Global Turbine Air Filtration Market Size, Trends & Analysis - Forecasts to 2026 By Type (Cartridge Collectors, Dust Collectors, HEPA Filters, Baghouse Filters, Others), By Application (Power Generation, Oil, & Gas, And Others), By Face Velocity (Low Velocity, Medium Velocity, & High Velocity), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

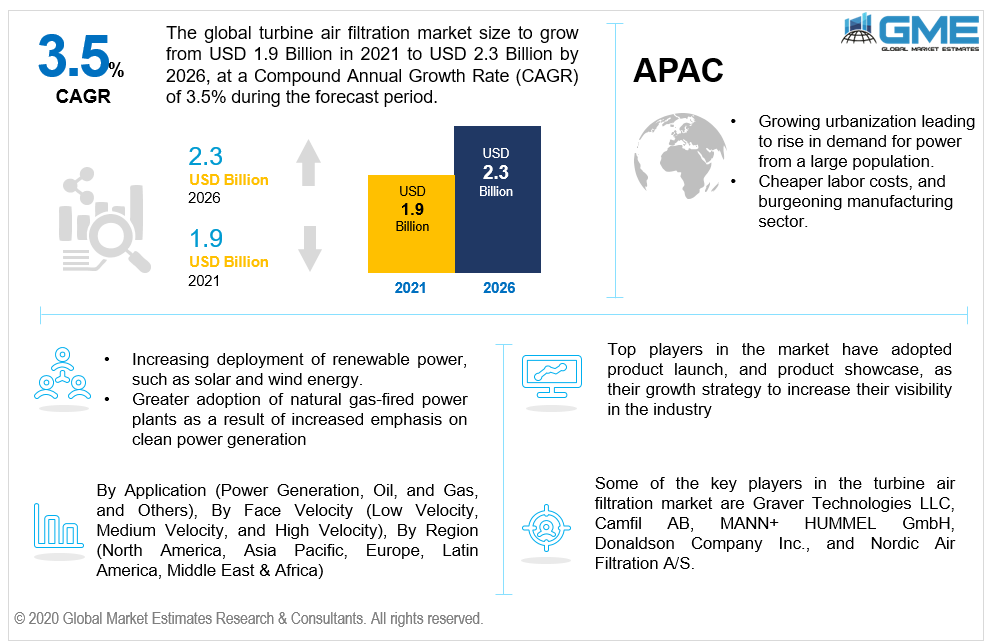

The global turbine air filtration market is projected to grow from USD 1.9 billion in 2021 to USD 2.3 billion by 2026 at a CAGR value of 3.5% from 2021 to 2026.

The market was severely impacted due to the COVID-19 since the prime consumers of the market, such as the oil & gas industry and power generation industry, witnessed a decline in the market activities and fluctuation in the raw material prices.

However, increasing adoption of natural gas-fired power plants, due to rising focus on clean power generation, and flourishing electric power generation industry are some of the factors expected to boost the demand for turbine air filtration in the market.

A gas turbine's inlet air filtering system is critical to its proper operation. The filtration system keeps dangerous particles out of the gas turbine, which can cause problems including FOD, erosion, fouling, and corrosion. As a result, gas turbine performance and productivity should be upgraded based on the availability of suitable input filtering. If these concerns are not rectified, the gas turbine's operative lifespan and effectiveness will be shortened.

Turbine air filtration systems have evolved from rudimentary fine particle elimination techniques to complex and economic systems capable of purifying solid and liquid particles over time. Due to the sheer increased delicate nature of particles entering gas turbines, this progression and enhancement of filtering systems are required.

In modern turbines, technology has resulted in improved tolerance of equipment and systems for increasing operating temperature. As a result, selecting an inlet filtering system is critical in the construction of a gas turbine. Inlet air systems that are not up to par might negatively impact gas turbine performances, efficiency, and durability.

Aspects such as the greater adoption of natural gas-fired power plants as a result of increased emphasis on clean power generation are anticipated to drive the turbine air filtration market over the forecast period, which, in turn, is supposed to propel the turbine air filtration market due to its extensive application in the power industry. Nevertheless, throughout the study, the increasing deployment of renewable power, such as solar and wind energy, is anticipated to stifle market expansion.

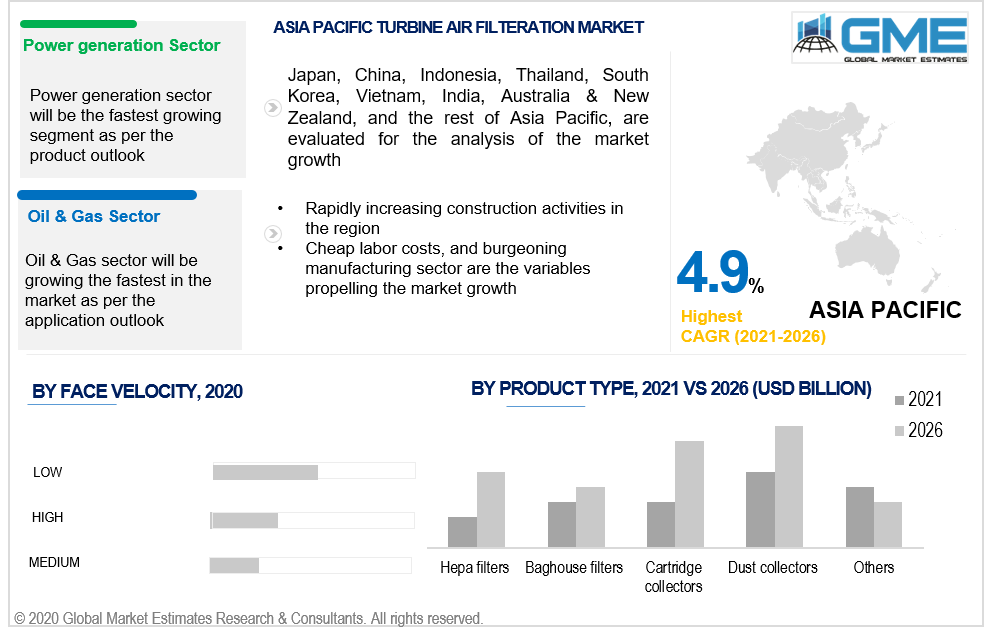

The global air filtration market is split into cartridge collectors, dust collectors, HEPA filters, baghouse filters, and others, depending on the product types.

Dust collectors segment is expected to have the largest market share, owing to the need to maintain air quality, and are expected to continue to rise considerably fast during the forecast period. It helps to extend the equipment’s life by circulating clean air around the workplace and lowering energy expenditures. The increasing use of dust collectors in the metal and mining sectors is expected to drive the market forward. Product appeal is boosted by advanced features such as a wide range of additional components and equipment configured to match facility operations.

The demand for HEPA filters in the industrial, residential, and commercial sectors is anticipated to widen exponentially over the forecast period. These air filters are used to remove impurities such as droplets and sub-micron particles from the air. With their inherent superior diffusion processes, they do have a distinctive ability to recruit particles.

The market is categorized into three groups depending on product application namely, power generation, oil and gas, and others. The power generation segment is expected to be the largest in the market from 2021 to 2026.

The use of gas turbines to produce energy has progressed. It has progressed to become one of the most sustainable and ecologically friendly methods of energy production.

Additionally, multiple energy capabilities (renewable and synthetic fuels, short construction lead time, and modular construction), cheap electricity production, minimal installation expense, reduced emissions, and very high performance are factors driving demand for gas turbines. As a result, the rising gas turbine industry is anticipated to boost demand for air filtering systems throughout the forecast period.

Filtration systems are classified into three categories namely, high, medium, and low velocity.

The velocity of a filtration system is the precise capillary air flow divided by the whole filter face area. In low-velocity systems, airflow is less than 500 ft/min (2.54 m/s) compared to 610 to 680 feet per minute (3.1 to 3.45 meters per second) and higher than 780 ft/min (4 m/s) for medium and higher velocity, respectively.

Where space and weight are limited, high-velocity systems have typically been used aboard maritime vessels and offshore installations. In maritime and offshore applications, low, medium, and high-velocity systems are now frequently used. Although high-velocity systems have the benefits such as reduced size (cross-sectional area), mass, and upfront expense, they also need additional filtration replacement than lower velocity systems with comparable performance.

On the other extreme, low-velocity systems have huge inlet surface areas and large filter housings, and often Lower velocity often reduces static pressure and improves filtration efficiency. Low-velocity systems, on the aggregate, are more competent at lowering the bulk of pollutants that enter a circuit, resulting in longer rinse times for the engine. Low-velocity systems segment is expected to have the largest share in the market from 2021 to 2026.

The regional analysis segment for turbine air filtration market includes North America, Asia Pacific, Europe, Middle East & Africa and Central & South America.

The Asia Pacific region will dominate the market from 2021 to 2026 by growing the fastest with the highest CAGR value. Increasing urbanization, rising demand for power from a large population, cheaper labor costs, and burgeoning manufacturing sector are the variables propelling the market growth in Asia-Pacific. Furthermore, the region's rapidly increasing construction activities have contributed to a significant increase in pollution levels.

The governments of China, India, and other growing economies have favoured low-polluting gas-based stations, which is likely to raise demand for turbine air filtration systems in Asia-Pacific. Furthermore, top turbine air filtration producers have shifted their priorities to business expansions in China, which is one of the world's largest manufacturing markets.

In order to enhance the use of gas-fired power plants, Asian countries such as India declared in December 2019 that it is working on a new strategy to resuscitate gas-based power generation in the country. The idea is to combine natural gas-based power generating (electricity tariff of INR 4/unit) with solar-generated electricity (INR 2.95/Unit), reducing the financial strain on power-producing businesses while increasing profitability. During the projection period, the installation is expected to boost demand for turbine air filtration systems.

Some of the key players are Graver Technologies LLC, Camfil AB, MANN+ HUMMEL GmbH, Donaldson Company Inc., and Nordic Air Filtration A/S. Other players in the market include Daikin Industries Ltd, Parker Hannifin Corporation, Advanced Filtration Concepts, Koch Filter Corporation, Freudenberg Filtration Technologies SE & Co. KG, and W. L. Gore & Associates Inc.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview & Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Turbine Air Filtration Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Grade Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing adoption of natural gas-fired power plants, due to rising focus on clean power generation

3.3.2 Industry Challenges

3.3.2.1 Hard impact of COVID-19

3.4 Prospective Growth Scenario

3.5 Covid-19 Influence on Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Turbine Air Filtration Market, By Type

4.1 Type Outlook

4.2 Cartridge Collectors

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Dust Collectors

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 HEPA Filters

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.5 Baghouse Filters

4.5.1 Market Size, By Region, 2019-2026 (USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Turbine Air Filtration Market, By Application

5.1 Grade Outlook

5.2 Power Generation

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Oil & Gas

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Others

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 High Strength Aluminium Alloys Market, By Face Velocity

6.1 End-User Outlook

6.2 Low

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Medium

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 High

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Turbine Air Filtration Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Type, 2019-2026 (USD Billion)

7.2.3 Market Size, By Grade, 2019-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.2.7 Mexico

7.2.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.7.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Type, 2019-2026 (USD Billion)

7.3.3 Market Size, By Grade, 2019-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.5 Germany

7.2.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.6 Spain

7.3.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Billion)

7.4.2 Market Size, By Type, 2019-2026 (USD Billion)

7.4.3 Market Size, By Grade, 2019-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.7 Malaysia

7.4.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.8.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5 Central & South America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Type, 2019-2026 (USD Billion)

7.5.3 Market Size, By Grade, 2019-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.5.6 Argentina

7.5.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Billion)

7.6.2 Market Size, By Type, 2019-2026 (USD Billion)

7.6.3 Market Size, By Grade, 2019-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2019-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2019-2026 (USD Billion)

7.6.5.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.6.5.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2019-2026 (USD Billion)

7.6.6.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2019-2026 (USD Billion)

7.6.7.2 Market Size, By Grade, 2019-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Daikin Industries Ltd

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Camfil AB

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Graver Technologies

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Parker Hannifin Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Donaldson Company Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Advanced Filtration Concepts

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Koch Filter Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Mann+ Hummel Gmbh

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Infographic Analysis

8.10 Freudenberg Filtration Technologies Se & Co. Kg

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

The Global Turbine Air Filtration Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Turbine Air Filtration Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS