Global Vital Signs Monitoring Devices Market Size, Trends & Analysis – Forecasts to 2027 By Product (Temperature Monitoring Devices [Temperature Monitoring Device Accessories, Infrared Thermometers, Digital Thermometers, Liquid Crystal Thermometer, and Mercury Filled Thermometers], Pulse Oximeters [Pulse Oximeter Accessories, Fingertip Pulse Oximeter, Paediatric Pulse Oximeters, Table-Top/Bedside Pulse Oximeters, Wrist-Worn Pulse Oximeters, and Hand-Held Pulse Oximeters], Blood Pressure Monitors [Blood Pressure Instrument Accessories, Aneroid Blood Pressure Monitors, Ambulatory Blood Pressure Monitors, Mercury Blood Pressure Monitor, and Digital Blood Pressure Monitor], and Other Vital Sign Monitors), By End-Use (Emergency Care Centres, Physicians Office, Hospitals, Home Healthcare, Ambulatory Centres, and Other Healthcare Settings), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

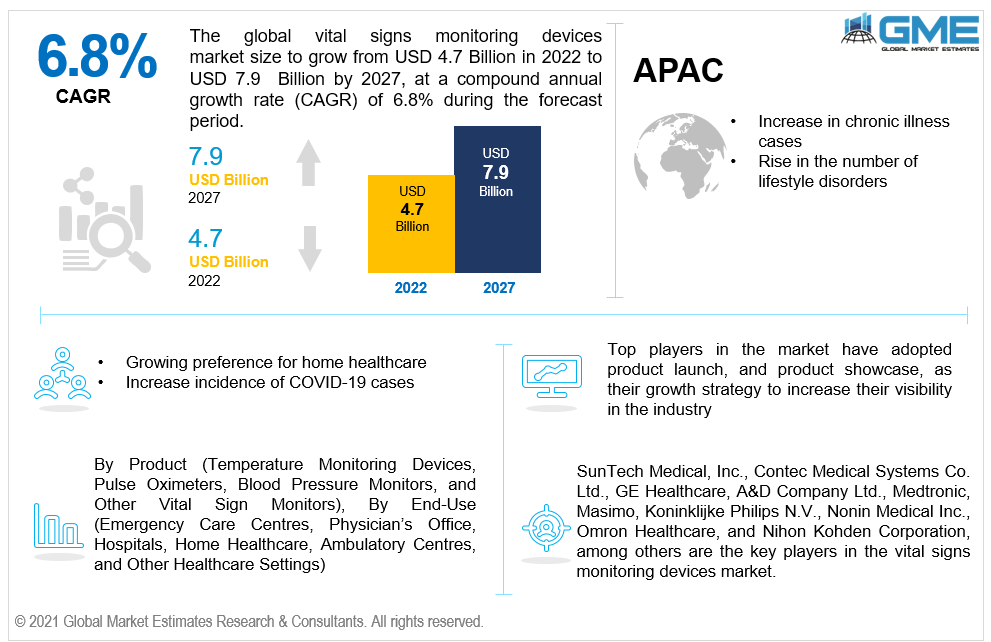

The global vital signs monitoring devices market is projected to grow from USD 4.7 billion in 2022 to USD 7.9 billion by 2027 at a CAGR value of 6.8% from 2022 to 2027.

Vital signs are used to measure the basic functions in human body such as body temperature, pulse rate, respiration rate, and blood pressure. Vital signs offer information about a patient's condition, such as identifying acute medical issues, indicating the presence of a chronic medical condition, and understanding how the body reacts to stress response. The rapid expansion of the market is due to continuous technology development, growing preference for home healthcare, increasing incidence of lifestyle disorders primarily hospitals, and expanding burden of chronic conditions.

The increasing prevalence of chronic diseases, rising awareness regarding portable and smart vital sign monitoring devices, increasing demand for personalized and accurate cardiac oxygen saturation monitoring technology are some of the factors expected to propel the growth of the market. Other significant drivers of market involve increasing need for personalised healthcare devices, an uptick in the frequency of geriatric patients, supportive reimbursement norms for medical devices and the flourishing health tourism in emerging nations.

The COVID-19 pandemic, on the other hand, has posed a serious threat to the whole healthcare industry, affecting the vital signs monitoring equipment market as well. In COVID-19 patients, vital signs monitoring devices were primarily employed to monitor different physiological processes including such core temperature and hypertension. As a result, the rising use of vital sign monitoring devices is likely to boost the market.

One of most recent medical trends is the migration of therapy from clinics to homes in order to save money, and cut healthcare expenses. The shift from therapy to continuous monitoring is also giving home tracking devices new opportunities. Patients prefer home monitoring devices for reasons, including comfort and expenditure. Nevertheless, in low- and intermediate nations, lack of awareness of such technologies is impeding market expansion.

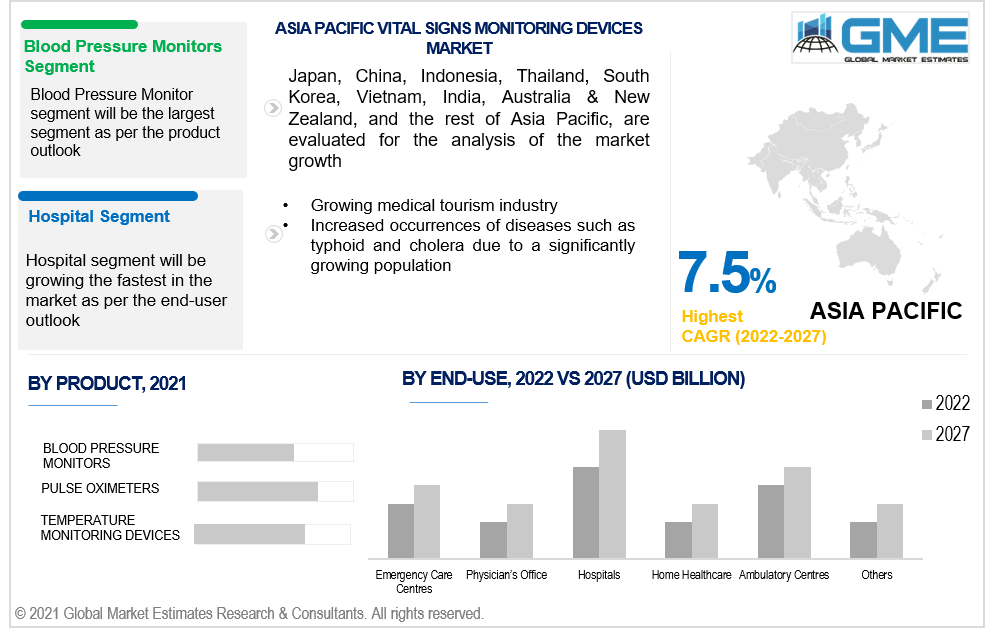

Based on the product, the market is segmented into temperature monitoring devices, pulse oximeters, blood pressure monitors, and other vital sign monitors. The market for blood pressure monitors segment (blood pressure instrument accessories, aneroid blood pressure monitors, ambulatory blood pressure monitors, mercury blood pressure monitor, and digital blood pressure monitor) is expected to be the largest shareholder of the market from 2022 to 2027.

The increased incidences of hypertension among patients, growing healthcare tourism, and growing preference for self-operated electronic monitors are all fuelling the segment’s growth. Also, as a consequence of enhanced consciousness, people are now monitoring their heart rate as a preventive or prophylactic step. As a result, the need for self-operating wrist blood pressure monitors has skyrocketed.

Based on the end-use, the market is segmented into emergency care centres, physician’s office, hospitals, home healthcare, ambulatory centres, and other healthcare settings. The market for hospitals segment is expected to be the largest shareholder of the market from 2022 to 2027.

The dominance of the segment is due to presence of huge patient demographic across the developing and developed regions, favourable reimbursement scenarios and availabity of better healthcare infrastructure in hospitals.

As per the geographical analysis, the market for vital signs monitoring devices can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the vital signs monitoring devices market from 2022 to 2027. The dominance of North American region is due to factors such as rising prevalence of geriatric patients, an increase in the incidence of chronic diseases and lifestyle disorder, increasing recognition of distant and cellular technologies such as telemedicine, and favorable reimbursement scenarios.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest growing segment in the vital signs monitoring devices market during the forecast period. This can be attributable to the growing medical tourism market and the strengthening healthcare industry in this region, both of which have a great deal to offer market participants during the forecast period. Increased occurrences of diseases such as typhoid and cholera due to a significantly massive population, increased disposable expenditures, enhancing customer awareness of advanced monitoring devices, and increased incidences of diseases like malaria and dengue. Furthermore, the growth of the vital signs monitoring devices market has been aided by a rise in the geriatric population and an increase in demand for vital signs monitoring devices in residential care facilities and at-home facilities.

SunTech Medical, Inc., Contec Medical Systems Co. Ltd., GE Healthcare, A&D Company Ltd., Medtronic, Masimo, Koninklijke Philips N.V., Nonin Medical Inc., Omron Healthcare, and Nihon Kohden Corporation, among others are the key players in the vital signs monitoring devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Vital Signs Monitoring Devices Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 End-Use Overview

2.1.4 Regional Overview

Chapter 3 Vital Signs Monitoring Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increase in demand for personalized and accurate cardiac oxygen saturation monitoring technology

3.3.2 Industry Challenges

3.3.2.1 Lack of understanding of such technologies is impeding market expansion

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Vital Signs Monitoring Devices Market, By Product

4.1 Product Outlook

4.2 Temperature Monitoring Devices

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Pulse Oximeters

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Blood Pressure Monitors

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Vital Signs Monitoring Devices Market, By End-Use

5.1 End-Use Outlook

5.2 Emergency Care Centres

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Physician’s Office

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Hospitals

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Home Healthcare

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Ambulatory Centres

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

5.7 Other Healthcare Settings

5.7.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Vital Signs Monitoring Devices Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Billion)

6.2.2 Market Size, By Card Type, 2022-2027 (USD Billion)

6.2.3 Market Size, By End-Use, 2022-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.2.4.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.2.5.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Billion)

6.3.2 Market Size, By Card Type, 2022-2027 (USD Billion)

6.3.3 Market Size, By End-Use, 2022-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.3.4.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.3.5.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.3.6.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.3.7.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.3.8.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.3.9.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Billion)

6.4.2 Market Size, By Card Type, 2022-2027 (USD Billion)

6.4.3 Market Size, By End-Use, 2022-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.4.4.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.4.5.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.4.6.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.4.7.2 Market size, By End-Use, 2022-2027 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.4.8.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2022-2027 (USD Billion)

6.5.2 Market Size, By Card Type, 2022-2027 (USD Billion)

6.5.3 Market Size, By End-Use, 2022-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.5.4.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.5.5.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.5.6.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Billion)

6.6.2 Market Size, By Card Type, 2022-2027 (USD Billion)

6.6.3 Market Size, By End-Use, 2022-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.6.4.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.6.5.2 Market Size, By End-Use, 2022-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Card Type, 2022-2027 (USD Billion)

6.6.6.2 Market Size, By End-Use, 2022-2027 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2022

7.2 SunTech Medical, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 GE Healthcare

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Contec Medical Systems Co. Ltd

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 A&D Company Ltd

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Medtronic

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Masimo

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Koninklijke Philips N.V

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Nonin Medical Inc

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Vital Signs Monitoring Devices Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Vital Signs Monitoring Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS