Global Veterinary Telehealth Market Size, Trends & Analysis - Forecasts to 2026 By Animal Type (Canine, Feline, Equine, Bovine, Swine, and Others), By Service Type (Telemedicine, Teleconsulting, Telemonitoring, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

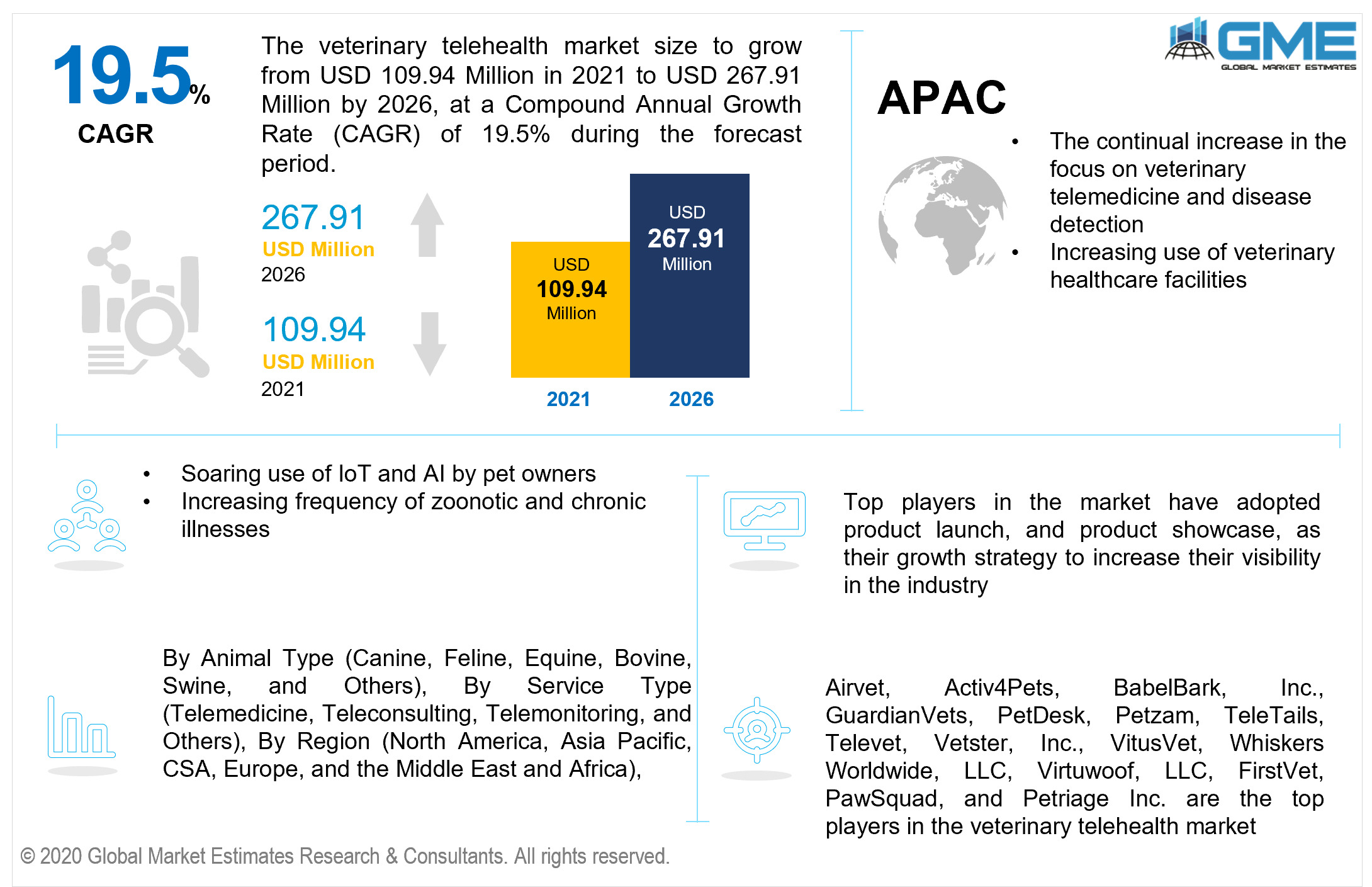

The veterinary telehealth market is projected to grow from USD 109.94 million in 2021 to USD 267.91 million by 2026 at a CAGR value of 19.5% between 2021 to 2026. The increase in veterinary healthcare expenditures is estimated to drive market expansion. Additionally, there is a strong demand for animal-derived goods, and a growing rate of utilization is likely to boost the market. As the demand for livestock grows, so does the necessity to safeguard them from illness. The market participants' preference for targeting the unexplored market in emerging nations, as well as the government's substantial investment in IT networks, are likely to offer new possibilities for companies in the veterinary telehealth market throughout the forecast period.

The continual increase in the focus on veterinary telemedicine and disease detection can be linked to the increased usage of these management systems. Furthermore, the increased use of IoT and AI by pet owners, as well as the frequency of zoonotic and chronic illnesses in animals, are some of the market's significant drivers. The rising frequency of ailments including diabetes, renal illness, spinal disc disorders, and blood pressure-related disorders is fuelling the veterinary telehealth industry even more. Obesity in dogs is on the rise, owing to illnesses including joint illness and osteoarthritis, which is driving the need for new treatment alternatives.

The rising frequency of uncommon illnesses is fuelling the veterinary telehealth industry. Obesity in animals is becoming more common, fuelling the desire for improved treatment alternatives. According to World Health Organization (WHO) figures for 2021, zoonotic illnesses cause roughly 1 million cases of sickness and millions of mortality each year, while zoonotic diseases cause approximately 60% of new illnesses globally. As a result of the increase in illnesses, pet owners and agricultural animal breeders are being compelled to use telehealth services to improve and manage the wellness of their companion animals. Furthermore, the rising incidence of illnesses in the animal community, including chronic kidney disease and diabetes, is driving the broad use of veterinary telemedicine services.

The COVID-19 pandemic is having a beneficial impact on the veterinary telemedicine business. During the current crisis, there is a surge in popularity in veterinary telemedicine. According to a 2020 article published by the Veterinary Medical Association (AVMA), the usage of telemedicine to safeguard and assess the wellbeing of veterinary individuals and veterinarian personnel has risen. Furthermore, the US Food and Drug Administration (USFDA) has declared that it would not implement specific standards that will allow vets to effectively employ telemedicine to treat animal health problems during the epidemic.

Furthermore, some healthcare organizations have begun to offer telemedicine services. Similarly, in the case of an epidemic, the Centers for Disease Control and Prevention (CDC) suggested that veterinarians use telemedicine to limit their interaction with pet breeders in 2020. As a result of the preceding causes, the range of veterinary telehealth solutions is increasing during the contemporary epidemic.

Furthermore, disease incursions in animals can pose significant macroeconomic risks, including disruptions in provincial markets, global commerce, and regional economies, as well as productivity losses. Development for veterinary telemedicine is being driven by such considerations.

Based on the animal type, the market can be segmented as canine, feline, equine, bovine, swine, and others. The others segment is foreseen to dominate in the market during the forecast period. Other animals include chickens, sheep, and goats, among others. The regular excessive demand for poultry and cattle products is one of the primary factors driving this segment's supremacy. Sheep are also needed for other products like wool. Moreover, the rising frequency of chronic illnesses in goats and sheep is a high-impact economic factor for this market, potentially leading to the use of veterinary telemedicine for disease prevention and control.

During the forecast period, the canine category is expected to grow at the highest CAGR. The segment's significant market share is a result of rising animal healthcare expenditures, particularly in industrialized countries.

Based on service type, the market is divided into telemedicine, teleconsulting, telemonitoring, and others. The teleconsulting segment is presumed to dominate the market. The increased use of telehealth solutions by veterinarians to seek consultation from veterinary specialists for guidance and ideas on animal care is credited to the segment's rise. Teleconsultation also saves money on transportation and related expenditures. As a result, professional advice may be obtained immediately rather than having to wait for extended periods. These reasons are fuelling the sector market's expansion.

Due to increased internet penetration, telemedicine is expected to be the fastest-growing category throughout the forecast period. The rise in internet users has increased the use of animal telehealth. The telemedicine sector market is expected to increase due to rising initiatives by industry participants.

North America will be dominating during the forecast period. This expansion may be ascribed to a variety of factors, including the presence of significant businesses in the region and a high level of investment in animal health care. Furthermore, technological developments and rising disposable income are likely to drive the veterinary telehealth market during the forecast period. According to the North American Pet Health Insurance Association (NAPHIA), gross written premiums in the United States will reach USD 1.99 billion in 2020, a 27.5 percent rise from USD 1.56 billion in 2019. As a result of the aforesaid considerations, the North American veterinary telehealth market is likely to develop considerably over the forecast period.

Due to the ongoing upgrading of the health sector in the APAC region, the market is expected to rise significantly during the forecast period. The market is being propelled forward by the increasing use of veterinary healthcare facilities, as well as the fast expansion of production facilities in emerging nations like China and India. Furthermore, the region's substantial livestock population is fuelling the telehealth market. China and India, for example, account for more than one-third percent of the worldwide cattle population.

Airvet, Activ4Pets, BabelBark, Inc., GuardianVets, PetDesk, Petzam, TeleTails, Televet, Vetster, Inc., VitusVet, Whiskers Worldwide, LLC, Virtuwoof, LLC, FirstVet, PawSquad, and Petriage Inc. are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Veterinary Telehealth Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Animal Type Overview

2.1.3 Service Type Overview

2.1.4 Regional Overview

Chapter 3 Veterinary Telehealth Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increased focus on the telemedicine market

3.3.1.2 Increased use of IoT and AI by pet owners

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Animal Type Growth Scenario

3.4.2 Service Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Veterinary Telehealth Market, By Animal Type

4.1 Animal Type Outlook

4.2 Canine

4.2.1 Market Size, By Region, 2021-2026 (USD Million)

4.3 Feline

4.3.1 Market Size, By Region, 2021-2026 (USD Million)

4.4 Equine

4.4.1 Market Size, By Region, 2021-2026 (USD Million)

4.5 Bovine

4.5.1 Market Size, By Region, 2021-2026 (USD Million)

4.6 Swine

4.6.1 Market Size, By Region, 2021-2026 (USD Million)

4.7 Others

4.7.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 5 Veterinary Telehealth Market, By Service Type

5.1 Service Type Outlook

5.2 Telemedicine

5.2.1 Market Size, By Region, 2021-2026 (USD Million)

5.3 Teleconsulting

5.3.1 Market Size, By Region, 2021-2026 (USD Million)

5.4 Telemonitoring

5.4.1 Market Size, By Region, 2021-2026 (USD Million)

5.5 Others

5.5.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 6 Veterinary Telehealth Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2021-2026 (USD Million)

6.2.2 Market Size, By Animal Type, 2021-2026 (USD Million)

6.2.3 Market Size, By Service Type, 2021-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.2.4.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.2.5.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2021-2026 (USD Million)

6.3.2 Market Size, By Animal Type, 2021-2026 (USD Million)

6.3.3 Market Size, By Service Type, 2021-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.2.4.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.3.5.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.3.6.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.3.7.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.3.8.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.3.9.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2021-2026 (USD Million)

6.4.2 Market Size, By Animal Type, 2021-2026 (USD Million)

6.4.3 Market Size, By Service Type, 2021-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.4.4.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.4.5.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.4.6.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.4.7.2 Market size, By Service Type, 2021-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.4.8.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2021-2026 (USD Million)

6.5.2 Market Size, By Animal Type, 2021-2026 (USD Million)

6.5.3 Market Size, By Service Type, 2021-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.5.4.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.5.5.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.5.6.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2021-2026 (USD Million)

6.6.2 Market Size, By Animal Type, 2021-2026 (USD Million)

6.6.3 Market Size, By Service Type, 2021-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.6.4.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.6.5.2 Market Size, By Service Type, 2021-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Animal Type, 2021-2026 (USD Million)

6.6.6.2 Market Size, By Service Type, 2021-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Activ4Pets

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Airvet

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 BabelBark, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 GuardianVets

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 PetDesk

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Petzam

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Teletails

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Televet

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Vetster, Inc

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 VitusVet

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Whiskers Worldwide, LLC

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Virtuwoof, LLC.

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 FirstVet

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 PawSquad

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

7.16 Petriage Inc.

7.16.1 Company Overview

7.16.2 Financial Analysis

7.16.3 Strategic Positioning

7.16.4 Info Graphic Analysis

7.17 Other Companies

7.17.1 Company Overview

7.17.2 Financial Analysis

7.17.3 Strategic Positioning

7.17.4 Info Graphic Analysis

The Global Veterinary Telehealth Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Veterinary Telehealth Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS