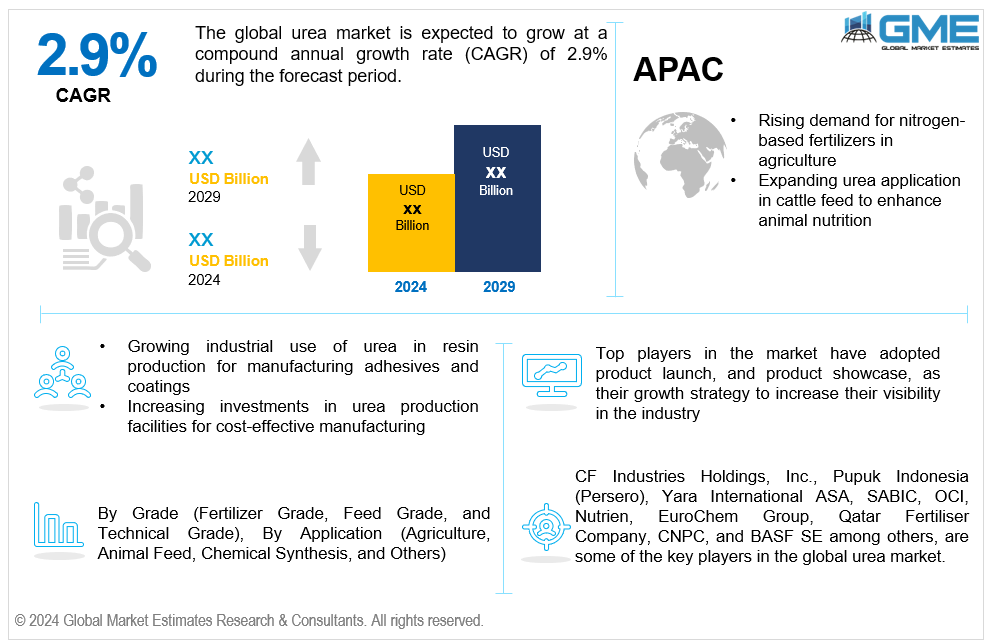

Global Urea Market Size, Trends & Analysis - Forecasts to 2029 By Grade (Fertilizer Grade, Feed Grade, and Technical Grade), By Application (Agriculture, Animal Feed, Chemical Synthesis, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global urea market is estimated to exhibit a CAGR of 2.9% from 2024 to 2029.

The primary factors propelling the market growth are the rising demand for nitrogen-based fertilizers in agriculture and expanding urea application in cattle feed to enhance animal nutrition. The demand in the farming industry to increase crop yields and guarantee food security is growing as the world's population continues to rise. Nitrogen is a critical nutrient for plant growth, and urea, being the most widely used nitrogen fertilizer, plays a crucial role in enhancing crop productivity. Farmers are increasingly adopting urea-based fertilizers to improve soil fertility and optimize crop output. Urea's high nitrogen content makes it highly effective and cost-efficient compared to other fertilizers, further driving its adoption. The need for urea is also being fueled by the increased focus on precision agriculture and sustainable agricultural methods, both of which depend on efficient fertilizer use. As agricultural practices intensify to meet global food needs, the demand for urea continues to rise, positioning it as a pivotal component in modern farming and contributing to the growth of the global urea market.

Growing industrial use of urea in resin production for manufacturing adhesives and coatings along with the increasing investments in urea production facilities for cost-effective manufacturing are expected to support the market growth. The urea-formaldehyde (UF) resins, which are extensively utilized as bonding agents in wood-based products such as particleboard, plywood, and fiberboard, are made using urea as a primary raw material. These UF resins offer strong adhesion, quick curing, and cost efficiency, making them highly attractive for use in the construction and furniture industries. The demand for durable and lightweight construction materials is rising globally, driving the use of UF resins and, consequently, increasing urea consumption. Additionally, urea-based resins are essential in coating applications, offering protective, glossy finishes for various surfaces. With expanding industrial sectors in emerging economies and a growing focus on affordable, high-strength materials, the need for urea in adhesive and coating resins is expected to remain strong, propelling the global urea market forward.

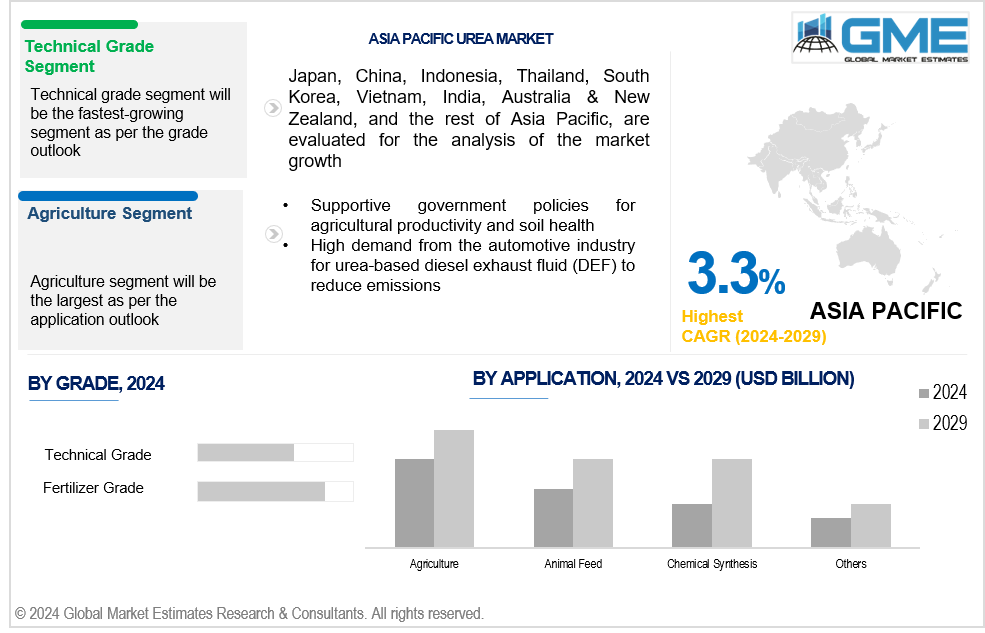

Supportive government policies for agricultural productivity and soil health coupled with the high demand from the automotive industry for urea-based diesel exhaust fluid (DEF) to reduce emissions propel market growth. Governments worldwide recognize the importance of stable agricultural output to ensure food security and economic resilience. Many offer subsidies and incentives for nitrogen-based fertilizers like urea, enabling farmers to access affordable, nutrient-rich solutions that boost crop yields. These policies often include direct subsidies, tax exemptions, or pricing controls that reduce the cost of fertilizers, making urea more accessible to small-scale and large-scale farmers alike. In addition, initiatives promoting soil health have spurred greater use of balanced fertilization practices, where urea's high nitrogen content helps replenish essential nutrients in depleted soils. As part of broader agricultural development plans, many governments also support research and education on optimal fertilizer use, further increasing urea's demand.

The growing demand for sustainable agricultural inputs presents an opportunity for bio-based urea production. In line with the growing use of environmentally friendly methods in the agricultural industry, using renewable raw materials to make urea helps lessen its impact on the environment. Additionally, there is an opportunity to develop urea-based enhanced efficiency fertilizers (EEFs), which control nitrogen release more effectively. These EEFs improve nutrient absorption, lower environmental impacts, and meet the growing demand for environmentally responsible, high-efficiency fertilizer options.

However, strict environmental regulations targeting nitrogen emissions and dependence on government subsidies impede market growth.

The fertilizer grade segment is expected to hold the largest share of the market over the forecast period. Fertilizer-grade urea provides a cost-effective nitrogen source for large-scale farming. Its high nitrogen concentration makes it economically favorable, allowing farmers to achieve better crop performance with lower application rates compared to other fertilizers.

The technical grade segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Technical-grade urea is increasingly used in urea-formaldehyde resin production, essential for adhesives in the wood industry. This application is growing alongside construction and furniture manufacturing, boosting demand for high-quality technical-grade urea.

The agriculture segment is expected to hold the largest share of the market over the forecast period. Many governments subsidize urea fertilizers to make them affordable for farmers, especially in developing countries. These subsidies support agriculture’s demand for urea, further cementing its position as the dominant market segment.

The chemical synthesis segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Urea-formaldehyde resins, widely used in the automotive, construction, and furniture industries, require high-quality urea. As these industries grow, the demand for urea in chemical synthesis applications is increasing, contributing to its rapid market expansion.

Asia Pacific is expected to be the largest region in the global market. Asia Pacific has vast agricultural land, with countries like China and India being major producers of crops like rice, wheat, and vegetables. The region’s reliance on urea as a primary fertilizer makes it the largest market for urea.

North America is anticipated to witness rapid growth during the forecast period. As North American farmers adopt more sustainable practices, such as precision agriculture, urea-based fertilizers are increasingly being used for efficient nutrient delivery. This trend promotes the region's rapid growth in the urea market.

CF Industries Holdings, Inc., Pupuk Indonesia (Persero), Yara International ASA, SABIC, OCI, Nutrien, EuroChem Group, Qatar Fertiliser Company, CNPC, and BASF SE among others, are some of the key players in the global urea market.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2024, as part of a plan to focus on African countries that are anticipated to grow more rapidly, Yara International ASA announced selective divestitures from its fertilizer import and distribution operations in Ivory Coast.

In July 2024, by using sustainable biomethane at its Ludwigshafen and Antwerp facilities, BASF SE and ENGIE agreed to minimize the company's carbon footprint and increase the number of products in its range that have lower or zero PCF.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL UREA MARKET, BY Grade

4.1 Introduction

4.2 Urea Market: Grade Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Fertilizer Grade

4.4.1 Fertilizer Grade Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Feed Grade

4.5.1 Feed Grade Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Technical Grade

4.6.1 Technical Grade Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL UREA MARKET, BY APPLICATION

5.1 Introduction

5.2 Urea Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Agriculture

5.4.1 Agriculture Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Animal Feed

5.5.1 Animal Feed Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Chemical Synthesis

5.6.1 Chemical Synthesis Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL UREA MARKET, BY REGION

6.1 Introduction

6.2 North America Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Grade

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Grade

6.2.3.1.2 By Application

6.2.3.2 Canada Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Grade

6.2.3.2.2 By Application

6.2.3.3 Mexico Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Grade

6.2.3.3.2 By Application

6.3 Europe Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Grade

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Grade

6.3.3.1.2 By Application

6.3.3.2 U.K. Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Grade

6.3.3.2.2 By Application

6.3.3.3 France Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Grade

6.3.3.3.2 By Application

6.3.3.4 Italy Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Grade

6.3.3.4.2 By Application

6.3.3.5 Spain Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Grade

6.3.3.5.2 By Application

6.3.3.6 Netherlands Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Grade

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Grade

6.3.3.6.2 By Application

6.4 Asia Pacific Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Grade

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Grade

6.4.3.1.2 By Application

6.4.3.2 Japan Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Grade

6.4.3.2.2 By Application

6.4.3.3 India Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Grade

6.4.3.3.2 By Application

6.4.3.4 South Korea Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Grade

6.4.3.4.2 By Application

6.4.3.5 Singapore Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Grade

6.4.3.5.2 By Application

6.4.3.6 Malaysia Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Grade

6.4.3.6.2 By Application

6.4.3.7 Thailand Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Grade

6.4.3.6.2 By Application

6.4.3.8 Indonesia Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Grade

6.4.3.7.2 By Application

6.4.3.9 Vietnam Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Grade

6.4.3.8.2 By Application

6.4.3.10 Taiwan Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Grade

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Grade

6.4.3.11.2 By Application

6.5 Middle East and Africa Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Grade

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Grade

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Grade

6.5.3.2.2 By Application

6.5.3.3 Israel Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Grade

6.5.3.3.2 By Application

6.5.3.4 South Africa Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Grade

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Grade

6.5.3.5.2 By Application

6.6 Central and South America Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Grade

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Grade

6.6.3.1.2 By Application

6.6.3.2 Argentina Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Grade

6.6.3.2.2 By Application

6.6.3.3 Chile Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Grade

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Urea Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Grade

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 CF Industries Holdings, Inc.

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Pupuk Indonesia (Persero)

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Yara International ASA

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 SABIC

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 OCI

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 NUTRIEN

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 EuroChem Group

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Qatar Fertiliser Company

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 CNPC

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 BASF SE

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Type of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Urea Market, By Grade, 2021-2029 (USD Million)

2 Fertilizer Grade Market, By Region, 2021-2029 (USD Million)

3 Feed Grade Market, By Region, 2021-2029 (USD Million)

4 Technical Grade Market, By Region, 2021-2029 (USD Million)

5 Global Urea Market, By Application, 2021-2029 (USD Million)

6 Agriculture Market, By Region, 2021-2029 (USD Million)

7 Animal Feed Market, By Region, 2021-2029 (USD Million)

8 Chemical Synthesis Market, By Region, 2021-2029 (USD Million)

9 Others Market, By Region, 2021-2029 (USD Million)

10 Regional Analysis, 2021-2029 (USD Million)

11 North America Urea Market, By Grade, 2021-2029 (USD Million)

12 North America Urea Market, By Application, 2021-2029 (USD Million)

13 North America Urea Market, By COUNTRY, 2021-2029 (USD Million)

14 U.S. Urea Market, By Grade, 2021-2029 (USD Million)

15 U.S. Urea Market, By Application, 2021-2029 (USD Million)

16 Canada Urea Market, By Grade, 2021-2029 (USD Million)

17 Canada Urea Market, By Application, 2021-2029 (USD Million)

18 Mexico Urea Market, By Grade, 2021-2029 (USD Million)

19 Mexico Urea Market, By Application, 2021-2029 (USD Million)

20 Europe Urea Market, By Grade, 2021-2029 (USD Million)

21 Europe Urea Market, By Application, 2021-2029 (USD Million)

22 EUROPE Urea Market, By COUNTRY, 2021-2029 (USD Million)

23 Germany Urea Market, By Grade, 2021-2029 (USD Million)

24 Germany Urea Market, By Application, 2021-2029 (USD Million)

25 U.K. Urea Market, By Grade, 2021-2029 (USD Million)

26 U.K. Urea Market, By Application, 2021-2029 (USD Million)

27 France Urea Market, By Grade, 2021-2029 (USD Million)

28 France Urea Market, By Application, 2021-2029 (USD Million)

29 Italy Urea Market, By Grade, 2021-2029 (USD Million)

30 Italy Urea Market, By Application, 2021-2029 (USD Million)

31 Spain Urea Market, By Grade, 2021-2029 (USD Million)

32 Spain Urea Market, By Application, 2021-2029 (USD Million)

33 Netherlands Urea Market, By Grade, 2021-2029 (USD Million)

34 Netherlands Urea Market, By Application, 2021-2029 (USD Million)

35 Rest Of Europe Urea Market, By Grade, 2021-2029 (USD Million)

36 Rest Of Europe Urea Market, By Application, 2021-2029 (USD Million)

37 Asia Pacific Urea Market, By Grade, 2021-2029 (USD Million)

38 Asia Pacific Urea Market, By Application, 2021-2029 (USD Million)

39 ASIA PACIFIC Urea Market, By COUNTRY, 2021-2029 (USD Million)

40 China Urea Market, By Grade, 2021-2029 (USD Million)

41 China Urea Market, By Application, 2021-2029 (USD Million)

42 Japan Urea Market, By Grade, 2021-2029 (USD Million)

43 Japan Urea Market, By Application, 2021-2029 (USD Million)

44 India Urea Market, By Grade, 2021-2029 (USD Million)

45 India Urea Market, By Application, 2021-2029 (USD Million)

46 South Korea Urea Market, By Grade, 2021-2029 (USD Million)

47 South Korea Urea Market, By Application, 2021-2029 (USD Million)

48 Singapore Urea Market, By Grade, 2021-2029 (USD Million)

49 Singapore Urea Market, By Application, 2021-2029 (USD Million)

50 Thailand Urea Market, By Grade, 2021-2029 (USD Million)

51 Thailand Urea Market, By Application, 2021-2029 (USD Million)

52 Malaysia Urea Market, By Grade, 2021-2029 (USD Million)

53 Malaysia Urea Market, By Application, 2021-2029 (USD Million)

54 Indonesia Urea Market, By Grade, 2021-2029 (USD Million)

55 Indonesia Urea Market, By Application, 2021-2029 (USD Million)

56 Vietnam Urea Market, By Grade, 2021-2029 (USD Million)

57 Vietnam Urea Market, By Application, 2021-2029 (USD Million)

58 Taiwan Urea Market, By Grade, 2021-2029 (USD Million)

59 Taiwan Urea Market, By Application, 2021-2029 (USD Million)

60 Rest of APAC Urea Market, By Grade, 2021-2029 (USD Million)

61 Rest of APAC Urea Market, By Application, 2021-2029 (USD Million)

62 Middle East and Africa Urea Market, By Grade, 2021-2029 (USD Million)

63 Middle East and Africa Urea Market, By Application, 2021-2029 (USD Million)

64 MIDDLE EAST & AFRICA Urea Market, By COUNTRY, 2021-2029 (USD Million)

65 Saudi Arabia Urea Market, By Grade, 2021-2029 (USD Million)

66 Saudi Arabia Urea Market, By Application, 2021-2029 (USD Million)

67 UAE Urea Market, By Grade, 2021-2029 (USD Million)

68 UAE Urea Market, By Application, 2021-2029 (USD Million)

69 Israel Urea Market, By Grade, 2021-2029 (USD Million)

70 Israel Urea Market, By Application, 2021-2029 (USD Million)

71 South Africa Urea Market, By Grade, 2021-2029 (USD Million)

72 South Africa Urea Market, By Application, 2021-2029 (USD Million)

73 Rest Of Middle East and Africa Urea Market, By Grade, 2021-2029 (USD Million)

74 Rest Of Middle East and Africa Urea Market, By Application, 2021-2029 (USD Million)

75 Central and South America Urea Market, By Grade, 2021-2029 (USD Million)

76 Central and South America Urea Market, By Application, 2021-2029 (USD Million)

77 CENTRAL AND SOUTH AMERICA Urea Market, By COUNTRY, 2021-2029 (USD Million)

78 Brazil Urea Market, By Grade, 2021-2029 (USD Million)

79 Brazil Urea Market, By Application, 2021-2029 (USD Million)

80 Chile Urea Market, By Grade, 2021-2029 (USD Million)

81 Chile Urea Market, By Application, 2021-2029 (USD Million)

82 Argentina Urea Market, By Grade, 2021-2029 (USD Million)

83 Argentina Urea Market, By Application, 2021-2029 (USD Million)

84 Rest Of Central and South America Urea Market, By Grade, 2021-2029 (USD Million)

85 Rest Of Central and South America Urea Market, By Application, 2021-2029 (USD Million)

86 CF Industries Holdings, Inc.: Products & Services Offering

87 Pupuk Indonesia (Persero): Products & Services Offering

88 Yara International ASA: Products & Services Offering

89 SABIC: Products & Services Offering

90 OCI: Products & Services Offering

91 NUTRIEN: Products & Services Offering

92 EuroChem Group: Products & Services Offering

93 Qatar Fertiliser Company: Products & Services Offering

94 CNPC, Inc: Products & Services Offering

95 BASF SE: Products & Services Offering

96 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Urea Market Overview

2 Global Urea Market Value From 2021-2029 (USD Million)

3 Global Urea Market Share, By Grade (2023)

4 Global Urea Market Share, By Application (2023)

5 Global Urea Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Urea Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Urea Market

10 Impact Of Challenges On The Global Urea Market

11 Porter’s Five Forces Analysis

12 Global Urea Market: By Grade Scope Key Takeaways

13 Global Urea Market, By Grade Segment: Revenue Growth Analysis

14 Fertilizer Grade Market, By Region, 2021-2029 (USD Million)

15 Feed Grade Market, By Region, 2021-2029 (USD Million)

16 Technical Grade Market, By Region, 2021-2029 (USD Million)

17 Global Urea Market: By Application Scope Key Takeaways

18 Global Urea Market, By Application Segment: Revenue Growth Analysis

19 Agriculture Market, By Region, 2021-2029 (USD Million)

20 Animal Feed Market, By Region, 2021-2029 (USD Million)

21 Chemical Synthesis Market, By Region, 2021-2029 (USD Million)

22 Others Market, By Region, 2021-2029 (USD Million)

23 Regional Segment: Revenue Growth Analysis

24 Global Urea Market: Regional Analysis

25 North America Urea Market Overview

26 North America Urea Market, By Grade

27 North America Urea Market, By Application

28 North America Urea Market, By Country

29 U.S. Urea Market, By Grade

30 U.S. Urea Market, By Application

31 Canada Urea Market, By Grade

32 Canada Urea Market, By Application

33 Mexico Urea Market, By Grade

34 Mexico Urea Market, By Application

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 CF Industries Holdings, Inc.: Company Snapshot

38 CF Industries Holdings, Inc.: SWOT Analysis

39 CF Industries Holdings, Inc.: Geographic Presence

40 Pupuk Indonesia (Persero): Company Snapshot

41 Pupuk Indonesia (Persero): SWOT Analysis

42 Pupuk Indonesia (Persero): Geographic Presence

43 Yara International ASA: Company Snapshot

44 Yara International ASA: SWOT Analysis

45 Yara International ASA: Geographic Presence

46 SABIC: Company Snapshot

47 SABIC: Swot Analysis

48 SABIC: Geographic Presence

49 OCI: Company Snapshot

50 OCI: SWOT Analysis

51 OCI: Geographic Presence

52 NUTRIEN: Company Snapshot

53 NUTRIEN: SWOT Analysis

54 NUTRIEN: Geographic Presence

55 EuroChem Group : Company Snapshot

56 EuroChem Group : SWOT Analysis

57 EuroChem Group : Geographic Presence

58 Qatar Fertiliser Company: Company Snapshot

59 Qatar Fertiliser Company: SWOT Analysis

60 Qatar Fertiliser Company: Geographic Presence

61 CNPC, Inc.: Company Snapshot

62 CNPC, Inc.: SWOT Analysis

63 CNPC, Inc.: Geographic Presence

64 BASF SE: Company Snapshot

65 BASF SE: SWOT Analysis

66 BASF SE: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Urea Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Urea Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS