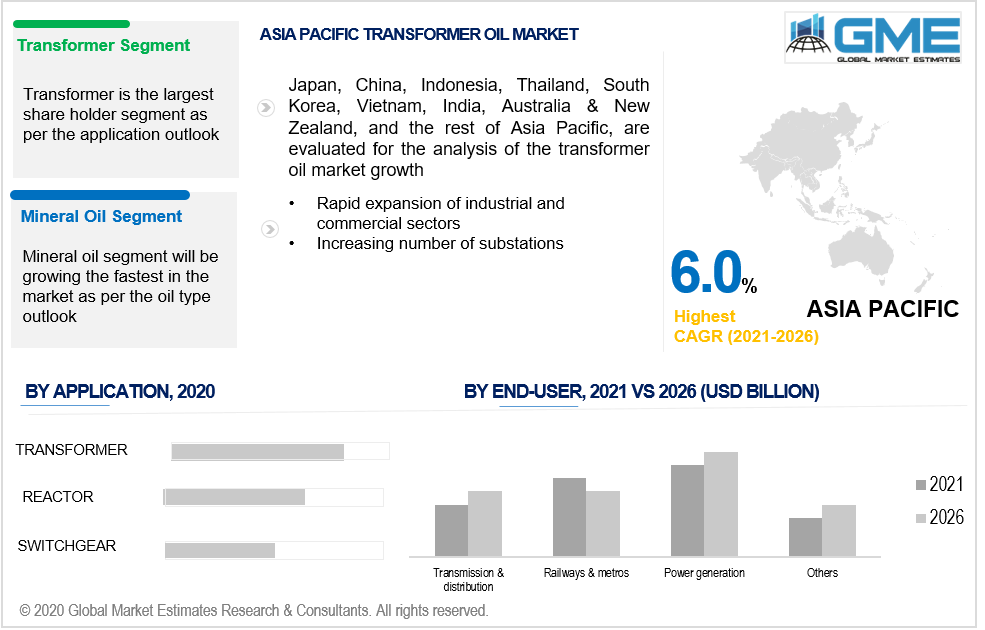

Based on the oil type, the market is segmented into mineral oil, bio-based oil, and silicone oil. The mineral oil is expected to have the largest share in the market during the forecast period. Mineral oil is used for conditioning and shielding transformers, boilers, and switchgear. It can also be used for thermal transfer as well as to safeguard the transformer's interior field winding. Mineral oil is further subdivided into naphthenic and paraffinic oil, and mineral oil is used as the dielectric fluid in the most of new and existing transformers for its low-cost indices and accessibility of availability in contrast to other heat transfer fluids, mineral oil consumption is expected to rise during the forecast period.

Based on the application, the market is segmented into transformer, reactor, and switchgear. The transformer segment is expected to have the largest share in the market during the forecast period. The large size is mainly due to the exponential increase in the global population that has led to investments in both developed and developing countries for the extension of current power networks as well as the reinforcement of power infrastructure. Upgrades and expansions of electric networks due to rising power demands would enhance the installation of transformers, which will finally accelerate the transformer segment's growth.

Based on the end-user, the market is segmented into transmission and distribution, railways & metros, power generation, others. The transmission and distribution segment are expected to have the largest share in the market during the forecast period. The large size is mainly because of the global increase in the production and use of electricity. The transmission and distribution system are owned and operated by transmission and distribution utilities. With higher electricity usage, transmission and distribution system have expanded, as well as deployment of electronic systems such as transformers, reactors, and switchgear, due to increase in transformer oil consumption.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (UAE, Saudi Arabia, and Rest of MEA) and Central & South America.

The North American region is expected to hold the lion’s share of the global revenue generated in the transformer oil market. This growth is due to rising expenditure on electric infrastructure modernization, rising energy consumption, and increasing support of government for the development of renewable networks, and increasing product launch strategies in the market. Expansion of road and rail networks, notably in emerging markets, as well as considerable investments in the transportation industry, are expected to drive product demand.

During the forecast period, the Asia Pacific region is expected to grow rapidly. This is mainly due to rising electricity demand and increasing organic and inorganic strategies for transformer oil in developing countries such as India and China. Moreover, increasing number of substations will drive up demand for transformers in APAC region.

Ergon, Inc., Nynas AB, Apar Industries Limited, PetroChina Company Limited, Sinopec Corporation, Calumet Specialty Products Partners, Cargill Incorporated, Hydrodec Group Plc, Valvoline, Engen Petroleum Limited, Gandhar Oil Refinery India Limited, and San Joaquin Refining Co., Inc., among others are the top players in the transformer oil market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Analysis

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Transformer Oil Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Oil Type Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Transformer Oil Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Massive development in the power generation sector to fulfil rising electricity consumption

3.3.2 End-User Challenges

3.3.2.1 High crude oil price instability and the increased use of dry transformers are projected to stymie industry expansion

3.4 Prospective Growth Scenario

3.4.1 Oil Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Transformer Oil Market, By Oil Type

4.1 Oil Type Outlook

4.2 Mineral Oil

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Bio-Based Oil

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Silicone Oil

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Transformer Oil Market, By Application

5.1 Application Outlook

5.2 Transformer

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Reactor

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Switchgear

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Transformer Oil Market, By End-User

6.1 Transmission and Distribution

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Railways & Metros

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Power Generation

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Transformer Oil Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Oil Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Nynas AB

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Ergon, Inc

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 PetroChina Company Limited

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Apar Industries Limited

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Calumet Specialty Products Partners

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Sinopec Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Hydrodec Group Plc

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Cargill Incorporated

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Engen Petroleum Limited

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Valvoline

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Infographic Analysis

The Global Transformer Oil Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Transformer Oil Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS