Global Wireless Charger Market Size, Trends & Analysis - Forecasts to 2028 By Technology Type (Resonant, Inductive, Radio Frequency, and Others), By End-use Industry (Automotive, Consumer Electronics, Healthcare, Industrial, Aerospace, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

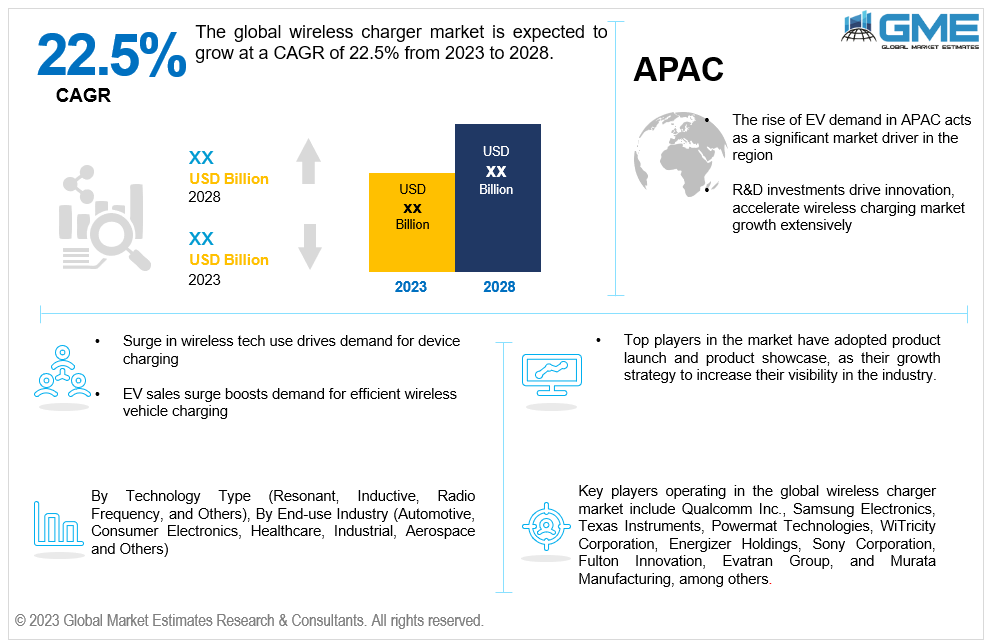

The global wireless charger market is expected to grow at a CAGR of 22.5% from 2023 to 2028. Wireless chargers send electricity from an energy source to a suitable device without physical connections. They operate based on electromagnetic induction, creating a magnetic field between the charger and the device, allowing power transfer. These chargers typically consist of a charging pad or stand where you place your device, and they are convenient for recharging smartphones, smartwatches, and other gadgets simply by laying them on the charging surface without having to plug them in directly.

Many market drivers positively affect the growth of the wireless charger market. The widespread adoption of wireless technologies in consumer electronics has propelled the market growth. This surge in wireless technology users has not only increased the demand for wireless chargers but also contributed to a remarkable rise in electric vehicle (EV) sales. The escalating sales of EVs, totalling around 6.8 million globally in 2020 and witnessing a staggering 98% increase in electric vehicle sales according to GREEN CARS, have further fuelled the demand for wireless charging solutions. Additionally, the introduction and development of innovative wireless charging products by major companies like Samsung, Apple, Belkin, and Anker, among others, have significantly propelled market growth. The expanding markets for wireless EV charging, wireless charging ICs, NFC wireless charging, drone wireless charging, and wireless car charging collectively contribute to the comprehensive growth of the wireless charger market.

The market for wireless chargers faces notable restraints primarily stemming from compatibility issues, creating a significant hurdle for widespread adoption. Devices not adhering to the Qi-enabled wireless charging standards find themselves incompatible with wireless charging pads, compelling users to make substantial investments in acquiring multiple chargers to suit their diverse range of products. This limitation restricts the universal applicability of wireless chargers, as users are constrained by the need for specific standards in their devices, resulting in increased expenditure and inconvenience. The necessity for Qi-compatible devices poses a notable challenge, hindering the seamless integration and accessibility of wireless charging across a broader spectrum of consumer electronics.

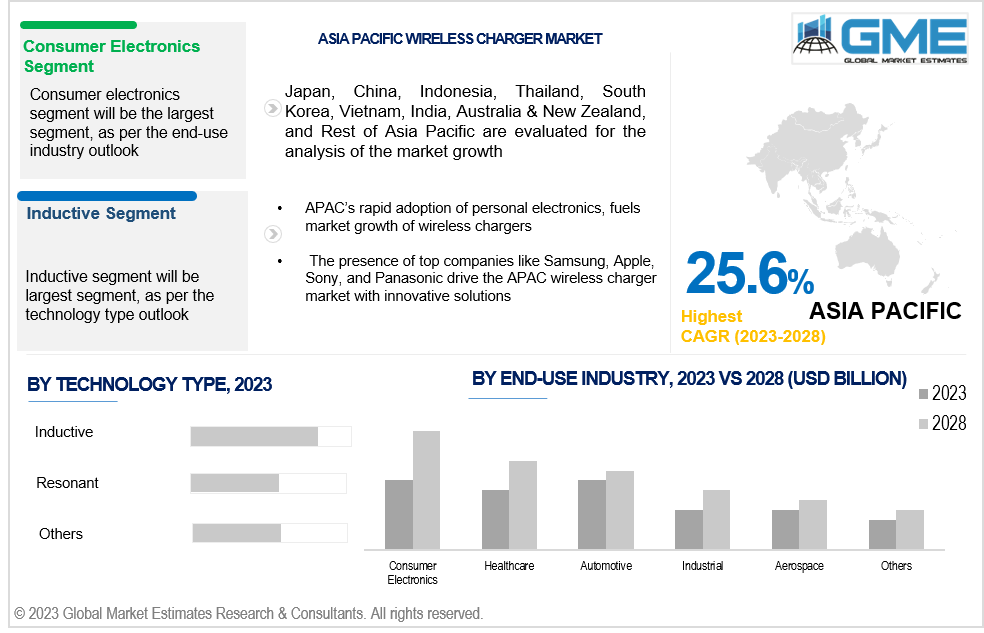

Based on technology type, the market is segmented into resonant, inductive, radio frequency, and others. The inductive segment is expected to be the largest and fastest-growing segment during the forecast period. This technology utilizes electromagnetic fields to transfer power between the charger and the device, offering convenience and ease of use. Its established presence in smartphones, wearables, and various consumer electronics has bolstered its dominance, driving market growth. Moreover, the familiarity of inductive charging, coupled with its relatively mature infrastructure, positions it as the leading choice among consumers and manufacturers.

The resonant segment is expected to be the fastest-growing segment in the global wireless charger market during the forecast period. Unlike traditional inductive charging, resonant technology offers greater spatial freedom and efficiency. This innovation allows devices to charge even when slightly misaligned from the charging pad, enhancing user convenience. Moreover, resonant charging facilitates the simultaneous charging of multiple devices on the same pad, a highly sought-after feature in today's interconnected tech landscape. Its ability to optimize charging efficiency while offering versatility drives its rapid adoption and market growth.

Based on end-use industry, the market is segmented into automotive, consumer electronics, healthcare, industrial, aerospace, and others. The consumer electronics segment is expected to be the largest segment during the forecast period. As consumers increasingly rely on these devices in daily life, the convenience of wireless charging has become a sought-after feature. The sheer volume of smartphones and wearable tech sold annually surpasses other sectors, amplifying the demand for compatible wireless chargers. This segment's prominence is further fueled by tech giants like Apple and Samsung, driving innovation and setting industry standards for wireless charging.

The healthcare segment is expected to be the fastest-growing segment in the global wireless charger market over the forecast period. Wireless charging's convenience and hygiene benefits are particularly valuable in healthcare settings, where sanitation and efficiency are paramount. Medical devices, wearables, and tools can be conveniently charged wirelessly, ensuring they are readily available for patient care without the hassle of cords. The technology's seamless integration into medical infrastructure and the growing demand for innovative, accessible healthcare solutions are propelling its rapid adoption within this sector.

North America is analysed to be the region with the largest share in the global wireless charger market during the forecast period. The region's burgeoning demand for smartphones, portable devices, and electric vehicles drives the need for efficient and convenient charging solutions. The absence of specific regulations targeting wireless charging fosters a relatively open market environment, allowing technology innovation and market expansion. Furthermore, the proactive role of the FCC in governing wireless charging technology, ensuring minimal interference with other electronics and radio frequencies, encourages the adoption and proliferation of wireless charging solutions in the region.

Asia Pacific is projected to be the fastest-growing region across the global wireless charger market over the forecast period. The widespread adoption of wireless charging in the region, particularly inductive technology embedded in smartphones and portable electronics, has significantly boosted its prominence. Additionally, the burgeoning demand for faster charging solutions, especially in the automotive sector propelled by the rise of electric vehicles, has driven the surge towards resonant technology with its quicker charging capabilities. Major players like Samsung, Sony, and Panasonic investing substantially in R&D to innovate and improve charging times, efficiency, and security have further accelerated the market's rapid growth within the APAC region.

Key players operating in the global wireless charger market include Qualcomm Inc., Samsung Electronics, Texas Instruments, Powermat Technologies, WiTricity Corporation, Energizer Holdings, Sony Corporation, Fulton Innovation, Evatran Group, and Murata Manufacturing, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2023, Indie Semiconductor introduced a system-on-chip (SoC) for wireless power charging, the iND87200 SoC, which sets a new standard in integration for developing cost-effective in-cabin portable device charging designs that meet the WPC 'Qi' standard, simplifying and expediting the development process for automotive manufacturers.

In August 2022, Siemens AG, an international producer of cutting-edge technology in various industries, and MAHALE Baher, a global developer of electric vehicle solutions, joined to develop and commercialize wireless inductive charging stations for autonomous and electric cars.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market OpportunIties: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL WIRELESS CHARGER MARKET, BY TECHNOLOGY TYPE

4.1 Introduction

4.2 Global Wireless Charger Market: Technology Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Resonant

4.4.1 Resonant Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Inductive

4.5.1 Inductive Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Radio Frequency

4.6.1 Radio Frequency Market Estimates and Forecast, 2020-2028 (USD Billion)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL WIRELESS CHARGER MARKET, BY END-USE INDUSTRY

5.1 Introduction

5.2 Global Wireless Charger Market: End-use Industry Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Automotive

5.4.1 Automotive Market Estimates And Forecast, 2020-2028 (USD Billion)

5.5 Consumer Electronics

5.5.1 Consumer Electronics Market Estimates And Forecast, 2020-2028 (USD Billion)

5.6 Healthcare

5.6.1 Healthcare Market Estimates And Forecast, 2020-2028 (USD Billion)

5.7 Industrial

5.7.1 Industrial Market Estimates And Forecast, 2020-2028 (USD Billion)

5.8 Aerospace

5.8.1 Aerospace Market Estimates And Forecast, 2020-2028 (USD Billion)

5.9 Other Industries

5.9.1 Other Industries Market Estimates And Forecast, 2020-2028 (USD Billion)

6 GLOBAL WIRELESS CHARGER MARKET, BY REGION

6.1 Introduction

6.2 North America Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.1 By Technology Type

6.2.2 By End-use Industry

6.2.3 By Country

6.2.3.1 U.S. Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.1.1 By Technology Type

6.2.3.1.2 By End-use Industry

6.2.3.2 Canada Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.2.1 By Technology Type

6.2.3.2.2 By End-use Industry

6.2.3.3 Mexico Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.3.1 By Technology Type

6.2.3.3.2 By End-use Industry

6.3 Europe Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.1 By Technology Type

6.3.2 By End-use Industry

6.3.3 By Country

6.3.3.1 Germany Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.1.1 By Technology Type

6.3.3.1.2 By End-use Industry

6.3.3.2 U.K. Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.2.1 By Technology Type

6.3.3.2.2 By End-use Industry

6.3.3.3 France Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.3.1 By Technology Type

6.3.3.3.2 By End-use Industry

6.3.3.4 Italy Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.4.1 By Technology Type

6.3.3.4.2 By End-use Industry

6.3.3.5 Spain Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.5.1 By Technology Type

6.3.3.5.2 By End-use Industry

6.3.3.6 Netherlands Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6.1 By Technology Type

6.3.3.6.2 By End-use Industry

6.3.3.7 Rest of Europe Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6.1 By Technology Type

6.3.3.6.2 By End-use Industry

6.4 Asia Pacific Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.1 By Technology Type

6.4.2 By End-use Industry

6.4.3 By Country

6.4.3.1 China Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.1.1 By Technology Type

6.4.3.1.2 By End-use Industry

6.4.3.2 Japan Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.2.1 By Technology Type

6.4.3.2.2 By End-use Industry

6.4.3.3 India Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.3.1 By Technology Type

6.4.3.3.2 By End-use Industry

6.4.3.4 South Korea Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.4.1 By Technology Type

6.4.3.4.2 By End-use Industry

6.4.3.5 Singapore Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.5.1 By Technology Type

6.4.3.5.2 By End-use Industry

6.4.3.6 Malaysia Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6.1 By Technology Type

6.4.3.6.2 By End-use Industry

6.4.3.7 Thailand Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6.1 By Technology Type

6.4.3.6.2 By End-use Industry

6.4.3.8 Indonesia Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.7.1 By Technology Type

6.4.3.7.2 By End-use Industry

6.4.3.9 Vietnam Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.8.1 By Technology Type

6.4.3.8.2 By End-use Industry

6.4.3.10 Taiwan Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.10.1 By Technology Type

6.4.3.10.2 By End-use Industry

6.4.3.11 Rest of Asia Pacific Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.11.1 By Technology Type

6.4.3.11.2 By End-use Industry

6.5 Middle East and Africa Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 By Technology Type

6.5.2 By End-use Industry

6.5.3 By Country

6.5.3.1 Saudi Arabia Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.1.1 By Technology Type

6.5.3.1.2 By End-use Industry

6.5.3.2 U.A.E. Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.2.1 By Technology Type

6.5.3.2.2 By End-use Industry

6.5.3.3 Israel Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.3.1 By Technology Type

6.5.3.3.2 By End-use Industry

6.5.3.4 South Africa Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.4.1 By Technology Type

6.5.3.4.2 By End-use Industry

6.5.3.5 Rest of Middle East and Africa Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.5.1 By Technology Type

6.5.3.5.2 By End-use Industry

6.6 Central and South America Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.1 By Technology Type

6.6.2 By End-use Industry

6.6.3 By Country

6.6.3.1 Brazil Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.1.1 By Technology Type

6.6.3.1.2 By End-use Industry

6.6.3.2 Argentina Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.2.1 By Technology Type

6.6.3.2.2 By End-use Industry

6.6.3.3 Chile Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3.1 By Technology Type

6.6.3.3.2 By End-use Industry

6.6.3.3 Rest of Central and South America Wireless Charger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3.1 By Technology Type

6.6.3.3.2 By End-use Industry

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Sony Corporation

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 WiTricity Corporation

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Qualcomm Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Samsung Electronics Co. Ltd.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Texas Instruments

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Powermat Technologies

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Energizer Holdings

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Fulton Innovation LLC

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Evatran Group

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Murata Manufacturing

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

2 Resonant Market, By Region, 2020-2028 (USD Billion)

3 Inductive Market, By Region, 2020-2028 (USD Billion)

4 Radio Frequency Market, By Region, 2020-2028 (USD Billion)

5 Others Market, By Region, 2020-2028 (USD Billion)

6 Global Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

7 Automotive Market, By Region, 2020-2028 (USD Billion)

8 Consumer Electronics Market, By Region, 2020-2028 (USD Billion)

9 Healthcare Market, By Region, 2020-2028 (USD Billion)

10 Industrial Market, By Region, 2020-2028 (USD Billion)

11 Aerospace Market, By Region, 2020-2028 (USD Billion)

12 Other Industries Market, By Region, 2020-2028 (USD Billion)

13 Regional Analysis, 2020-2028 (USD Billion)

14 North America Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

15 North America Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

16 North America Wireless Charger Market, By Country, 2020-2028 (USD Billion)

17 U.S. Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

18 U.S. Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

19 Canada Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

20 Canada Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

21 Mexico Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

22 Mexico Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

23 Europe Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

24 Europe Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

25 Europe Wireless Charger Market, By Country, 2020-2028 (USD Billion)

26 Germany Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

27 Germany Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

28 U.K. Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

29 U.K. Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

30 France Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

31 France Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

32 Italy Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

33 Italy Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

34 Spain Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

35 Spain Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

36 Netherlands Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

37 Netherlands Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

38 Rest Of Europe Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

39 Rest Of Europe Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

40 Asia Pacific Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

41 Asia Pacific Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

42 Asia pacific Wireless Charger Market, By Country, 2020-2028 (USD Billion)

43 China Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

44 China Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

45 Japan Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

46 Japan Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

47 India Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

48 India Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

49 South Korea Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

50 South Korea Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

51 Singapore Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

52 Singapore Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

53 Thailand Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

54 Thailand Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

55 Malaysia Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

56 Malaysia Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

57 Indonesia Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

58 Indonesia Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

59 Vietnam Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

60 Vietnam Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

61 Taiwan Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

62 Taiwan Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

63 Australia Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

64 Australia Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

65 Singapore Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

66 Singapore Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

67 Rest of APAC Global Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

68 Rest of APAC Global Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

69 Middle East and Africa Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

70 Middle East and Africa Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

71 Middle East and Africa Wireless Charger Market, By Country, 2020-2028 (USD Billion)

72 Saudi Arabia Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

73 Saudi Arabia Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

74 UAE Global Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

75 UAE Global Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

76 Israel Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

77 Israel Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

78 South Africa Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

79 South Africa Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

80 Rest Of Middle East and Africa Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

81 Rest Of Middle East and Africa Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

82 Central and South America Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

83 Central and South America Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

84 Central and South America Wireless Charger Market, By Country, 2020-2028 (USD Billion)

85 Brazil Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

86 Brazil Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

87 Chile Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

88 Chile Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

89 Argentina Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

90 Argentina Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

91 Rest Of Central and South America Wireless Charger Market, By Technology Type, 2020-2028 (USD Billion)

92 Rest Of Central and South America Wireless Charger Market, By End-use Industry, 2020-2028 (USD Billion)

93 Sony Corporation: Products & Services Offering

94 WiTricity Corporation: Products & Services Offering

95 Qualcomm Inc.: Products & Services Offering

96 SAMSUNG ELECTRONICS CO. LTD.: Products & Services Offering

97 Texas Instruments: Products & Services Offering

98 POWERMAT TECHNOLOGIES: Products & Services Offering

99 Energizer Holdings: Products & Services Offering

100 Fulton Innovation LLC: Products & Services Offering

101 Evatran Group: Products & Services Offering

102 Murata Manufacturing: Products & Services Offering

103 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Wireless Charger Market Overview

2 Global Wireless Charger Market Value From 2020-2028 (USD Billion)

3 Global Wireless Charger Market Share, By Technology Type (2022)

4 Global Wireless Charger Market Share, By End-use Industry (2022)

5 Global Wireless Charger Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Wireless Charger Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Wireless Charger Market

10 Impact Of Challenges On The Global Wireless Charger Market

11 Porter’s Five Forces Analysis

12 Global Wireless Charger Market: By Technology Type Scope Key Takeaways

13 Global Wireless Charger Market, By Technology Type Segment: Revenue Growth Analysis

14 Resonant Market, By Region, 2020-2028 (USD Billion)

15 Inductive Market, By Region, 2020-2028 (USD Billion)

16 Radio Frequency Market, By Region, 2020-2028 (USD Billion)

17 Others Market, By Region, 2020-2028 (USD Billion)

18 Global Wireless Charger Market: By End-use Industry Scope Key Takeaways

19 Global Wireless Charger Market, By End-use Industry Segment: Revenue Growth Analysis

20 Automotive Market, By Region, 2020-2028 (USD Billion)

21 Consumer Electronics Market, By Region, 2020-2028 (USD Billion)

22 Healthcare Market, By Region, 2020-2028 (USD Billion)

23 Industrial Market, By Region, 2020-2028 (USD Billion)

24 Aerospace Market, By Region, 2020-2028 (USD Billion)

25 Other Industries Market, By Region, 2020-2028 (USD Billion)

26 Regional Segment: Revenue Growth Analysis

27 Global Wireless Charger Market: Regional Analysis

28 North America Wireless Charger Market Overview

29 North America Wireless Charger Market, By Technology Type

30 North America Wireless Charger Market, By End-use Industry

31 North America Wireless Charger Market, By Country

32 U.S. Wireless Charger Market, By Technology Type

33 U.S. Wireless Charger Market, By End-use Industry

34 Canada Wireless Charger Market, By Technology Type

35 Canada Wireless Charger Market, By End-use Industry

36 Mexico Wireless Charger Market, By Technology Type

37 Mexico Wireless Charger Market, By End-use Industry

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 Sony Corporation: Company Snapshot

41 Sony Corporation: SWOT Analysis

42 Sony Corporation: Geographic Presence

43 WiTricity Corporation: Company Snapshot

44 WiTricity Corporation: SWOT Analysis

45 WiTricity Corporation: Geographic Presence

46 Qualcomm Inc.: Company Snapshot

47 Qualcomm Inc.: SWOT Analysis

48 Qualcomm Inc.: Geographic Presence

49 Samsung Electronics Co. Ltd.: Company Snapshot

50 Samsung Electronics Co. Ltd.: SWOT Analysis

51 Samsung Electronics Co. Ltd.: Geographic Presence

52 Texas Instruments: Company Snapshot

53 Texas Instruments: SWOT Analysis

54 Texas Instruments: Geographic Presence

55 Powermat Technologies: Company Snapshot

56 Powermat Technologies: SWOT Analysis

57 Powermat Technologies: Geographic Presence

58 Energizer Holdings: Company Snapshot

59 Energizer Holdings: SWOT Analysis

60 Energizer Holdings: Geographic Presence

61 Fulton Innovation LLC: Company Snapshot

62 Fulton Innovation LLC: SWOT Analysis

63 Fulton Innovation LLC: Geographic Presence

64 Evatran Group: Company Snapshot

65 Evatran Group: SWOT Analysis

66 Evatran Group: Geographic Presence

67 Murata Manufacturing: Company Snapshot

68 Murata Manufacturing: SWOT Analysis

69 Murata Manufacturing: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Wireless Charger Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Wireless Charger Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS