Global Tunable Laser Market Size, Trends & Analysis - Forecasts to 2026 By Type (Solid State, Gas, Fiber Liquid, Free-Electron Laser (FEL), Nanoseconds Pulsed OPO, Others), By Technology (External Cavity Diode Laser, Distributed Bragg Reflector Laser (DBR), Distributed Feedback Laser (DFB), Vertical Cavity Surface Emitting Lasers (VCSELs), Micro Electro Mechanical System (MEMS), Others), By Wavelength (< 1000 nm, 1000nm-1500nm, > 1500nm), By Application (Micro Processing, Drilling, Cutting, Welding, Engraving & Marking, Communication, Others), By End-User (Electronics & Semiconductors, Automotive, Aerospace, Telecommunication & Networking Devices, Medical, Manufacturing, Packaging, Others); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

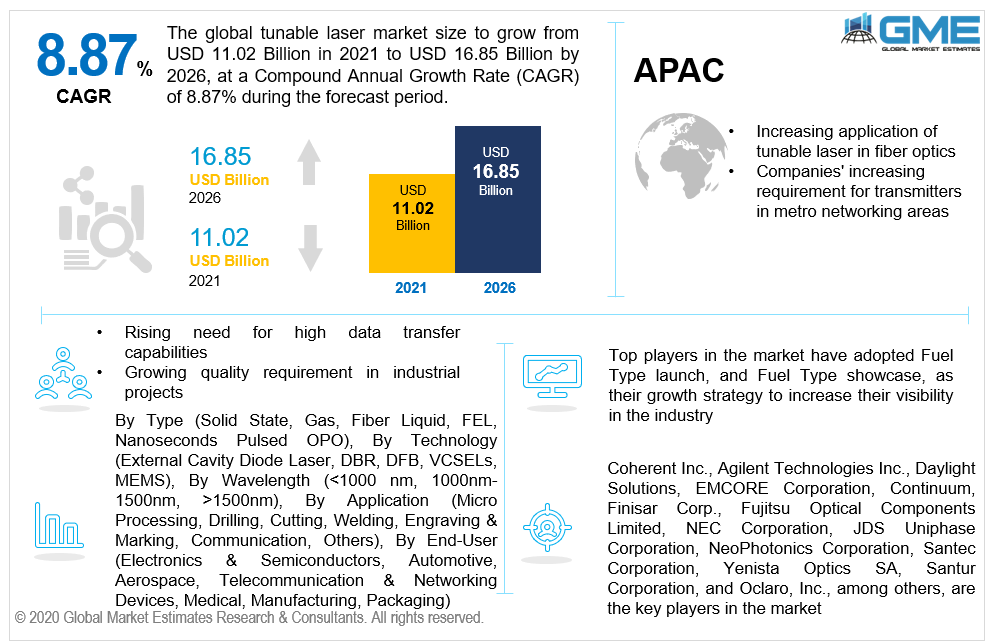

The global tunable laser market is estimated to be valued at USD 11.02 billion in 2021 and is projected to reach USD 16.85 billion by 2026 at a CAGR of 8.87%. The expanding demand for wide bandwidth and increased data transmission capacity, burgeoning quality requirements in engineering applications, and skyrocketing demand for consumer electronics are all contributing to the market's advancement. Innovations in semiconductors and measuring devices, increased network congestion and traffic, and the use of spectroscopy in medicare, as well as other relevant fields, are all contributing to the market's growth. The necessity for speedy outcomes at a reasonable cost is one of the primary factors propelling the global market forward. The requirement for such lasers is also being driven by an increase in the need for the ecological inspection market, as well as their increasing acceptance in the pharmaceutical as well as other sectors. Though with a limited specimen set, such lasers aid in the analysis of poisons and toxins in substances.

The latest epidemic has enhanced the requirement for technological innovation in the medical industry, and globally the government is investing extensively to offer that innovation. This, in turn, will result in breakthroughs in medical operating systems and elevated demand for such lasers, strengthening the expansion of the market. Growing smartphone proliferation and social networking have produced a tremendous need for network capacity, which is expected to drive the necessity for such lasers to fulfill network enlargement requirements. Companies' increasing requirement for transmitters in metro networking areas is projected to drive up tunable laser market share in the near term. In addition, essential characteristics like customizable tuning alternatives, cost management, competitive advantage, and deployment efficiency for metro network carriers are expected to significantly boost market needs.

Due to an improvement in throughput via dynamic reconfigurability, a very rewarding potential in the fiber optic components industry, particularly such lasers, is projected to fuel market demand. Such lasers make it easier to incorporate or remove throughput by allowing users to regulate the system remotely, allowing for a variety of on-demand operations. Broadband communication sector advances are predicted to influence the market. The requirement for more capable, high-speed, and dynamic networking is leading to the path to improved laser technology research and development.

One of the many advantages of a tunable diode laser is the spectrum variety it can provide. A tunable diode laser may produce approximately all of the wavelengths possible in a semiconductor diode laser. Such lasers can cut costs while increasing network flexibility and productivity by using wavelength-division multiplexing. These variables are favorable to market expansion. Furthermore, focusing on client expectations has proven to be beneficial to the tunable laser market growth. Such lasers, on the other hand, are more costly than fixed-wavelength competitors. In addition, the market may be threatened by the unsatisfactory performance of previous such laser systems. The market for such lasers is being stifled as a result of this. The global market is still in its early stages of evolution, but it is expected to grow rapidly over the next few years.

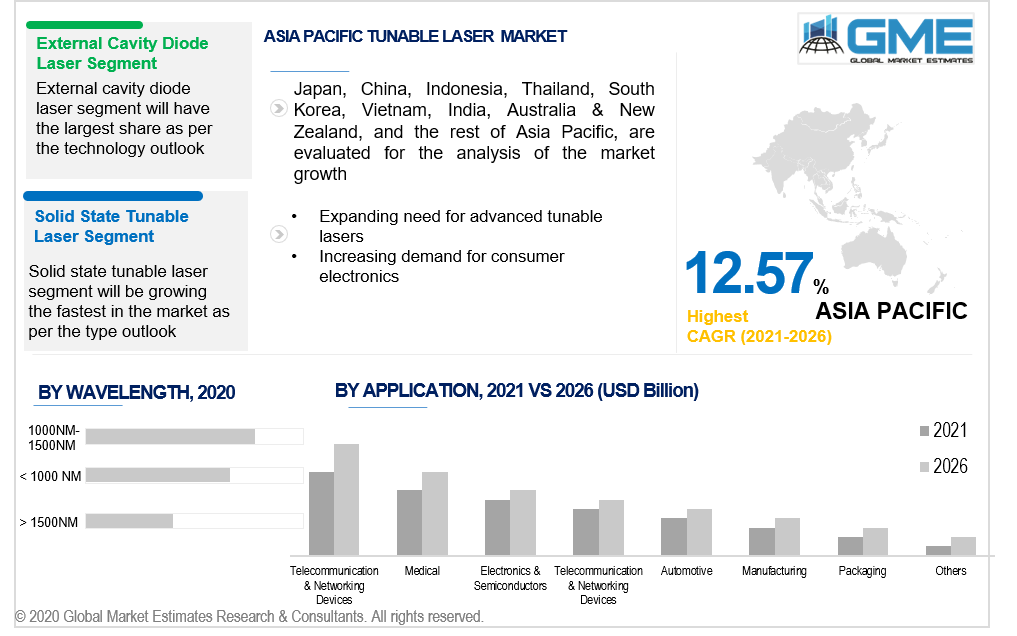

Depending on the type, the market is categorized as solid state, gas, fiber liquid, free-electron laser (FEL), nanoseconds pulsed OPO, and others. The solid-state segment dominates the market with the largest market share owing to its feature of offering additional freedom in the laser system design. Sapphire is currently the most popular crystal for such lasers. Its strong thermodynamic structural and optical qualities are combined with the widest tunable range of any given substance in this class. It may be layered across the entire wavelength range of 660 to 1100 nm. Tunable solid-state lasers encompass a large portion of the near-infrared spectrum and extend well into the ultraviolet.

Depending on the technology, the market is categorized as an external cavity diode laser, distributed Bragg reflector laser (DBR), distributed feedback laser (DFB), vertical-cavity surface-emitting lasers (VCSELS), micro electro mechanical system (MEMS), and others. External cavity diode lasers possess the major market share because they have a broad tunable band (more than 40 nm) and, although they have a slow turning speed, they may switch wavelengths in tens of milliseconds, thereby increasing their employment in optical testing and evaluation instruments.

Depending on the wavelength, the market is categorized as < 1000 nm, 1000nm-1500nm, and > 1500nm. Because of its outstanding quantization economy and outstanding fiber coupling effectiveness, the 1000nm-1500nm category has the largest market share.

Depending on the application, the market is categorized as microprocessing, drilling, cutting, welding, engraving & marking, communication, and others. Owing to the significant proliferation of optical communication, where such lasers will aid in wavelength management, network optimization, and the development of next-generation optical infrastructure the communication segment leads with the largest market share.

Depending on the end-user, the market is categorized as electronics & semiconductors, automotive, aerospace, telecommunication & networking devices, medical, manufacturing, packaging, and others. Such a laser serves to increase networking intelligence, functionality, and the economy. Therefore, the telecommunication and networking devices category has a major market share.

The market is presumed to be dominated by North America. The supremacy would be attributable to marketing analytics technologies and incumbent players who have been in the market since its inception. Furthermore, government organizations, businesses, third-party administrations, and others are focusing their resources on developing customer-centric goods, which will help the area prosper. The market is expected to rise tremendously due to soaring demand, greater incomes, sophisticated technology, and equipment, as well as programs to raise the consciousness of the requirements. As a result of advances in the domain of sophisticated medical lasers. Throughout the forecast period, the employment of such lasers in medical instruments and therapies, fiber optic connectivity, and the automotive sector is expected to grow rapidly.

Owing to its rapidly rising demographic, Asia-Pacific is expected to have higher demand in the forecast period. The area has been urbanized to a considerable level as a result of gains in GDP per capita and infrastructural developments, transforming rural regions towards urban environments. Cities have fallen under unsustainable consumerism paradigms as a result of the unexpected spike in demand. The area is home to the most important players in the market. This is attributable to continuous rapid industrialization, which has culminated in lower production costs in developing economies as well as increased expansion in the automobile industry.

Coherent Inc., Agilent Technologies Inc., Daylight Solutions, EMCORE Corporation, Continuum, Finisar Corp., Fujitsu Optical Components Limited, NEC Corporation, JDS Uniphase Corporation, NeoPhotonics Corporation, Santec Corporation, Yenista Optics SA, Santur Corporation, and Oclaro, Inc., among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Tunable Laser Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Technology Overview

2.1.4 Application Overview

2.1.5 Wavelength Overview

2.1.6 End-User Overview

2.1.7 Regional Overview

Chapter 3 Global Tunable Laser Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The Expanding Demand For Wide Bandwidth And Increased Data Transmission Capacity

3.3.1.2 Increasing Market Penetration of Consumer Electronics

3.3.2 Industry Challenges

3.3.2.1 High Cost of Tunable Laser

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Wavelength Growth Scenario

3.4.5 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.10.1 Company Positioning Overview, 2020

Chapter 4 Global Tunable Laser Market, By Type

4.1 Type Outlook

4.2 Solid State Tunable Lasers

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Gas Tunable Lasers

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Fiber Tunable Lasers

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Liquid Tunable Lasers

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Free-Electron Laser (FEL)

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

4.7 Nanoseconds Pulsed OPO

4.7.1 Market Size, By Region, 2019-2026 (USD Million)

4.8 Others

4.8.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Tunable Laser Market, By Technology

5.1 Technology Outlook

5.2 External Cavity Diode Laser

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Distributed Bragg Reflector Laser (DBR)

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Distributed Feedback Laser (DFB)

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Vertical Cavity Surface Emitting Lasers (VCSELs)

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Micro Electro Mechanical System (MEMS)

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Others

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Tunable Laser Market, By Application

6.1 Application Outlook

6.2 Micro Processing

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Drilling

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Cutting

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Welding

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Engraving & Marking

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Communication

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

6.6 Others

6.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Tunable Laser Market, By Wavelength

7.1 Wavelength Outlook

7.2 < 1000 nm

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 1000nm-1500nm

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 > 1500nm

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Tunable Laser Market, By End-User

8.1 End-User Outlook

8.2 Electronics & Semiconductors

8.2.1 Market Size, By Region, 2019-2026 (USD Million)

8.3 Automotive

8.3.1 Market Size, By Region, 2019-2026 (USD Million)

8.4 Aerospace

8.4.1 Market Size, By Region, 2019-2026 (USD Million)

8.5 Telecommunication & Networking Devices

8.5.1 Market Size, By Region, 2019-2026 (USD Million)

8.6 Medical

8.6.1 Market Size, By Region, 2019-2026 (USD Million)

8.7 Manufacturing

8.7.1 Market Size, By Region, 2019-2026 (USD Million)

8.8 Packaging

8.8.1 Market Size, By Region, 2019-2026 (USD Million)

8.9 Others

8.9.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 10 Global Tunable Laser Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2019-2026 (USD Million)

9.2.2 Market Size, By Type, 2019-2026 (USD Million)

9.2.3 Market Size, By Technology, 2019-2026 (USD Million)

9.2.4 Market Size, By Application, 2019-2026 (USD Million)

9.2.5 Market Size, By Wavelength, 2019-2026 (USD Million)

9.2.6 Market Size, By End-User, 2019-2026 (USD Million)

9.2.7 U.S.

9.2.7.1 Market Size, By Type, 2019-2026 (USD Million)

9.2.7.2 Market Size, By Technology, 2019-2026 (USD Million)

9.2.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.2.7.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.2.7.5 Market Size, By End-User, 2019-2026 (USD Million)

9.2.8 Canada

9.2.8.1 Market Size, By Type, 2019-2026 (USD Million)

9.2.8.2 Market Size, By Technology, 2019-2026 (USD Million)

9.2.8.3 Market Size, By Application, 2019-2026 (USD Million)

9.2.8.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.2.8.5 Market Size, By End-User, 2019-2026 (USD Million)

9.3 Europe

9.3.1 Market Size, By Country 2019-2026 (USD Million)

9.3.2 Market Size, By Type, 2019-2026 (USD Million)

9.3.3 Market Size, By Technology, 2019-2026 (USD Million)

9.3.4 Market Size, By Application, 2019-2026 (USD Million)

9.3.5 Market Size, By Wavelength, 2019-2026 (USD Million)

9.3.6 Market Size, By End-User, 2019-2026 (USD Million)

9.3.7 Germany

9.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

9.3.7.2 Market Size, By Technology, 2019-2026 (USD Million)

9.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.7.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.3.7.5 Market Size, By End-User, 2019-2026 (USD Million)

9.3.8 UK

9.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

9.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

9.3.8.3 Market Size, By Technology, 2019-2026 (USD Million)

9.3.8.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.3.8.5 Market Size, By End-User, 2019-2026 (USD Million)

9.3.9 France

9.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

9.3.9.2 Market Size, By Technology, 2019-2026 (USD Million)

9.3.9.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.9.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.3.9.5 Market Size, By End-User, 2019-2026 (USD Million)

9.3.10 Italy

9.3.10.1 Market Size, By Type, 2019-2026 (USD Million)

9.3.10.2 Market Size, By Technology, 2019-2026 (USD Million)

9.3.10.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.10.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.3.10.5 Market Size, By End-User, 2019-2026 (USD Million)

9.3.11 Spain

9.3.10.1 Market Size, By Type, 2019-2026 (USD Million)

9.3.11.2 Market Size, By Technology, 2019-2026 (USD Million)

9.3.11.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.11.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.3.11.5 Market Size, By End-User, 2019-2026 (USD Million)

9.3.12 Russia

9.3.12.1 Market Size, By Type, 2019-2026 (USD Million)

9.3.12.2 Market Size, By Technology, 2019-2026 (USD Million)

9.3.12.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.12.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.3.12.5 Market Size, By End-User, 2019-2026 (USD Million)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2019-2026 (USD Million)

9.4.2 Market Size, By Type, 2019-2026 (USD Million)

9.4.3 Market Size, By Technology, 2019-2026 (USD Million)

9.4.4 Market Size, By Application, 2019-2026 (USD Million)

9.4.5 Market Size, By Wavelength, 2019-2026 (USD Million)

9.4.6 Market Size, By End-User, 2019-2026 (USD Million)

9.4.7 China

9.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

9.4.7.2 Market Size, By Technology, 2019-2026 (USD Million)

9.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.4.7.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.4.7.5 Market Size, By End-User, 2019-2026 (USD Million)

9.4.8 India

9.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

9.4.8.2 Market Size, By Technology, 2019-2026 (USD Million)

9.4.8.3 Market Size, By Application, 2019-2026 (USD Million)

9.4.8.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.4.8.5 Market Size, By End-User, 2019-2026 (USD Million)

9.4.9 Japan

9.4.9.1 Market Size, By Type, 2019-2026 (USD Million)

9.4.9.2 Market Size, By Technology, 2019-2026 (USD Million)

9.4.9.3 Market Size, By Application, 2019-2026 (USD Million)

9.4.9.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.4.9.5 Market Size, By End-User, 2019-2026 (USD Million)

9.4.10 Australia

9.4.10.1 Market Size, By Type, 2019-2026 (USD Million)

9.4.10.2 Market size, By Technology, 2019-2026 (USD Million)

9.4.10.3 Market size, By Application, 2019-2026 (USD Million)

9.4.10.4 Market size, By Wavelength, 2019-2026 (USD Million)

9.4.10.5 Market size, By End-User, 2019-2026 (USD Million)

9.4.11 South Korea

9.4.10.1 Market Size, By Type, 2019-2026 (USD Million)

9.4.11.2 Market Size, By Technology, 2019-2026 (USD Million)

9.4.11.3 Market Size, By Application, 2019-2026 (USD Million)

9.4.11.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.4.11.5 Market Size, By End-User, 2019-2026 (USD Million)

9.5 Latin America

9.5.1 Market Size, By Country 2019-2026 (USD Million)

9.5.2 Market Size, By Type, 2019-2026 (USD Million)

9.5.3 Market Size, By Technology, 2019-2026 (USD Million)

9.5.4 Market Size, By Application, 2019-2026 (USD Million)

9.5.5 Market Size, By Wavelength, 2019-2026 (USD Million)

9.5.6 Market Size, By End-User, 2019-2026 (USD Million)

9.5.7 Brazil

9.5.7.1 Market Size, By Type, 2019-2026 (USD Million)

9.5.7.2 Market Size, By Technology, 2019-2026 (USD Million)

9.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.5.7.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.5.7.5 Market Size, By End-User, 2019-2026 (USD Million)

9.5.8 Mexico

9.5.8.1 Market Size, By Type, 2019-2026 (USD Million)

9.5.8.2 Market Size, By Technology, 2019-2026 (USD Million)

9.5.8.3 Market Size, By Application, 2019-2026 (USD Million)

9.5.8.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.5.8.5 Market Size, By End-User, 2019-2026 (USD Million)

9.5.9 Argentina

9.5.9.1 Market Size, By Type, 2019-2026 (USD Million)

9.5.9.2 Market Size, By Technology, 2019-2026 (USD Million)

9.5.9.3 Market Size, By Application, 2019-2026 (USD Million)

9.5.9.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.5.9.5 Market Size, By End-User, 2019-2026 (USD Million)

9.6 MEA

9.6.1 Market Size, By Country 2019-2026 (USD Million)

9.6.2 Market Size, By Type, 2019-2026 (USD Million)

9.6.3 Market Size, By Technology, 2019-2026 (USD Million)

9.6.4 Market Size, By Application, 2019-2026 (USD Million)

9.6.5 Market Size, By Wavelength, 2019-2026 (USD Million)

9.6.6 Market Size, By End-User, 2019-2026 (USD Million)

9.6.7 Saudi Arabia

9.6.7.1 Market Size, By Type, 2019-2026 (USD Million)

9.6.7.2 Market Size, By Technology, 2019-2026 (USD Million)

9.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.6.7.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.6.7.5 Market Size, By End-User, 2019-2026 (USD Million)

9.6.8 UAE

9.6.8.1 Market Size, By Type, 2019-2026 (USD Million)

9.6.8.2 Market Size, By Technology, 2019-2026 (USD Million)

9.6.8.3 Market Size, By Application, 2019-2026 (USD Million)

9.6.8.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.6.8.5 Market Size, By End-User, 2019-2026 (USD Million)

9.6.9 South Africa

9.6.9.1 Market Size, By Type, 2019-2026 (USD Million)

9.6.9.2 Market Size, By Technology, 2019-2026 (USD Million)

9.6.9.3 Market Size, By Application, 2019-2026 (USD Million)

9.6.9.4 Market Size, By Wavelength, 2019-2026 (USD Million)

9.6.9.5 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2020

10.2 Coherent Inc.

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 Agilent Technologies Inc.

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 Daylight Solutions

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 EMCORE Corporation

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Continuum

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 Finisar Corp.

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 Fujitsu Optical Components Limited

10.8.1 Company Overview

10.8.2 Financial Analysis

10.8.3 Strategic Positioning

10.8.4 Info Graphic Analysis

10.9 NEC Corporation

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Info Graphic Analysis

10.10 JDS Uniphase Corporation

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.11 NeoPhotonics Corporation

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Positioning

10.11.4 Info Graphic Analysis

10.12 Santec Corporation

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Positioning

10.12.4 Info Graphic Analysis

10.13 Yenista Optics SA

10.13.1 Company Overview

10.13.2 Financial Analysis

10.13.3 Strategic Positioning

10.13.4 Info Graphic Analysis

10.14 Santur Corporation

10.14.1 Company Overview

10.14.2 Financial Analysis

10.14.3 Strategic Positioning

10.14.4 Info Graphic Analysis

10.15 Oclaro, Inc.

10.15.1 Company Overview

10.15.2 Financial Analysis

10.15.3 Strategic Positioning

10.15.4 Info Graphic Analysis

10.16 Other Companies

10.16.1 Company Overview

10.16.2 Financial Analysis

10.16.3 Strategic Positioning

10.16.4 Info Graphic Analysis

The Global Tunable Laser Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Tunable Laser Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS