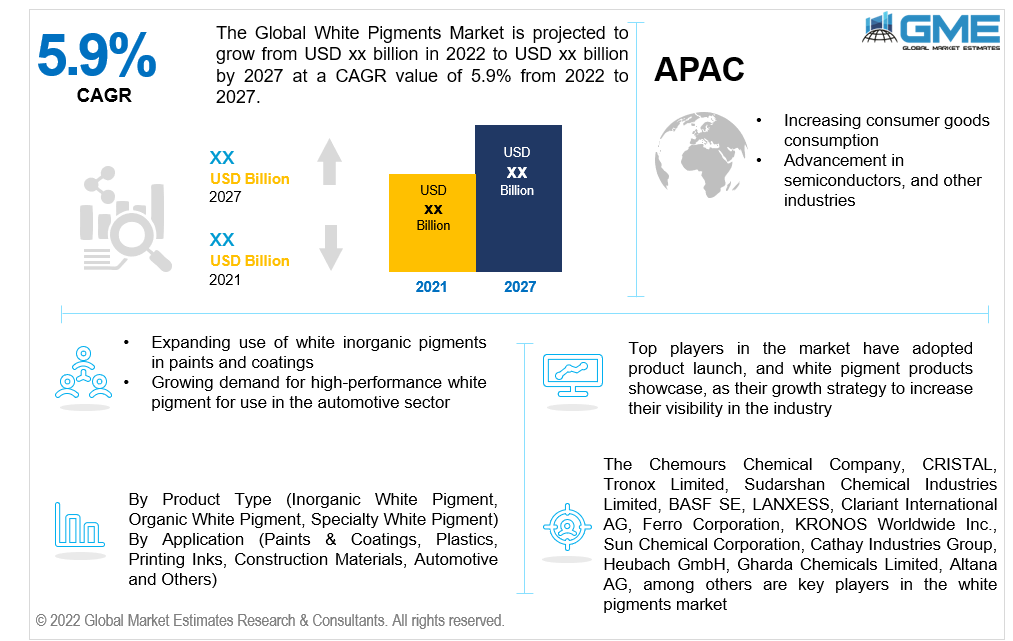

Global White Pigments Market Size, Trends & Analysis - Forecasts to 2027 By Product Type (Inorganic White Pigment, Organic White Pigment, Specialty White Pigment) By Application (Paints & Coatings, Plastics, Printing Inks, Construction Materials, Automotive, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global white pigments market is projected to grow at a CAGR value of 5.9% from 2022 to 2027.

White pigments have been used in paint to make white hues, tint colors, and cover undertones. For its great concealing capability, titanium is recommended for impenetrable covering. All compounds with an index of refraction greater than 1.7 are categorized as white pigments by convention, while fillers are defined as materials with a refractive index of less than 1.7. The expanding use of white inorganic pigments in paints and coatings, adhesives & sealants, polymers, pharmaceuticals, newsprint, and inks, among many other applications, drives the market for white inorganic pigments.

The growing demand for high-performance white pigment for use in the automotive sector due to rising electric vehicle manufacturing and growing consumer preference for black and white colors, particularly the white color trend, is expected to drive growth for white pigment and positively impact global market growth.

Furthermore, technological developments have led to an increase in the use of white pigment in the plastics industry, propelling the global white pigment market forward. Also, catapulting market growth is the growing use of white pigments for high weather resistance coatings for ships, overpasses, motorcars, housing developments, and other indoor and outdoor implementations, as well as benefits such as higher index of refraction, powerful chromatic aberration strength, enormous concealing power, good diffusion, excellent whiteness, and non-toxic character.

As per the OECD, annual household disposable income has grown globally for the past six years. Consumers' spending power and living standards are increased as discretionary income rises. These factors drive the demand for home decor and house remodeling, driving the need for artistic paints and coatings further. Furthermore, rising industrialization in emerging regions and growth in manufacturing industry development due to low labor costs, training of skilled workers, availability of raw materials contribute to growth.

The COVID-19 pandemic has substantially impacted the global white pigments business worldwide, and both organic and inorganic pigment manufacturers worldwide have been concerned about the sudden drop and uncertainty in raw material costs before and after the COVID-19 pandemic.

Furthermore, supply chain disruptions, logistical restrictions, human resources shortages, limited component availability, demand reduction, and manufacturing halts due to lockdown in numerous countries have harmed the business.

Nevertheless, rules governing cadmium- and chromium-based pigment and higher manufacturing costs per volume (Tons) of coating solvent and recyclable plastics restrictions are stifling industry expansion.

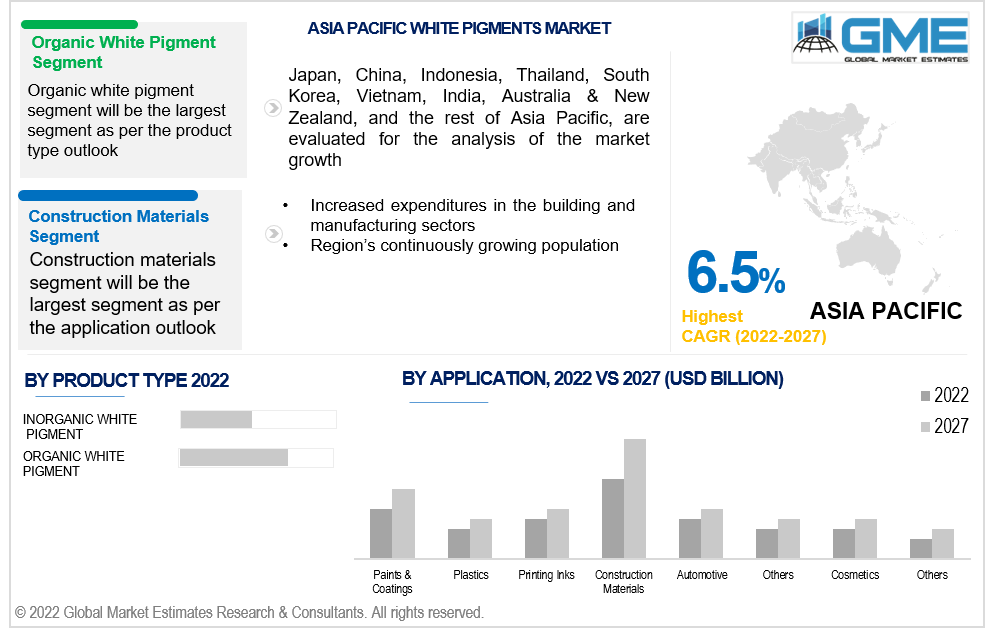

The global white pigments market is a segmented inorganic white pigment, organic white pigment, and specialty white pigment based on the product type. The organic white pigment segment is expected to be the fastest-growing segment in 2022-2027. This growth is attributed to increased consumer awareness of eco-friendly products and increasing demand from consumers.

Organic pigments are also being used in paints and printing inks for packaging, plastic injection molding, and printing technology, driving segment expansion.

The white pigments market is segmented into paints & coatings, plastics, printing inks, construction materials, automotive, and others. The construction material segment is projected to have the largest market share during the forecasted period from 2022 to 2027.

The building industry's expansion will likely create growth potential for coatings, resulting in increased demand for the white pigment shortly. Globally, there is a growing awareness of coating materials for long-term protection, which leads to an increase in the white pigment in the construction industry.

As per the geographical analysis, the white pigments market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will dominate the global share in the white pigments market from 2022 to 2027. The major factor driving the market in the North American region is due to the country's expanding construction industry, increasing demand for sustainable and eco-environment friendly white pigment, which has resulted in market expansion. Increasing consumer spending power has fueled the rise of many businesses. The continuously shifting demands for evolving technologies drive the demand for white pigments in this region considerably further.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the white pigments market during the forecast period between 2022 and 2027 attributable to increased expenditures in the building and manufacturing sectors, as well as the region's continuously growing population. During the forecast period, various factors such as increasing consumer goods consumption, advancement in semiconductors, and other industries are anticipated to propel the growth in this region.

The Chemours Chemical Company, CRISTAL, Tronox Limited, Sudarshan Chemical Industries Limited, BASF SE, LANXESS, Clariant International AG, Ferro Corporation, KRONOS Worldwide Inc., Sun Chemical Corporation, Cathay Industries Group, Heubach GmbH, Gharda Chemicals Limited, Altana AG, among others are key players in the white pigments market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 White Pigments Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 White Pigments Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for high-performance white pigment for use in the automotive sector

3.3.2 Industry Challenges

3.3.2.1 The increasing cost of production

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 White Pigments Market, By Product Type

4.1 Product Type Outlook

4.2 Inorganic White Pigment

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Organic White Pigment

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Specialty White Pigment

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 White Pigments Market, By Application

5.1 Application Outlook

5.2 Paints & Coatings

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Plastics

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Printing Inks

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Construction Materials

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Automotive

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

5.7 Others

5.7.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 White Pigments Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Billion)

6.2.2 Market Size, By Product Type, 2022-2027 (USD Billion)

6.2.3 Market Size, By Application, 2022-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.2.4.2 Market Size, By Application, 2022-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.2.5.2 Market Size, By Application, 2022-2027 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Billion)

6.3.2 Market Size, By Product Type, 2022-2027 (USD Billion)

6.3.3 Market Size, By Application, 2022-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.3.4.2 Market Size, By Application, 2022-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.3.5.2 Market Size, By Application, 2022-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.3.6.2 Market Size, By Application, 2022-2027 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.3.7.2 Market Size, By Application, 2022-2027 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.3.8.2 Market Size, By Application, 2022-2027 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.3.9.2 Market Size, By Application, 2022-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Billion)

6.4.2 Market Size, By Product Type, 2022-2027 (USD Billion)

6.4.3 Market Size, By Application, 2022-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.4.4.2 Market Size, By Application, 2022-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.4.5.2 Market Size, By Application, 2022-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.4.6.2 Market Size, By Application, 2022-2027 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.4.7.2 Market size, By Application, 2022-2027 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.4.8.2 Market Size, By Application, 2022-2027 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2022-2027 (USD Billion)

6.5.2 Market Size, By Product Type, 2022-2027 (USD Billion)

6.5.3 Market Size, By Application, 2022-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.5.4.2 Market Size, By Application, 2022-2027 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.5.5.2 Market Size, By Application, 2022-2027 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.5.6.2 Market Size, By Application, 2022-2027 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Billion)

6.6.2 Market Size, By Product Type, 2022-2027 (USD Billion)

6.6.3 Market Size, By Application, 2022-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.6.4.2 Market Size, By Application, 2022-2027 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.6.5.2 Market Size, By Application, 2022-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

6.6.6.2 Market Size, By Application, 2022-2027 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2022

7.2 Chemours Chemical Company

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 CRISTAL

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Tronox Limited.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Sudarshan Chemical Industries Limited

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 BASF SE

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 LANXESS

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Clariant International AG

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Ferro Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global White Pigments Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the White Pigments Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS