Global X-Ray & Metal Detectable Products Market Size, Trends & Analysis - Forecasts to 2026 By Component (Detectable Pens & Markers, Detectable Freezer Pens & Markers, Detectable Knives, Detectable Stationary, and Other Detectable Components), By End-User (Pharmaceutical Industry, and Food Industry [Bakery, Frozen Food, Meat and Others]), By Material (Stainless Steel, and Polypropylene), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

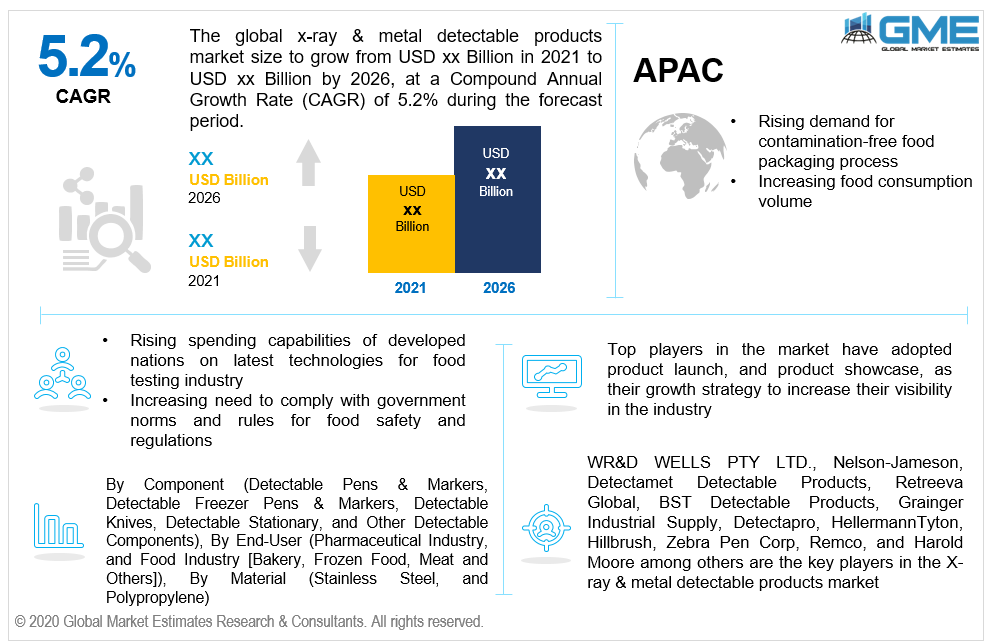

The global x-ray & metal detectable products market is projected to grow at a CAGR value of 5.2% from 2021 to 2026.

Metal or X-ray detectable products such as MD pens, markers, freezer pens, knives, and other stationaries are rapidly being adopted by the major giants present in the food manufacturing industry. Equipment used in food manufacture has to be detectable to prevent contamination of the final product. Metal detecting equipment is traditionally used to screen for metal contaminants; however, X-ray detection is becoming increasingly common as the equipment is getting more cost effective.

In order to ensure food safety and maintain the contamination free environment, metal detectable markers and pens are the most preferred products for marking food materials. These pens and markers are available in different coded colors that will help to track food supplies and maintain a real-time inventory track. Metal detectable pens are one of the most recent inventions in the field of food safety and health & pharmaceutical processing segment. Other type of metal detectable products are tags, scoops, scrapers, paddles, cable ties, and shovels.

The material used to manufacture these MD products are that of formulated polypropylene mix, containing a non-toxic, detectable additive under the FDA-compliant guidance. Manufacturers have to comply with the rules and norms to manufacture pens that are BRC8 compliant with no small parts and shatter proof bodies, along with toxic-free ink. These metal detectable food pens are color-coded for HACCP food safety programs.

The market for x-ray and metal detectable products is expected to grow owing to factors such as rising demand for contamination-free food packaging process, increasing food consumption volume, increasing need to comply with government norms and rules for food safety and regulations, and rapidly growing food industry in the Asian region.

The COVID-19 pandemic impacted the food industry greatly. The impact led to raw material supply disruption, fluctuation in the prices, and temporary shutdown of manufacturing & packaging sites. However, due to the ease on lockdown norms, and due to the sudden rise in food consumption volume across the globe, the market for x-ray & metal detectable products is expected to grow gradually during the forecast period of 2021 to 2026.

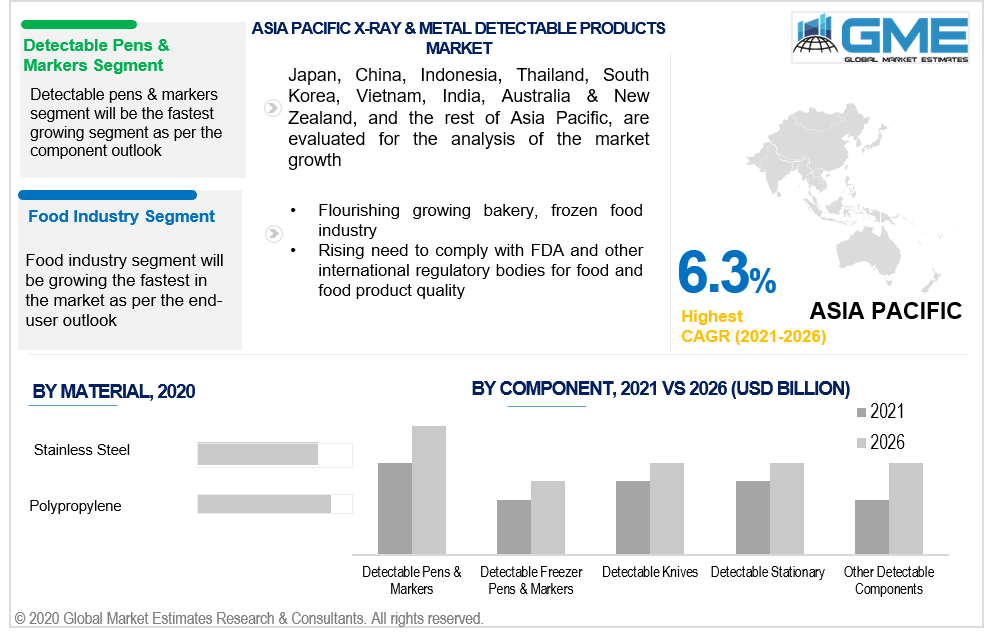

Based on component, the x-ray & metal detectable products market is divided into detectable pens & markers, detectable freezer pens & markers, detectable knives, detectable stationary, and other detectable components.

The detectable pens & markers segment is expected to hold the largest share of the x-ray & metal detectable products market from 2021 to 2026. Increasing demand for reducing risk of foreign body contamination and rising importance of detectability of factory pens are some of the prime reasons for the segment to have the largest share in the x-ray & metal detectable products market.

Based on the material, the market is segmented into stainless steel, and polypropylene. The polypropylene segment is expected to grow the fastest in the x-ray & metal detectable products market from 2021 to 2026. Rising product launch strategy, and sudden increase in food volume consumption (that led to regressive food safety and quality check) are some of the factors supporting the adoption of polypropylene based MD pens and products in the market.

Pharmaceutical industry, and food industry [bakery, frozen food, meat and others] are the end-users of x-ray & metal detectable products market. The food industry segment is ought to be the dominant or largest shareholding segment in the x-ray & metal detectable products market. This is mainly due to rising demand for contamination-free food packaging process, increasing food consumption volume, rising need to comply with government norms and rules for food safety and regulations.

As per the geographical analysis, the x-ray & metal detectable products market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the x-ray & metal detectable products market from 2021 to 2026. Established, and matured food industry in the U.S., Mexico and Canada, and increased awareness regarding FDA norms pertaining to food safety and quality check are some of the drivers supporting the growth of the North American market for x-ray & metal detectable products.

Moreover, the Asia-Pacific region is expected to be the fastest growing segment in the market during the forecast period. Flourishing bakery, frozen food segments in countries like China and India, increasing organic growth strategies with established firms, rising need to comply with FDA and other international regulatory bodies for food and food product quality are some of the drivers that are helping the APAC market grow the fastest in the x-ray & metal detectable products market.

WR&D WELLS PTY LTD., Nelson-Jameson, Detectamet Detectable Products, Retreeva Global, BST Detectable Products, Grainger Industrial Supply, Detectapro, HellermannTyton, Hillbrush, Zebra Pen Corp, Remco, and Harold Moore among others are the key players in the X-ray & metal detectable products market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 X-Ray & Metal Detectable Products Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Material Overview

2.1.3 Component Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 X-Ray & Metal Detectable Products Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand for contamination free food packaging process

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness regarding latest government norms related to food safety

3.4 Prospective Growth Scenario

3.4.1 Material Growth Scenario

3.4.2 Component Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 X-Ray & Metal Detectable Products Market, By Material

4.1 Material Outlook

4.2 Stainless Steel

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Polypropylene

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 X-Ray & Metal Detectable Products Market, By Component

5.1 Component Outlook

5.2 Detectable Pens & Markers

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 Detectable Freezer Pens & Markers

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

5.4 Detectable Knives

5.4.1 Market Size, By Region, 2021-2026 (USD Billion)

5.5 Detectable Stationary

5.5.1 Market Size, By Region, 2021-2026 (USD Billion)

5.6 Other Detectable Components

5.6.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 X-Ray & Metal Detectable Products Market, By End-User

6.1 Food Industry [Bakery, Frozen Food, Meat and Others]

6.1.1 Market Size, By Region, 2021-2026 (USD Billion)

6.2 Pharmaceutical Industry

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 X-Ray & Metal Detectable Products Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Billion)

7.2.2 Market Size, By Material, 2021-2026 (USD Billion)

7.2.3 Market Size, By Component, 2021-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Material, 2021-2026 (USD Billion)

7.2.4.2 Market Size, By Component, 2021-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.2.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Billion)

7.3.2 Market Size, By Material, 2021-2026 (USD Billion)

7.3.3 Market Size, By Component, 2021-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Material, 2021-2026 (USD Billion)

7.3.6.2 Market Size, By Component, 2021-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Material, 2021-2026 (USD Billion)

7.3.9.2 Market Size, By Component, 2021-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Material, 2021-2026 (USD Billion)

7.3.10.2 Market Size, By Component, 2021-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Material, 2021-2026 (USD Billion)

7.3.11.2 Market Size, By Component, 2021-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Billion)

7.4.2 Market Size, By Material, 2021-2026 (USD Billion)

7.4.3 Market Size, By Component, 2021-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Material, 2021-2026 (USD Billion)

7.4.6.2 Market Size, By Component, 2021-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Material, 2021-2026 (USD Billion)

7.4.9.2 Market size, By Component, 2021-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Material, 2021-2026 (USD Billion)

7.4.10.2 Market Size, By Component, 2021-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Billion)

7.5.2 Market Size, By Material, 2021-2026 (USD Billion)

7.5.3 Market Size, By Component, 2021-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Material, 2021-2026 (USD Billion)

7.5.6.2 Market Size, By Component, 2021-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Billion)

7.6.2 Market Size, By Material, 2021-2026 (USD Billion)

7.6.3 Market Size, By Component, 2021-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Material, 2021-2026 (USD Billion)

7.6.6.2 Market Size, By Component, 2021-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Material, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Component, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 WR&D WELLS PTY LTD.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Nelson-Jameson

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Detectamet Detectable Products

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Retreeva Global

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 BST Detectable Products

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Grainger Industrial Supply

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Detectapro

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 HellermannTyton

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Hillbrush

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global X-Ray & Metal Detectable Products Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the X-Ray & Metal Detectable Products Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS