Global Urinary Incontinence Market Size, Trends & Analysis - Forecasts to 2026 By Type (Stress, Urge, Overflow, Functional, and Others), By Product (Urinary Catheters [Foley, Suprapubic, Intermittent], Urethral Slings [Male, Female], Electrical Stimulation Devices [Non-implantable, Implantable], Artificial Urinary Sphincters, Neuromodulation Devices, and Others), By Category (External and Internal), By End-User (Hospitals, Specialty Clinics, and Others); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

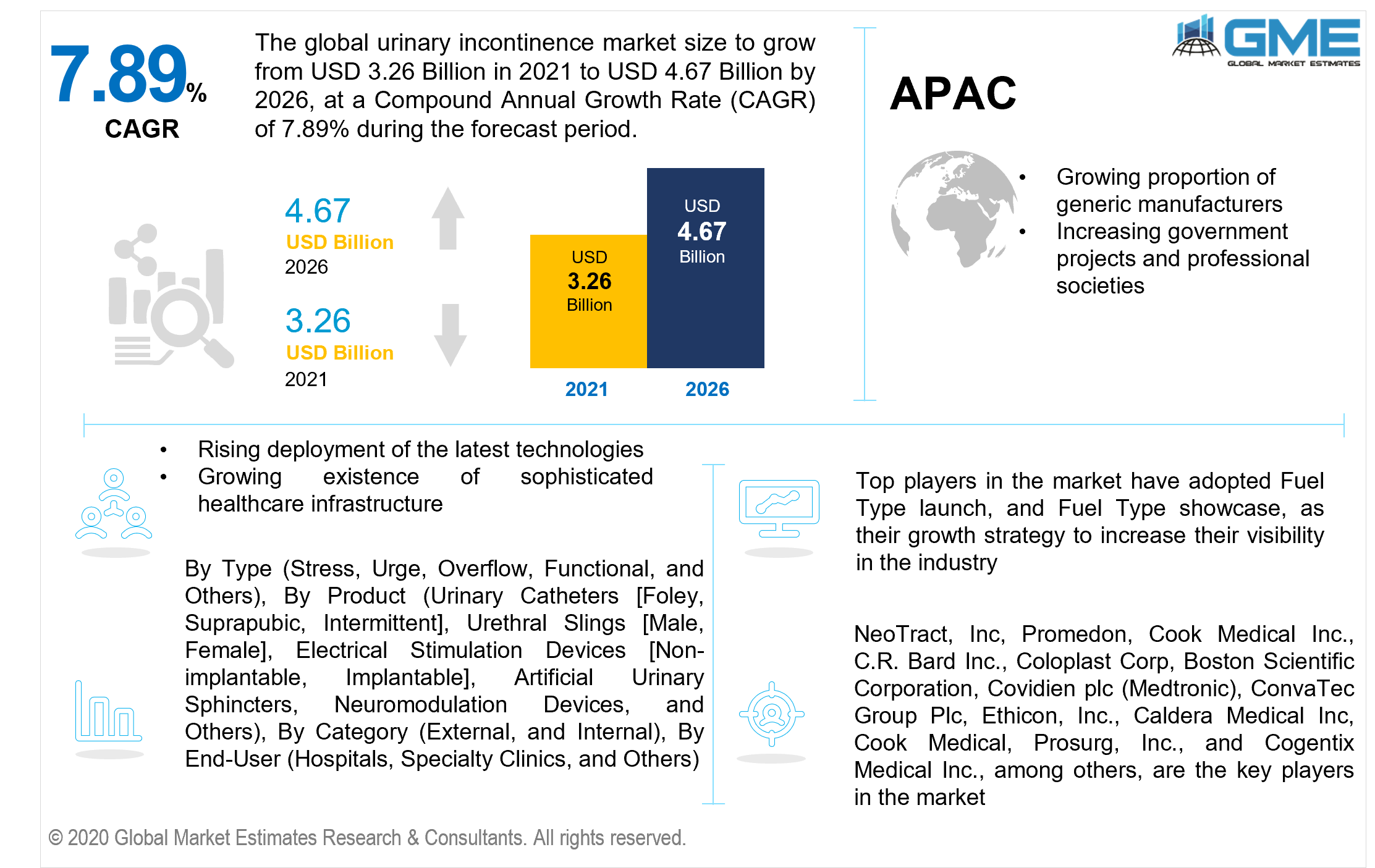

The urinary incontinence market is estimated to be valued at USD 3.26 billion in 2021 and is projected to reach USD 4.67 billion by 2026 at a CAGR of 7.89%. The expansion of overall urinary incontinence market size is due to, an aging demographic with an elevated danger of urological illnesses, and an increment in urinary incontinent patient populations switching from mainstream treatment options to sophisticated surgical therapies. In these complications, urine leaks can be caused by a variety of scenarios, including pregnancy, menopausal symptoms, abdominal therapy, multiple surgeries, diabetes, birth complications, and post-radical prostatectomy surgery. Thus, the market is likely to expand due to the aforementioned factors.

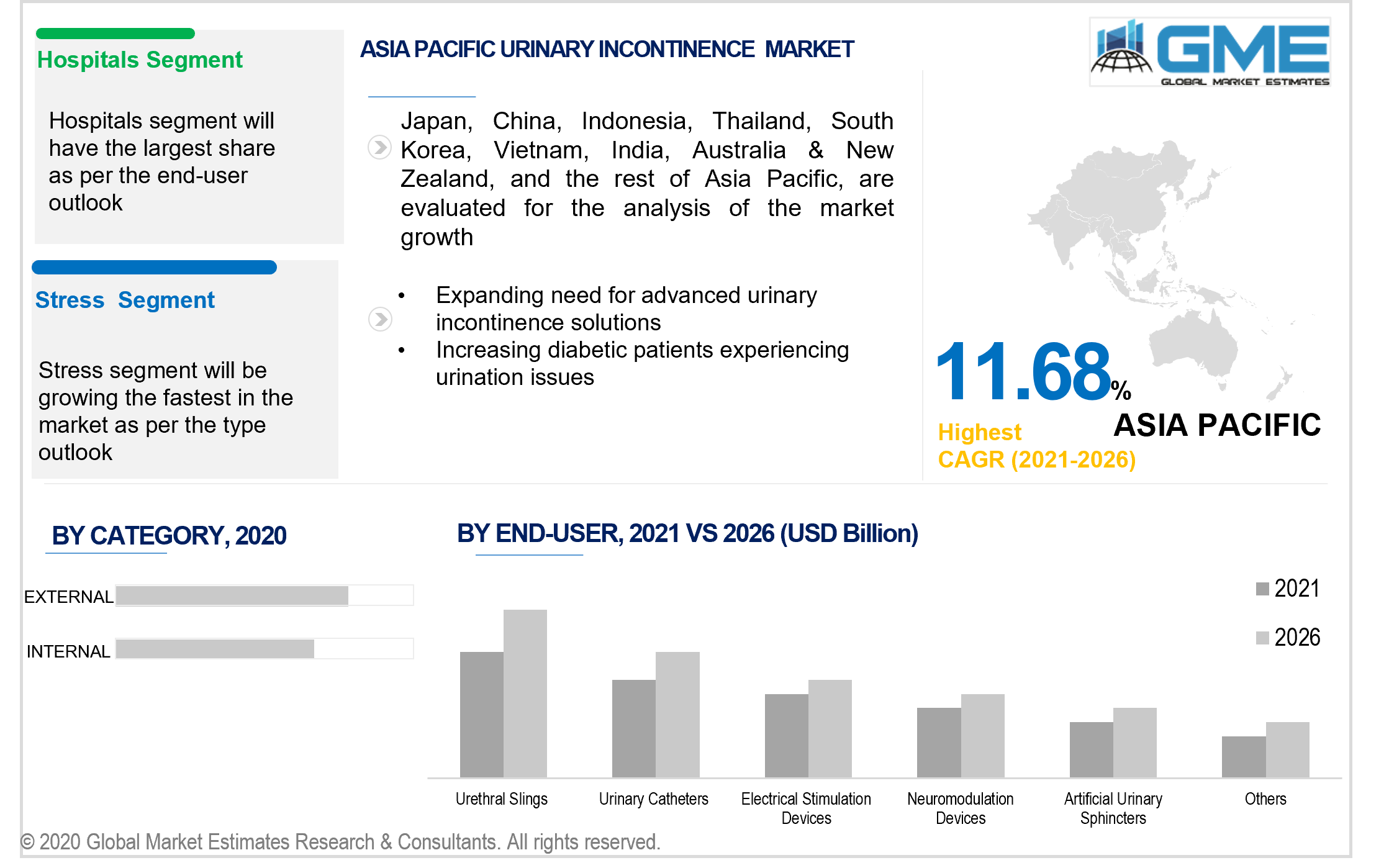

The skyrocketing predominance of physiological and medical conditions causing this disease, as well as a boost in the core demographic during the forecast period, are key aspects driving the market. According to the International Diabetes Federation, half a billion people worldwide have diabetes, and the number is expected to rise by 25% in 2030 and 51% in 2045. This increase in diabetic patients experiencing urination issues is expected to accelerate the incontinence market size during the forecast period.

As per the analysis, the urinary incontinence market overview indicates that urinary complications have a significant influence on sentimental, psychological, and social activities; the majority of patients experiencing these complications are unable to conduct normal operations with confidence. This encourages the advancement of efficacious treatments for the condition. According to the Urology Care Foundation, one-quarter to one-third of men and women in the United States experience this complication each year. This also indicates that approximately 33 million Americans have overactive bladders, which cause side effects of immediacy and recurrence, resulting in the desire to use advanced devices and expand the overall incontinence market.

According to a 2020 data analysis research paper titled 'A Global Survey on the Impact of COVID-19 on Urological Services' by Jeremy Yuen-Chun Teoh et al., community hospitals for this complication were the most impacted. Furthermore, throughout the COVID-19 epidemics 2020, there was a considerable reduction in different kinds of ambulatory care inquiries and processes, with medical interventions for this illness, fertility problems, renal stones, and bladder stones having the maximum levels of service reduction.

Several of the aspects driving market advancement include a skyrocketing requirement for noninvasive or non-surgical product categories, an increase in the occurrence of Parkinson's disease, and the production of unconventional devices. Furthermore, technologically sophisticated healthcare infrastructure in emerging economies will create numerous prospects for market expansion. Lack of consciousness about breakthroughs in urinary incontinence devices, as well as post-operative comorbidities correlated with the devices, limits market advancement to some degree.

Furthermore, rising healthcare expenses in emerging economies present profitable prospects for market participants to engage in such markets.

Depending on the type, the market is categorized as stress incontinence, urge incontinence, overflow incontinence, and functional incontinence. Stress incontinence is foreseen to predominate throughout the forecast period. Pregnancies trigger a woman's pelvic floor muscles to expand and undermine, resulting in this complication. Furthermore, prostate surgery in males can contribute to this disease. As a result, stress-based urinary complications have become one of the most common ailments among both males and females. Moreover, the rise in research into the epidemiology of stress-based urinary diseases has aided this segment's preeminence.

Depending on the product, the market is categorized as urinary catheters, urethral slings, neuromodulation devices, electrical stimulation devices, artificial urinary sphincters, and others. The segment of urethral slings is assumed to establish its preeminence throughout the forecast period. Furthermore, this segment has experienced the fastest growth rate. This is due to an increase in companies' involvement in the improvement of urethral slings, a primary emphasis on the product innovation of urethral slings, and an increase in the availability of single-incision slings among incontinent patient populations.

Depending on the category, the market is categorized as external and internal. An external urinary collection device is a versatile plastic ostomy-style container that is positioned over the urinary meatus (for males or females) or anus to divert urine or feces aside from the perineum and into a storage reservoir. Thus, such a device that efficaciously controls urinary output while evading serious harm to the pubic skin and sensitive areas of males and females leads to its supremacy.

Depending on the end-user, the market is categorized as hospitals, specialty clinics, and others. The hospital segment is expected to account for a substantial portion of the global market. The expansion in the proportion of multinational hospitals using sophisticated sling surgical procedures methodologies including TVT and TOT, as well as the implementation of mini slings, are foreseen to drive hospital segment development throughout the forecast period.

North America will dominate the overall market for the foreseeable future, attributable to global representatives in research and development, an increase in the deployment of the latest technologies, and the existence of sophisticated healthcare infrastructure. The largest proportion is primarily owed to the substantial patient pool and an expanding geriatric demographic. In addition, well-established health plans and the provision of sophisticated medical facilities are just some of the other aspects driving the market in this area. The United States has the largest share of the market in North America, attributable to determinants including an expanding percentage of senile populaces and a burgeoning proportion of the core patient base in the country. Moreover, novel drug approvals are aiding in its supremacy. For instance, The Food and Drug Administration authorized Safe Medical Design's Signal Catheter for merchandising in the United States in 2019, which is a flexible tube that passes via the urethra and into the bladder to expel urine and is projected to spur market expansion in the coming years.

Due to the elevated pervasiveness and increasing occurrence of these complications, the uptick in implementation of technologically sophisticated goods, a sizeable base of therapeutic device corporations, and a massive volume of items in the pipeline for the diagnosis of this illness, Europe is expected to be the second-largest market. During the forecast period, the market in the United Kingdom is foreseen to grow at the highest CAGR. Annually, approximately 15,000 mid-urethral sling surgical procedures (MUS) in women are conducted in the United Kingdom. Furthermore, the rising frequency of post-radical prostatectomy urinary-based incontinence in males is expected to stimulate market advancement in the nation.

Throughout the forecast period, Asia-Pacific is expected to have the highest rate of growth in the overall market. Because of its large, demographic base, rising disposable earnings, and increased patient consciousness of sophisticated urinary complications management, Asia-Pacific presents profitable prospects for the market players. Japan, India, and China have been among the pioneering countries in Asia-Pacific for urinary complications predominance, which pertains to the region's comprehensive expansion in the overall market. Urinary incontinence market size India is growing rapidly as a result of improving health services, a huge proportion of generic manufacturers, and an increase in government projects and professional societies.

NeoTract, Inc, Promedon, Cook Medical Inc., C.R. Bard Inc., Coloplast Corp, Boston Scientific Corporation, Covidien plc (Medtronic), ConvaTec Group Plc, Ethicon, Inc., Caldera Medical Inc, Cook Medical, Prosurg, Inc., and Cogentix Medical Inc., among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Urinary Incontinence Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Product Overview

2.1.4 Category Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Global Urinary Incontinence Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Skyrocketing Predominance Of Physiological And Medical Conditions Causing This Disease

3.3.1.2 Growing Aging Demographics With An Elevated Danger Of Urological Illnesses

3.3.2 Industry Challenges

3.3.2.1 Post-Operative Complications Associated With The Treatment

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Product Growth Scenario

3.4.3 Category Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Urinary Incontinence Market, By Type

4.1 Type Outlook

4.2 Stress

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Urge

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Overflow

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Functional

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Urinary Incontinence Market, By Product

5.1 Product Outlook

5.2 Urinary Catheters

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.2.2 Market Size, By Foley, 2019-2026 (USD Million)

5.2.3 Market Size, By Suprapubic, 2019-2026 (USD Million)

5.2.4 Market Size, By Intermittent, 2019-2026 (USD Million)

5.3 Urethral Slings

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.3.2 Market Size, By Male, 2019-2026 (USD Million)

5.3.3 Market Size, By Female, 2019-2026 (USD Million)

5.4 Electrical Stimulation Devices

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.4.2 Market Size, By Non-implantable, 2019-2026 (USD Million)

5.4.3 Market Size, By Implantable, 2019-2026 (USD Million)

5.5 Artificial Urinary Sphincters

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Neuromodulation Devices

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Others

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Urinary Incontinence Market, By Category

6.1 Category Outlook

6.2 External

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Internal

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Urinary Incontinence Market, By End-User

7.1 End-User Outlook

7.2 Hospitals

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Specialty Clinics

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Others

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Urinary Incontinence Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2019-2026 (USD Million)

8.2.2 Market Size, By Type, 2019-2026 (USD Million)

8.2.3 Market Size, By Product, 2019-2026 (USD Million)

8.2.4 Market Size, By Category, 2019-2026 (USD Million)

8.2.5 Market Size, By End-User, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Category, 2019-2026 (USD Million)

8.2.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Product, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Category, 2019-2026 (USD Million)

8.2.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2019-2026 (USD Million)

8.3.2 Market Size, By Type, 2019-2026 (USD Million)

8.3.3 Market Size, By Product, 2019-2026 (USD Million)

8.3.4 Market Size, By Category, 2019-2026 (USD Million)

8.3.5 Market Size, By End-User, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Category, 2019-2026 (USD Million)

8.3.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Category, 2019-2026 (USD Million)

8.3.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Category, 2019-2026 (USD Million)

8.3.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Category, 2019-2026 (USD Million)

8.3.9.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Category, 2019-2026 (USD Million)

8.3.10.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Category, 2019-2026 (USD Million)

8.3.11.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2019-2026 (USD Million)

8.4.2 Market Size, By Type, 2019-2026 (USD Million)

8.4.3 Market Size, By Product, 2019-2026 (USD Million)

8.4.4 Market Size, By Category, 2019-2026 (USD Million)

8.4.5 Market Size, By End-User, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Category, 2019-2026 (USD Million)

8.4.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Product, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Category, 2019-2026 (USD Million)

8.4.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Product, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Category, 2019-2026 (USD Million)

8.4.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.9.2 Market size, By Product, 2019-2026 (USD Million)

8.4.9.3 Market size, By Category, 2019-2026 (USD Million)

8.4.9.4 Market size, By End-User, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Product, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Category, 2019-2026 (USD Million)

8.4.10.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2019-2026 (USD Million)

8.5.2 Market Size, By Type, 2019-2026 (USD Million)

8.5.3 Market Size, By Product, 2019-2026 (USD Million)

8.5.4 Market Size, By Category, 2019-2026 (USD Million)

8.5.5 Market Size, By End-User, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Category, 2019-2026 (USD Million)

8.5.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Product, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Category, 2019-2026 (USD Million)

8.5.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Product, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Category, 2019-2026 (USD Million)

8.5.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2019-2026 (USD Million)

8.6.2 Market Size, By Type, 2019-2026 (USD Million)

8.6.3 Market Size, By Product, 2019-2026 (USD Million)

8.6.4 Market Size, By Category, 2019-2026 (USD Million)

8.6.5 Market Size, By End-User, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Category, 2019-2026 (USD Million)

8.6.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Product, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Category, 2019-2026 (USD Million)

8.6.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Product, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Category, 2019-2026 (USD Million)

8.6.8.4 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 NeoTract, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Promedon

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Cook Medical Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 C.R. Bard Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Coloplast Corp

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Boston Scientific Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Covidien plc (Medtronic)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 ConvaTec Group Plc

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Ethicon, Inc.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Caldera Medical Inc.

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Cook Medical, Prosurg, Inc.

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Cogentix Medical Inc.

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 Other Companies

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

The Global Urinary Incontinence Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Urinary Incontinence Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS