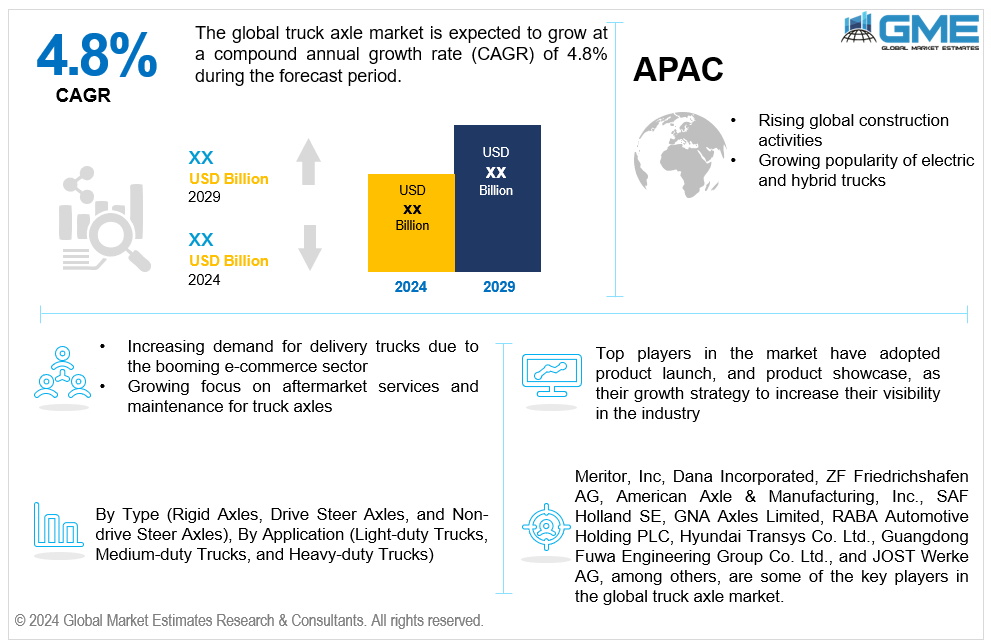

Global Truck Axle Market Size, Trends & Analysis - Forecasts to 2029 By Type (Rigid Axles, Drive Steer Axles, and Non-drive Steer Axles), By Application (Light-duty Trucks, Medium-duty Trucks, and Heavy-duty Trucks), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global truck axle market is estimated to exhibit a CAGR of 4.8% from 2024 to 2029.

The primary factors propelling the market growth are the rising global construction activities and the growing popularity of electric and hybrid trucks. As construction projects expand globally, there is an increasing demand for heavy-duty vehicles capable of transporting materials and equipment efficiently. This surge necessitates the use of robust and reliable heavy-duty truck axles to support the increased load capacities and rigorous operational demands. The truck axle manufacturing industry is responding with innovations in commercial vehicle axles, enhancing durability and performance to meet market needs. Moreover, key axle market trends include the development of stronger, lighter materials and advanced truck axle components that improve efficiency and longevity. Both front axle trucks and rear axle trucks are seeing enhancements to better handle the stresses of construction environments. These advances are critical as they ensure the vehicles' stability and reliability, further propelling market growth. For instance, according to the Global Infrastructure Hub, global construction spending is expected to exceed USD 3.7 trillion by 2024.

The increasing demand for delivery trucks due to the booming e-commerce sector, the growing focus on aftermarket services, and maintenance for truck axles are expected to support the truck axle industry growth. As trucks endure rigorous usage, maintaining optimal axle load capacity becomes crucial for performance and safety. This has led to a surge in demand for truck axle suppliers who can provide reliable and durable parts. Advances in axle technology are enabling the development of more efficient and robust off-road truck axles, catering to the specific needs of heavy-duty applications. Regular truck axle replacement and comprehensive axle maintenance services are essential to extend the lifespan of vehicles and ensure their continuous operation. This trend is bolstered by a growing recognition of the cost savings and operational efficiency that proactive maintenance offers.

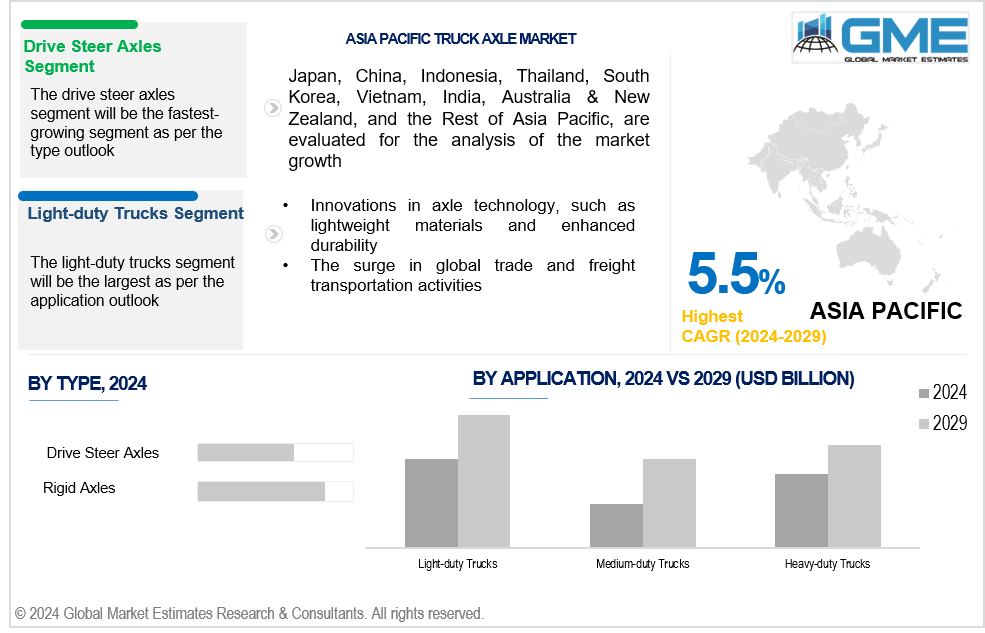

Innovations in axle technology, such as lightweight materials and enhanced durability, coupled with the surge in global trade and freight transportation activities, propel market growth. New truck axle types are being developed to meet the evolving demands of the transportation and logistics industries. Comprehensive axle market analysis reveals that advancements in materials science and engineering are significantly improving axle durability, making them more resilient to wear and tear. This, in turn, affects truck axle pricing as the market adjusts to the higher value and longer lifespan of these advanced components. Axle innovation is not only focused on materials but also on design improvements that enhance overall performance and efficiency. Adherence to stringent truck axle safety standards ensures that these innovations meet the necessary regulatory requirements, promoting safer and more reliable operations.

With the popularity of electric trucks, there is an opportunity to create axles specifically designed for electric drivetrains, with an emphasis on economy and weight reduction. Additionally, adoption of technology like as automation and 3D printing can also lower expenses, simplify production procedures, and allow for more specialized axle solutions.

However, the market growth is hindered by the price instability of raw materials and the emergence of alternative modes of transportation, such as rail and canals for freight transit.

The rigid axles segment is expected to hold the largest share of the market over the forecast period. Rigid axles are known for being exceptionally strong and able to sustain heavy loads due to their robust construction. This makes them especially appropriate for heavy-duty vehicles seen in long-distance haulage, mining, and construction.

The drive steer axles segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Drive steer axles provide trucks with more agility by combining the driving and steering operations into one unit. Applications like urban deliveries and construction sites that need precise vehicle control in confined places would significantly benefit from this.

The light-duty trucks segment is expected to hold the largest share of the market over the forecast period. Light-duty trucks are increasingly demanding for various sectors and uses, such as construction, urban delivery, and private transportation. Due to their preference for adaptability, fuel economy, and mobility, these vehicles necessitate axles that are specifically designed to meet their needs.

The medium-duty trucks segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The need for medium-duty trucks for last-mile delivery and urban logistics has surged due to the expansion of e-commerce. There is a need for specific axle solutions since these vehicles need axles that can handle frequent pauses, start-and-stop operating situations, and variable load capacities.

North America is expected to be the largest region in the global market. The region's well-developed transportation and logistics sector, which includes trucking businesses, freight carriers, and logistics providers, drives steady demand for vehicles and truck parts like axles. The requirement for dependable and efficient transportation drives the market for truck axles.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The regional market growth is due to rising demand for trucks with axles suitable for various applications, including construction, transportation, and logistics. These increased activities are driven by Asia Pacific governments' initiatives and investments in infrastructure projects, such as road construction, transportation networks, and urban development.

Meritor, Inc, Dana Incorporated, ZF Friedrichshafen AG, American Axle & Manufacturing, Inc., SAF Holland SE, GNA Axles Limited, RABA Automotive Holding PLC, Hyundai Transys Co. Ltd., Guangdong Fuwa Engineering Group Co. Ltd., and JOST Werke AG, among others, are some of the key players in the global truck axle market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, SAF Holland SE announced the acquisition of Tecma Srl, an Italy-based producer of unique axle systems and suspensions.

In July 2023, ZF introduced its next line of electric powertrains, which provide OEMs with all the necessary components to electrify their commercial vehicles. New integrated modular AxTrax 2 drives are appropriate for 44-ton trucks and trailers, as well as small delivery vehicles.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL TRUCK AXLE MARKET, BY Type

4.1 Introduction

4.2 Truck Axle Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Rigid Axles

4.4.1 Rigid Axles Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Drive Steer Axles

4.5.1 Drive Steer Axles Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Non-drive Steer Axles

4.6.1 Non-drive Steer Axles Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL TRUCK AXLE MARKET, BY APPLICATION

5.1 Introduction

5.2 Truck Axle Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Light-duty Trucks

5.4.1 Light-duty Trucks Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Medium-duty Trucks

5.5.1 Medium-duty Trucks Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Heavy-duty Trucks

5.6.1 Heavy-duty Trucks Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL TRUCK AXLE MARKET, BY REGION

6.1 Introduction

6.2 North America Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Application

6.2.3.2 Canada Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Application

6.3 Europe Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Application

6.3.3.3 France Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Application

6.3.3.4 Italy Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Application

6.3.3.5 Spain Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.4 Asia Pacific Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Application

6.4.3.2 Japan Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Application

6.4.3.3 India Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Application

6.5.3.3 Israel Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Application

6.6 Central and South America Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Application

6.6.3.3 Chile Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Truck Axle Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Meritor, Inc

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Dana Incorporated

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 ZF Friedrichshafen AG

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 American Axle & Manufacturing, Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 SAF Holland SE

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 GNA AXLES LIMITED

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 RABA Automotive Holding PLC

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Hyundai Transys Co. Ltd.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Guangdong Fuwa Engineering Group Co. Ltd.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 JOST Werke AG

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Truck Axle Market, By Type, 2021-2029 (USD Mllion)

2 Rigid Axles Market, By Region, 2021-2029 (USD Mllion)

3 Drive Steer Axles Market, By Region, 2021-2029 (USD Mllion)

4 Non-drive Steer Axles Market, By Region, 2021-2029 (USD Mllion)

5 Global Truck Axle Market, By Application, 2021-2029 (USD Mllion)

6 Light-duty Trucks Market, By Region, 2021-2029 (USD Mllion)

7 Medium-duty Trucks Market, By Region, 2021-2029 (USD Mllion)

8 Heavy-duty Trucks Market, By Region, 2021-2029 (USD Mllion)

9 Regional Analysis, 2021-2029 (USD Mllion)

10 North America Truck Axle Market, By Type, 2021-2029 (USD Mllion)

11 North America Truck Axle Market, By Application, 2021-2029 (USD Mllion)

12 North America Truck Axle Market, By COUNTRY, 2021-2029 (USD Mllion)

13 U.S. Truck Axle Market, By Type, 2021-2029 (USD Mllion)

14 U.S. Truck Axle Market, By Application, 2021-2029 (USD Mllion)

15 Canada Truck Axle Market, By Type, 2021-2029 (USD Mllion)

16 Canada Truck Axle Market, By Application, 2021-2029 (USD Mllion)

17 Mexico Truck Axle Market, By Type, 2021-2029 (USD Mllion)

18 Mexico Truck Axle Market, By Application, 2021-2029 (USD Mllion)

19 Europe Truck Axle Market, By Type, 2021-2029 (USD Mllion)

20 Europe Truck Axle Market, By Application, 2021-2029 (USD Mllion)

21 EUROPE Truck Axle Market, By COUNTRY, 2021-2029 (USD Mllion)

22 Germany Truck Axle Market, By Type, 2021-2029 (USD Mllion)

23 Germany Truck Axle Market, By Application, 2021-2029 (USD Mllion)

24 U.K. Truck Axle Market, By Type, 2021-2029 (USD Mllion)

25 U.K. Truck Axle Market, By Application, 2021-2029 (USD Mllion)

26 France Truck Axle Market, By Type, 2021-2029 (USD Mllion)

27 France Truck Axle Market, By Application, 2021-2029 (USD Mllion)

28 Italy Truck Axle Market, By Type, 2021-2029 (USD Mllion)

29 Italy Truck Axle Market, By Application, 2021-2029 (USD Mllion)

30 Spain Truck Axle Market, By Type, 2021-2029 (USD Mllion)

31 Spain Truck Axle Market, By Application, 2021-2029 (USD Mllion)

32 Netherlands Truck Axle Market, By Type, 2021-2029 (USD Mllion)

33 Netherlands Truck Axle Market, By Application, 2021-2029 (USD Mllion)

34 Rest Of Europe Truck Axle Market, By Type, 2021-2029 (USD Mllion)

35 Rest Of Europe Truck Axle Market, By Application, 2021-2029 (USD Mllion)

36 Asia Pacific Truck Axle Market, By Type, 2021-2029 (USD Mllion)

37 Asia Pacific Truck Axle Market, By Application, 2021-2029 (USD Mllion)

38 ASIA PACIFIC Truck Axle Market, By COUNTRY, 2021-2029 (USD Mllion)

39 China Truck Axle Market, By Type, 2021-2029 (USD Mllion)

40 China Truck Axle Market, By Application, 2021-2029 (USD Mllion)

41 Japan Truck Axle Market, By Type, 2021-2029 (USD Mllion)

42 Japan Truck Axle Market, By Application, 2021-2029 (USD Mllion)

43 India Truck Axle Market, By Type, 2021-2029 (USD Mllion)

44 India Truck Axle Market, By Application, 2021-2029 (USD Mllion)

45 South Korea Truck Axle Market, By Type, 2021-2029 (USD Mllion)

46 South Korea Truck Axle Market, By Application, 2021-2029 (USD Mllion)

47 Singapore Truck Axle Market, By Type, 2021-2029 (USD Mllion)

48 Singapore Truck Axle Market, By Application, 2021-2029 (USD Mllion)

49 Thailand Truck Axle Market, By Type, 2021-2029 (USD Mllion)

50 Thailand Truck Axle Market, By Application, 2021-2029 (USD Mllion)

51 Malaysia Truck Axle Market, By Type, 2021-2029 (USD Mllion)

52 Malaysia Truck Axle Market, By Application, 2021-2029 (USD Mllion)

53 Indonesia Truck Axle Market, By Type, 2021-2029 (USD Mllion)

54 Indonesia Truck Axle Market, By Application, 2021-2029 (USD Mllion)

55 Vietnam Truck Axle Market, By Type, 2021-2029 (USD Mllion)

56 Vietnam Truck Axle Market, By Application, 2021-2029 (USD Mllion)

57 Taiwan Truck Axle Market, By Type, 2021-2029 (USD Mllion)

58 Taiwan Truck Axle Market, By Application, 2021-2029 (USD Mllion)

59 Rest of APAC Truck Axle Market, By Type, 2021-2029 (USD Mllion)

60 Rest of APAC Truck Axle Market, By Application, 2021-2029 (USD Mllion)

61 Middle East and Africa Truck Axle Market, By Type, 2021-2029 (USD Mllion)

62 Middle East and Africa Truck Axle Market, By Application, 2021-2029 (USD Mllion)

63 MIDDLE EAST & AFRICA Truck Axle Market, By COUNTRY, 2021-2029 (USD Mllion)

64 Saudi Arabia Truck Axle Market, By Type, 2021-2029 (USD Mllion)

65 Saudi Arabia Truck Axle Market, By Application, 2021-2029 (USD Mllion)

66 UAE Truck Axle Market, By Type, 2021-2029 (USD Mllion)

67 UAE Truck Axle Market, By Application, 2021-2029 (USD Mllion)

68 Israel Truck Axle Market, By Type, 2021-2029 (USD Mllion)

69 Israel Truck Axle Market, By Application, 2021-2029 (USD Mllion)

70 South Africa Truck Axle Market, By Type, 2021-2029 (USD Mllion)

71 South Africa Truck Axle Market, By Application, 2021-2029 (USD Mllion)

72 Rest Of Middle East and Africa Truck Axle Market, By Type, 2021-2029 (USD Mllion)

73 Rest Of Middle East and Africa Truck Axle Market, By Application, 2021-2029 (USD Mllion)

74 Central and South America Truck Axle Market, By Type, 2021-2029 (USD Mllion)

75 Central and South America Truck Axle Market, By Application, 2021-2029 (USD Mllion)

76 CENTRAL AND SOUTH AMERICA Truck Axle Market, By COUNTRY, 2021-2029 (USD Mllion)

77 Brazil Truck Axle Market, By Type, 2021-2029 (USD Mllion)

78 Brazil Truck Axle Market, By Application, 2021-2029 (USD Mllion)

79 Chile Truck Axle Market, By Type, 2021-2029 (USD Mllion)

80 Chile Truck Axle Market, By Application, 2021-2029 (USD Mllion)

81 Argentina Truck Axle Market, By Type, 2021-2029 (USD Mllion)

82 Argentina Truck Axle Market, By Application, 2021-2029 (USD Mllion)

83 Rest Of Central and South America Truck Axle Market, By Type, 2021-2029 (USD Mllion)

84 Rest Of Central and South America Truck Axle Market, By Application, 2021-2029 (USD Mllion)

85 Meritor, Inc: Products & Services Offering

86 Dana Incorporated: Products & Services Offering

87 ZF Friedrichshafen AG: Products & Services Offering

88 American Axle & Manufacturing, Inc.: Products & Services Offering

89 SAF Holland SE: Products & Services Offering

90 GNA AXLES LIMITED: Products & Services Offering

91 RABA Automotive Holding PLC: Products & Services Offering

92 Hyundai Transys Co. Ltd.: Products & Services Offering

93 Guangdong Fuwa Engineering Group Co. Ltd., Inc: Products & Services Offering

94 JOST Werke AG: Products & Services Offering

95 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Truck Axle Market Overview

2 Global Truck Axle Market Value From 2021-2029 (USD Mllion)

3 Global Truck Axle Market Share, By Type (2023)

4 Global Truck Axle Market Share, By Application (2023)

5 Global Truck Axle Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Truck Axle Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Truck Axle Market

10 Impact Of Challenges On The Global Truck Axle Market

11 Porter’s Five Forces Analysis

12 Global Truck Axle Market: By Type Scope Key Takeaways

13 Global Truck Axle Market, By Type Segment: Revenue Growth Analysis

14 Rigid Axles Market, By Region, 2021-2029 (USD Mllion)

15 Drive Steer Axles Market, By Region, 2021-2029 (USD Mllion)

16 Non-drive Steer Axles Market, By Region, 2021-2029 (USD Mllion)

17 Global Truck Axle Market: By Application Scope Key Takeaways

18 Global Truck Axle Market, By Application Segment: Revenue Growth Analysis

19 Light-duty Trucks Market, By Region, 2021-2029 (USD Mllion)

20 Medium-duty Trucks Market, By Region, 2021-2029 (USD Mllion)

21 Heavy-duty Trucks Market, By Region, 2021-2029 (USD Mllion)

22 Regional Segment: Revenue Growth Analysis

23 Global Truck Axle Market: Regional Analysis

24 North America Truck Axle Market Overview

25 North America Truck Axle Market, By Type

26 North America Truck Axle Market, By Application

27 North America Truck Axle Market, By Country

28 U.S. Truck Axle Market, By Type

29 U.S. Truck Axle Market, By Application

30 Canada Truck Axle Market, By Type

31 Canada Truck Axle Market, By Application

32 Mexico Truck Axle Market, By Type

33 Mexico Truck Axle Market, By Application

34 Four Quadrant Positioning Matrix

35 Company Market Share Analysis

36 Meritor, Inc: Company Snapshot

37 Meritor, Inc: SWOT Analysis

38 Meritor, Inc: Geographic Presence

39 Dana Incorporated: Company Snapshot

40 Dana Incorporated: SWOT Analysis

41 Dana Incorporated: Geographic Presence

42 ZF Friedrichshafen AG: Company Snapshot

43 ZF Friedrichshafen AG: SWOT Analysis

44 ZF Friedrichshafen AG: Geographic Presence

45 American Axle & Manufacturing, Inc.: Company Snapshot

46 American Axle & Manufacturing, Inc.: Swot Analysis

47 American Axle & Manufacturing, Inc.: Geographic Presence

48 SAF Holland SE: Company Snapshot

49 SAF Holland SE: SWOT Analysis

50 SAF Holland SE: Geographic Presence

51 GNA AXLES LIMITED: Company Snapshot

52 GNA AXLES LIMITED: SWOT Analysis

53 GNA AXLES LIMITED: Geographic Presence

54 RABA Automotive Holding PLC : Company Snapshot

55 RABA Automotive Holding PLC : SWOT Analysis

56 RABA Automotive Holding PLC : Geographic Presence

57 Hyundai Transys Co. Ltd.: Company Snapshot

58 Hyundai Transys Co. Ltd.: SWOT Analysis

59 Hyundai Transys Co. Ltd.: Geographic Presence

60 Guangdong Fuwa Engineering Group Co. Ltd., Inc.: Company Snapshot

61 Guangdong Fuwa Engineering Group Co. Ltd., Inc.: SWOT Analysis

62 Guangdong Fuwa Engineering Group Co. Ltd., Inc.: Geographic Presence

63 JOST Werke AG: Company Snapshot

64 JOST Werke AG: SWOT Analysis

65 JOST Werke AG: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

68 Other Companies: Geographic Presence

The Global Truck Axle Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Truck Axle Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS