Global Veterinary Vaccines Market Size, Trends & Analysis - Forecasts to 2027 By Type (Porcine Vaccines, Poultry Vaccine, Livestock Vaccine, Companion Animal Vaccine, Aquaculture Vaccines, Other Animal Vaccines), By Diseases (Porcine, Poultry, Livestock, Companion Animal Aquaculture, Others), By Technology (Live Attenuated Vaccines, Inactivated Vaccines, Toxoid Vaccines, Recombinant Vaccines, Other Vaccines), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

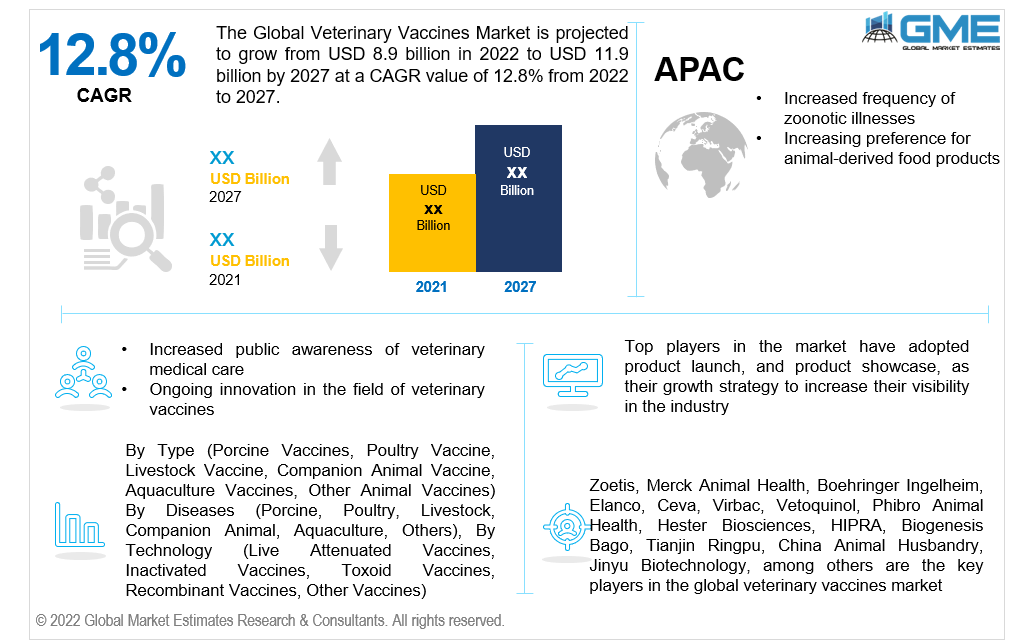

The global veterinary vaccines market is projected to grow from USD 8.9 billion in 2022 to USD 11.9 billion by 2027 at a CAGR value of 12.8% from 2022 to 2027.

While veterinary vaccines account for just around 23% of the global market for animal health products, the industry has been steadily growing due to new technological developments in vaccine production, the ongoing development of pathogen drug resistance, and the appearance of new diseases. The increased frequency of zoonotic illnesses, activities by governmental bodies and animal associations to protect animal care, and the growing preference for animal-derived packaged foods are driving the expansion of this market.

Their substantial impact on the public health through cutbacks in the use of veterinary pharmaceuticals and hormones and their by-products in the human food chain, and their massive impact not only on animal production and health as well as on human wellbeing by continuing to increase safe supplies of food and preventing animal-to-human transmission of infection, are some of the factors driving the market growth.

Furthermore, the ongoing innovation in the field of veterinary vaccines, increased public awareness of veterinary medical care, increased government and international animal husbandry programs, and rise in animal ownership among individuals are reasons the market is expected to boost the global market.

Veterinary vaccinations are used in livestock farming to boost overall productivity and ensure animal health. To feed the rising population, more efficient livestock production and better access to high-quality protein are required. According to an FAO High-Level Expert Forum, overall food production will need to increase by 70% between 2005 and 2050 to feed a predicted global population of 9.1 billion people, and vaccinations that preserve animal health and improve supply are crucial components in fulfilling this goal. Additionally, they decrease the need for antimicrobials to treat infections in food-producing and companion animals, as there are growing concerns about antibiotic resistance linked to the advent of antibiotics in human and veterinary medicine, as well as their potential to eliminate the thinning of organisms causing foodborne illness in humans, propelling market growth over the forecast period.

Many businesses, notably the veterinary vaccination industry, were badly impacted by the COVID-19 epidemic. During the early stages of the pandemic, however, the OAE (World Organisation for Animal Health) had proven that no animal can spread the virus, Human-to-animal viral transmission has been recorded in a few countries, nevertheless. Many dogs and cats have indeed been diagnosed with the virus by laboratories and organizations, with negative results, severely hampering the market growth.

The market for animal vaccinations is restrained by expensive vaccine storage costs, a lack of animal health consciousness, and the potential for harmful effects of veterinary vaccines on humans and other zoonotic diseases.

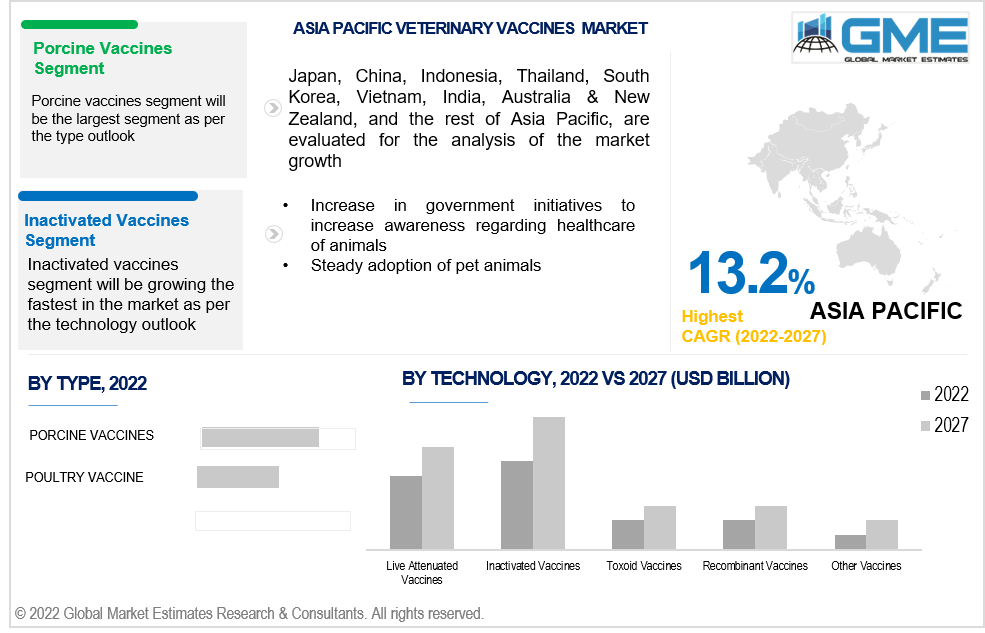

Based on the type, the veterinary vaccines market fragmented into porcine vaccines, poultry vaccines, livestock vaccines, companion animal vaccines, aquaculture vaccines, and other animal vaccines. The porcine vaccines segment is expected to grow the fastest in the VRF system market from 2022 to 2027. Disease outbreaks such as porcine respiratory and reproductive syndrome (PRRS) and pig epidemic diarrhoea have contributed to this surge. According to an article posted in NCBI, approximately 70% of pig farmers are small farmers with farms containing fewer than 50 pigs, and pig sanitary procedures and nutrition are not regulated, which is driving demand for porcine vaccines.

Based on the disease, the veterinary vaccines market is divided into porcine, poultry, livestock, companion animal, aquaculture, and others. The livestock segment is expected to grow the fastest in the VRF system market from 2022 to 2027. The increase is due to the rise in beef, milk, and dairy product production, rendering animal care a critical component of disease control. Growing demand for chicken, with total poultry sector exports of $23.1 billion in 2019, is also driving the segment growth.

Based on the technology, the veterinary vaccines market is divided into live attenuated vaccines, inactivated vaccines, toxoid vaccines, recombinant vaccines, and other vaccines.

The inactivated vaccines segment is expected to grow the fastest in the VRF system market from 2022 to 2027. The disorder viral, or parts of it, is still present in inactivated virus vaccinations, but its genetic content has been obliterated. As a result, they are regarded as being safer and much more robust than live attenuated vaccines, and they can be administered to individuals with compromised immune systems. Inactivated virus vaccines have successfully been developed for other flaviviruses such as Japanese encephalitis virus (JEV), Yellow fever virus (YFV), and tick-borne encephalitis virus (TBEV)

As per the geographical analysis, the veterinary vaccines market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will dominate the global share in the veterinary vaccines market from 2022 to 2027. The high frequency of livestock and zoonotic illnesses, which result in large-scale animal mortality, can be blamed for this enormous percentage. In addition, the market is predicted to rise due to the huge number of well-established drug companies that are continually working to expand the commercialization of their vaccinations and expand their geographic reach is boosting growth.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the veterinary vaccines market during the forecast period. The forecasted increase in cattle population, as well as government measures, particularly in developing nations, are expected to promote market growth in the region. India's cow population increased to 192.5 million in 2019 from 190.9 million in 2012, according to the National Dairy Development Board. As a result, the country's enormous cattle population necessitates vaccine requirements. High R&D spending by many key players, coupled with increasing initiatives to commercialize veterinary vaccinations and immunizations at tolerably low prices, are driving the industry.

Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, Ceva, Virbac, Vetoquinol, Phibro Animal Health, Hester Biosciences, HIPRA, Biogenesis Bago, Tianjin Ringpu, China Animal Husbandry, Jinyu Biotechnology, among others are the key players in the global veterinary vaccines market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Veterinary Vaccines Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Diseases Overview

2.1.4 Technology Overview

2.1.6 Regional Overview

Chapter 3 Veterinary Vaccines Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The increased frequency of zoonotic illnesses

3.3.1.2 Rise in Research and Development At Various Institutes To Build Efficient Vaccines

3.3.2 Industry Challenges

3.3.2.1 High Storage Cost for Vaccines

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Diseases Growth Scenario

3.4.3 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Veterinary Vaccines Market, By Type

4.1 Type Outlook

4.2 Porcine Vaccines

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Poultry Vaccine

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Livestock Vaccine

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Companion Animal Vaccine

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

4.6 Aquaculture Vaccines

4.6.1 Market Size, By Region, 2022-2027 (USD Billion)

4.7 Other Animal Vaccines

4.7.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Veterinary Vaccines Market, Diseases

5.1 Diseases Outlook

5.2 Porcine

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Poultry

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Livestock

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Companion Animal

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Aquaculture

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Veterinary Vaccines Market, By Technology

6.1 Live Attenuated Vaccines

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Inactivated Vaccines

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Toxoid Vaccines

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

6.4 Recombinant Vaccines

6.4.1 Market Size, By Region, 2022-2027 (USD Billion)

6.5 Other Vaccines

6.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Veterinary Vaccines Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Billion)

7.2.2 Market Size, By Type, 2022-2027 (USD Billion)

7.2.3 Market Size, By Diseases, 2022-2027 (USD Billion)

7.2.4 Market Size, By Technology, 2022-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.2.4.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.2.4.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.2.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.2.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Billion)

7.3.2 Market Size, By Type, 2022-2027 (USD Billion)

7.3.3 Market Size, By Diseases, 2022-2027 (USD Billion)

7.3.4 Market Size, By Technology, 2022-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.6.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.3.6.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.9.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.3.9.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.10.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.3.10.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2022-2027 (USD Billion)

7.3.11.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.3.11.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Billion)

7.4.2 Market Size, By Type, 2022-2027 (USD Billion)

7.4.3 Market Size, By Diseases, 2022-2027 (USD Billion)

7.4.4 Market Size, By Technology, 2022-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.6.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.4.6.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.9.2 Market size, By Diseases, 2022-2027 (USD Billion)

7.4.9.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2022-2027 (USD Billion)

7.4.10.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.4.10.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Billion)

7.5.2 Market Size, By Type, 2022-2027 (USD Billion)

7.5.3 Market Size, By Diseases, 2022-2027 (USD Billion)

7.5.4 Market Size, By Technology, 2022-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.5.6.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.5.6.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Billion)

7.6.2 Market Size, By Type, 2022-2027 (USD Billion)

7.6.3 Market Size, By Diseases, 2022-2027 (USD Billion)

7.6.4 Market Size, By Technology, 2022-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2022-2027 (USD Billion)

7.6.6.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.6.6.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Diseases, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Technology, 2022-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2021

8.2 Zoetis

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Merck Animal Health

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Boehringer Ingelheim

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Elanco

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Ceva

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Virbac

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8. Vetoquinol

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Phibro Animal Health

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Hester Biosciences

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Veterinary Vaccines Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Veterinary Vaccines Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS