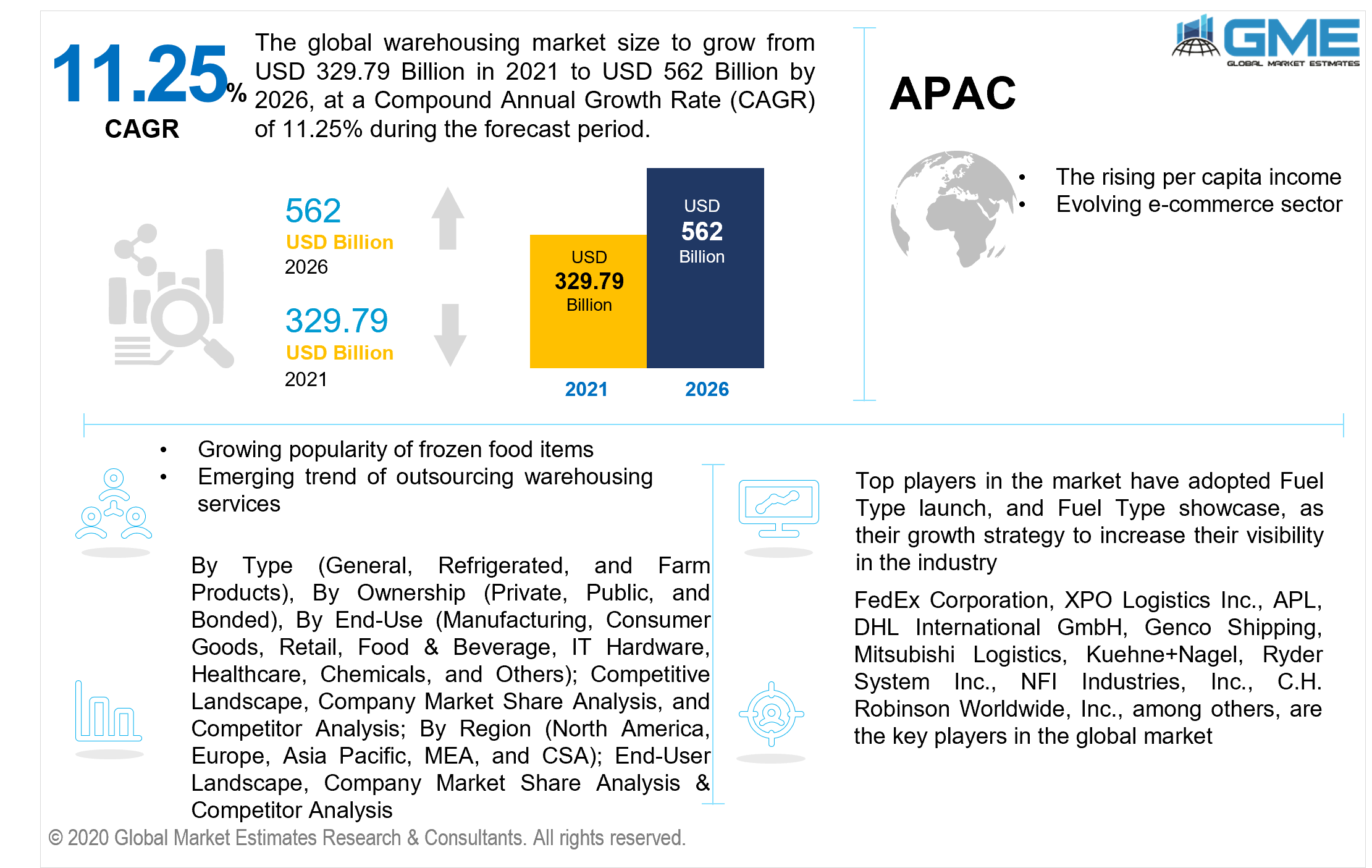

Global Warehousing Market Size, Trends & Analysis - Forecasts to 2026 By Type (General, Refrigerated, and Farm Products), By Ownership (Private, Public, and Bonded), By End-Use (Manufacturing, Consumer Goods, Retail, Food & Beverage, IT Hardware, Healthcare, Chemicals, and Others); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis.

The warehousing market is estimated to be valued at USD 329.79 billion in 2021 and is projected to reach USD 562 billion by 2026 at a CAGR of 11.25%. Warehousing is the foundation of the global logistics sector, with a crucial contribution to products storage and management. According to our warehouse market analysis, the resurgence and expansion of eCommerce have reformed the nuances of the market, with a growing demand for the accelerated reply and the capacity to organize shipment inventory loads. As the eCommerce sector expands the global market will be primed for intelligent digital evolution including the automation of a wide range of functions. The logistics sector's enhanced inclination for digital transformation will change the characteristics and operational strategies of prospective warehouses. The growing demand for an omnichannel retailing model is intended to fuel the market. Thus, the global warehousing market size will increase throughout the forecast period.

According to our analysis key warehouse market trends includes that the warehouse service providers can revamp their value chain methodologies with the help of evolving digital technology solutions The proliferation of cloud-based product lines and enterprise software solutions has facilitated warehouse service providers to gain improved inventory management and experiment with an on-demand service model for clients to fulfill seasonal market pressure. Furthermore, the utilization of digital technologies can assist warehouse companies in overcoming operational problems by reducing inventory inaccuracies increasing resource productive capacity ensuring end-to-end system transparency, and providing precise inventory predictions for sophisticated demand management.

The warehouse market is steadily increasing digitalization and process automation which is foreseen to improve information flow between integrated resources and coordinated enterprise applications. For sustained advancement information compendium and assessment on structural operational activities and the external ecosystem will enable warehouse companies to make data-driven decisions to maintain optimized resource utilization and the allocation and assessment of the appropriate operational benchmarks to formulate a strategic plan for enhanced top-and bottom-line development.

As per our warehouse market report the COVID -19 epidemic has compelled shipping companies to reconsider their supplier network infrastructure, phase inventory to account for contemporary demand volatility, and rely on organizational or third-party transportation connectivity solutions. According to warehouse industry statistics, Amazon, Aldi, Asda, and Lidl have all reported a necessity to raise their capabilities and employ more warehouse workers.

Market and industry trends for warehousing indicates that mobile technology solutions have grown in popularity among warehouse owners because they assist them to execute and route warehouse management while also saving time and reducing labor force utilization. Laptops, smartphones, as well as other communications and consumer devices are examples of digital technology. For warehouse management in device profile throughput, and monitoring, such devices employ GPS, RFID, VoIP, digital imaging, and voice technology. Such technologies also enable hands-free activities and faster data access. Nevertheless, soaring warehouse rental prices and manufacturing plant maintenance costs, as well as elevated preliminary setup costs, may limit market development during the forecast period.

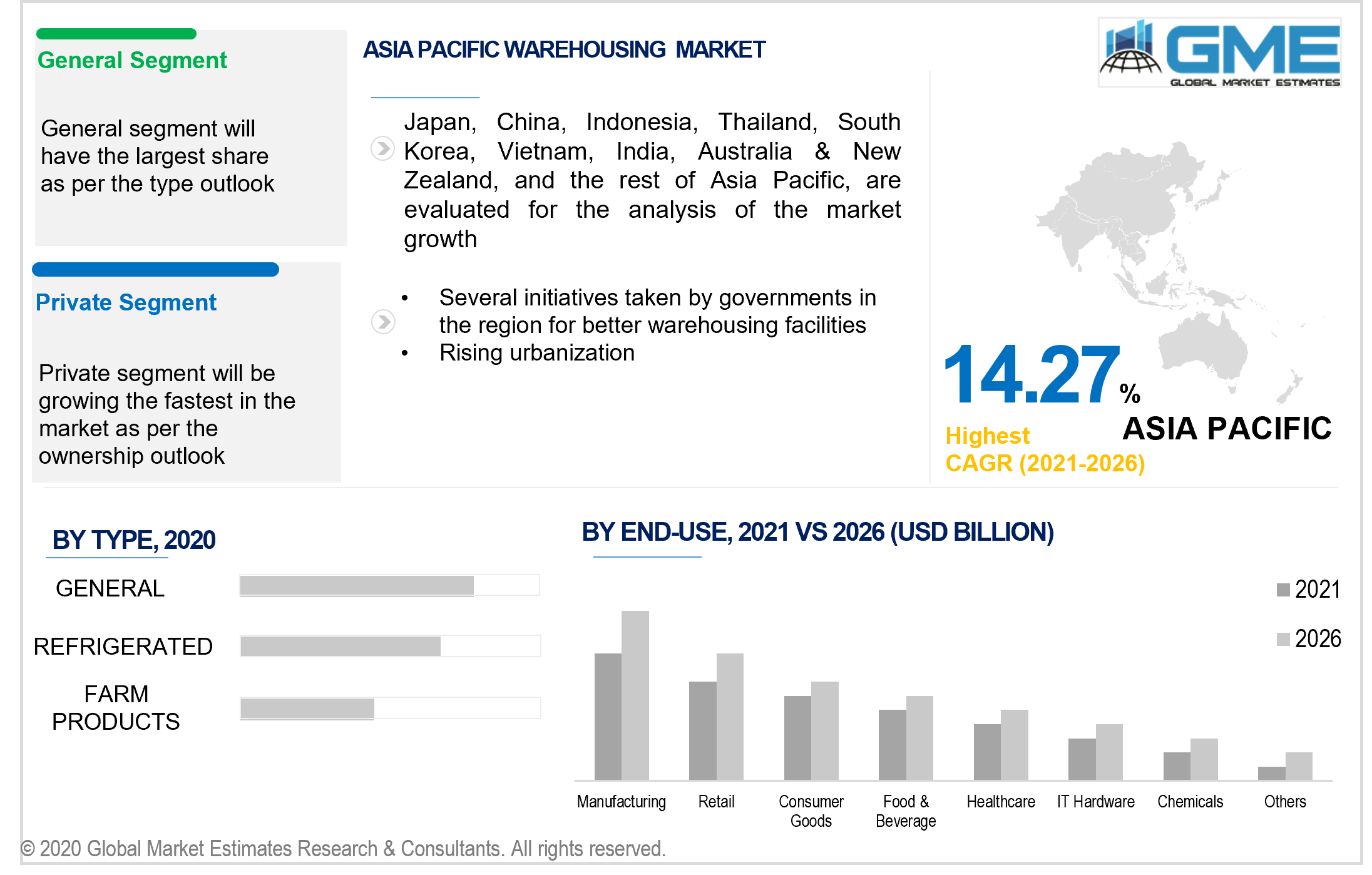

Depending on the type, the market is categorized as general, refrigerated, and farm products. General accounts for the largest market share in the type segment. Different types, of chemical compounds including specialty chemicals, must be processed in warehouses before being transported to end-user industrial sectors such as automobiles consumer products, and retail. The expanding global chemical sector is presumed to boost requirements for chemical storage facilities classified as general warehousing and processing.

Depending on the ownership, the market is categorized as private, public, and bonded warehouses. Private warehouses are foreseen to predominate. Regulation, flexibility, expense, as well as other economic benefits, are among the primary advantages of private warehousing. Private warehouses offer greater control because the organization has complete authority on overall operations and strategic objectives on the site. Furthermore, it aids in the minimization of inaccuracies, can be leased rather than acquired, can be customized to meet the needs of the company, and enhances performance.

Depending on the end-use, the market is categorized as manufacturing, consumer goods, retail, food & beverage, IT hardware, healthcare, chemicals, and others. The manufacturing segment is foreseen to predominate. The rise in global business is primarily driving expansion in this segment. The entrance of innumerable international and domestic industrial players, as well as the institutionalization of manufacturing facilities, has increased trade potential, fueling global demand for the warehousing landscape. The increasing manufacturing and export of multiple products from both developed and developing economies will have a considerable impact on the expansion of the market.

North America is foreseen to predominate in the global market. The government is taking steps to build cutting-edge warehouses with sophisticated features like Web Map Service (WMS) functionality for expiration date monitoring, barcode scanning, order fulfillment, and enhanced inventory management. Aside from that, the expanding eCommerce sector is driving a substantial demand for strengthened storage and warehousing infrastructure to meet demand in the pandemic. There is considerable expansion potential for third-party warehousing and supply chain players, as only a limited portion of the sector in North America is outsourced, and e-commerce is expanding rapidly. As a result, players are also broadening their infrastructure through expansions, strategic alliances, and acquisitions.

On a regional basis, Asia Pacific represents the highest CAGR. This can be ascribed to several projects undertaken by governments in the area in aspects of technological advances, infrastructural facilities, and taxation regulations to improve warehousing resources. Furthermore, to mitigate operational and logistical difficulties many manufacturing and distribution centers in this region are implementing automated processing and sequencing mechanisms.

FedEx Corporation, XPO Logistics Inc., APL, DHL International GmbH, Genco Shipping, Mitsubishi Logistics, Kuehne+Nagel, Ryder System Inc., NFI Industries, Inc., C.H. Robinson Worldwide, Inc., among others, are the key players in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Warehousing Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Ownership Overview

2.1.4 End-Use Overview

2.1.5 Regional Overview

Chapter 3 Global Warehousing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing eCommerce sector

3.3.1.2 Rising Technological Developments

3.3.2 Industry Challenges

3.3.2.1 Increasing Rental Prices And Manufacturing Plant Maintenance Costs

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Ownership Growth Scenario

3.4.3 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Warehousing Market, By Type

4.1 Type Outlook

4.2 General

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Refrigerated

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Farm Products

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Warehousing Market, By Ownership

5.1 Ownership Outlook

5.2 Private

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Public

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Bonded

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Warehousing Market, By End-Use

6.1 End-Use Outlook

6.2 Manufacturing

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Consumer Goods

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Retail

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Food & Beverage

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 IT Hardware

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

6.7 Healthcare

6.7.1 Market Size, By Region, 2016-2026 (USD Million)

6.8 Chemicals

6.8.1 Market Size, By Region, 2016-2026 (USD Million)

6.9 Others

6.9.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Depth Filtration Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Type, 2016-2026 (USD Million)

7.2.3 Market Size, By Ownership, 2016-2026 (USD Million)

7.2.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.2.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.2.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.3 Market Size, By Ownership 2016-2026 (USD Million)

7.3.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.3.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.3.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.3.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.3.9.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.3.10.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2016-2026 (USD Million)

7.4.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.3 Market Size, By Ownership, 2016-2026 (USD Million)

7.4.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.4.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.4.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.8.2 Market size, By Ownership, 2016-2026 (USD Million)

7.4.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.4.9.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.3 Market Size, By Ownership, 2016-2026 (USD Million)

7.5.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.5.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.5.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.3 Market Size, By Ownership, 2016-2026 (USD Million)

7.6.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.6.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.6.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Ownership, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 FedEx Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 XPO Logistics Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 APL

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 DHL International GmbH

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Genco Shipping

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Mitsubishi Logistics

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Kuehne+Nagel

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Ryder System Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 NFI Industries, Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 C.H. Robinson Worldwide, Inc.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Warehousing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Warehousing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS