Global Yard Automation Market Size, Trends & Analysis - Forecasts to 2029 By Type of Equipment (Automated Guided Vehicles (AGVs), Automated Rail Mounted Gantry Cranes (ARMGs), Automated Stacking Cranes (ASCs), Automated Truck Loading and Unloading Systems, Automated Terminal Tractors, and Others), By End-use Industry (Ports, Airports, Warehousing, Manufacturing, Distribution Centers, Railway Terminals, and Others), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

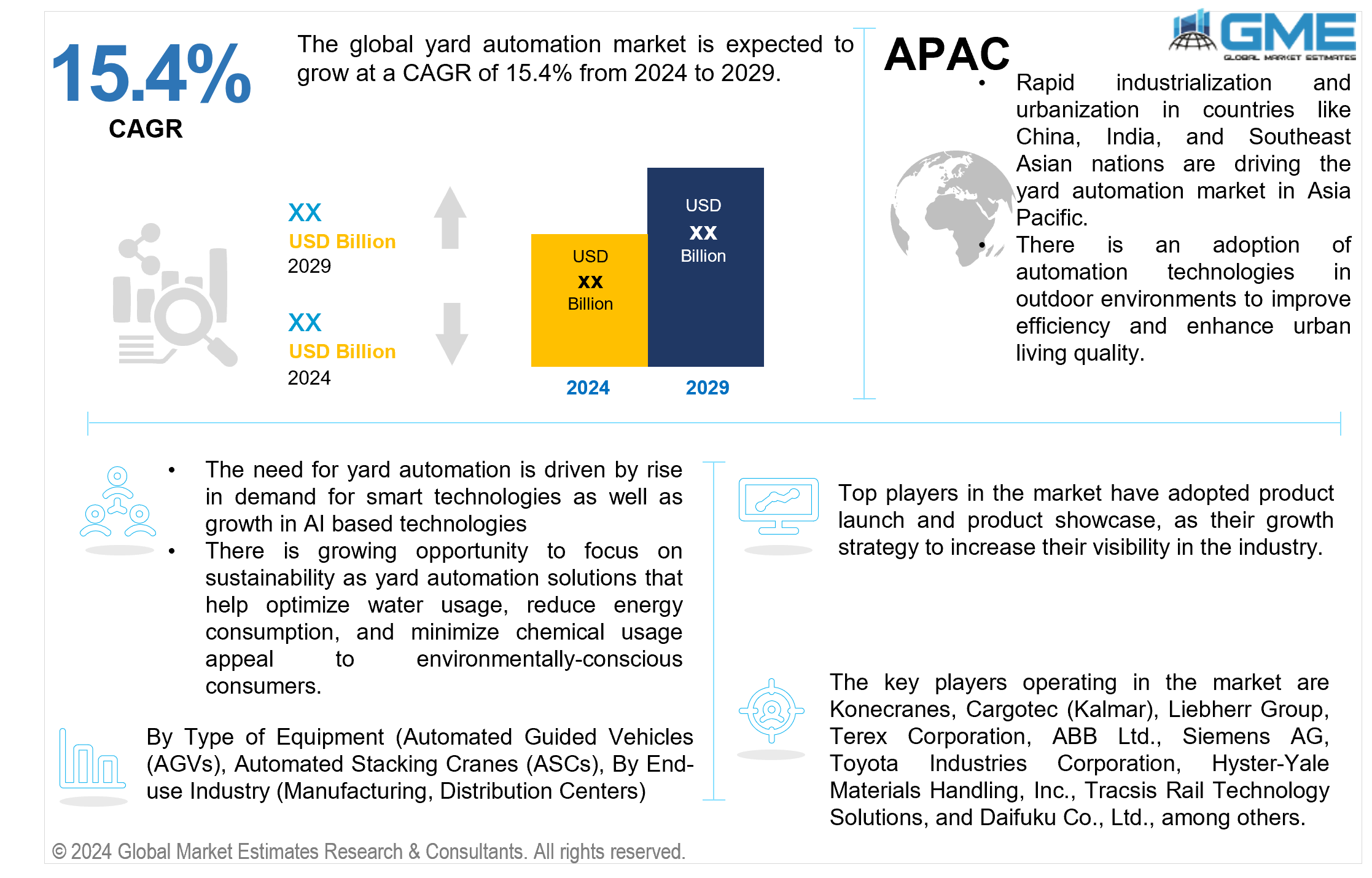

The global yard automation market is expected to grow at a CAGR of 15.4% from 2024 to 2029. Yard automation is a process that uses technology to automate tasks and operations within a yard or outdoor space in a large landscaping area. Yard automation aims to make outdoor maintenance more efficient, convenient, and environmentally friendly.

The market is driven by a rise in demand for smart technologies and growth in AI-based technologies. The surge in adoption of smart home technology has sparked increased interest in automating outdoor areas. Consumers seek solutions that simplify and enhance yard maintenance, boosting the demand for yard automation products and services. Continuous technological advancements, including IoT, AI, and robotics, drive innovation in yard automation systems. These advancements enable the creation of more intelligent, interconnected devices and systems capable of automating watering, mowing, and monitoring outdoor environments. There is a growing opportunity to focus on sustainability as yard automation solutions that help optimize water usage, reduce energy consumption, and minimize chemical usage appeal to environmentally-conscious consumers.

One of the main restraints of the yard automation market is the high initial cost. The initial investment required for yard automation systems, including the purchase of equipment and installation costs, can be significant. This may act as a deterrent for some consumers, particularly those with limited budgets or those who perceive the upfront costs as too high compared to the potential long-term savings.

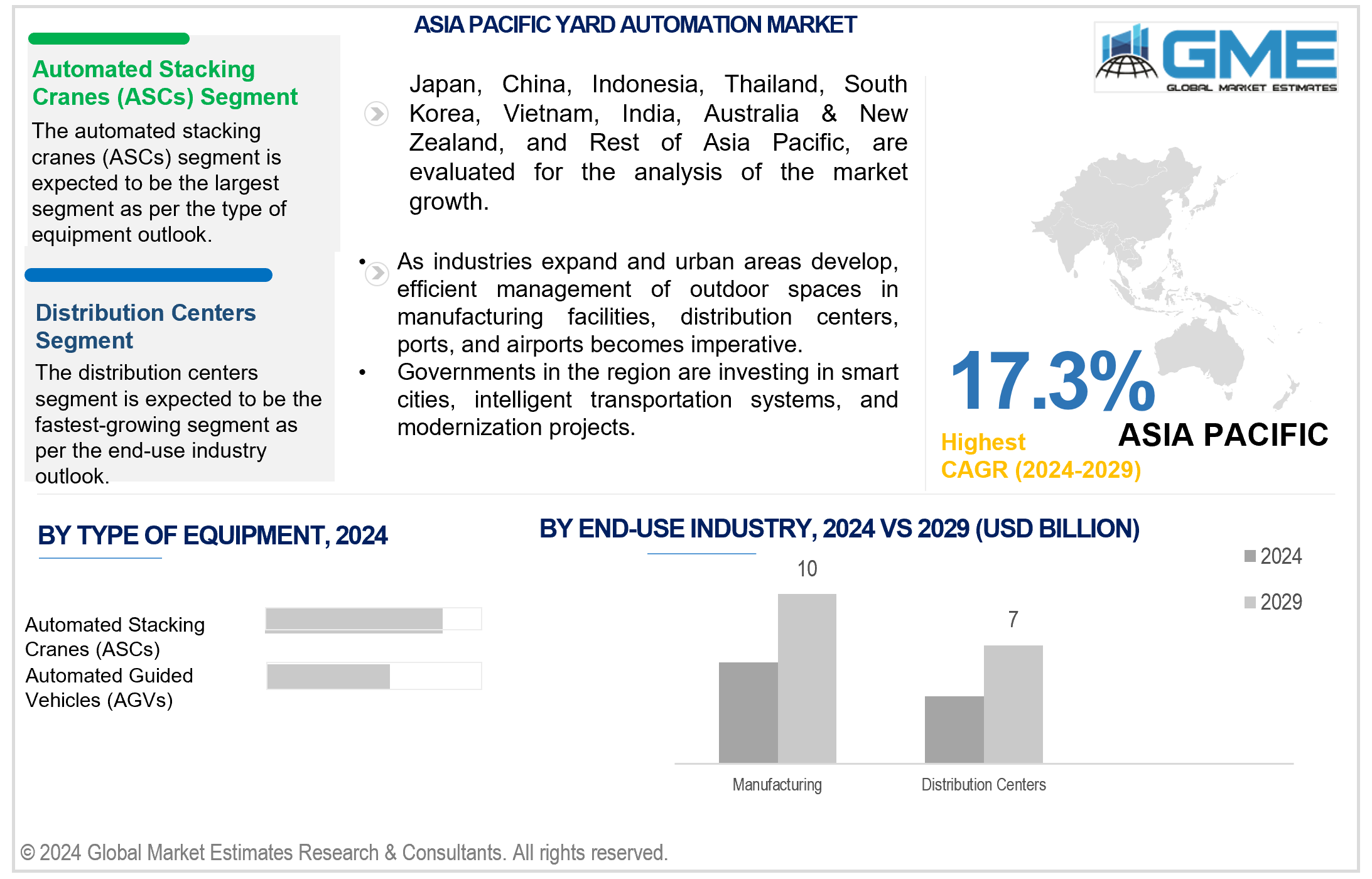

Based on type of equipment, the market is segmented into automated guided vehicles (AGVs), automated rail mounted gantry cranes (ARMGs), automated stacking cranes (ASCs), automated truck loading and unloading systems, automated terminal tractors, and others. The automated stacking cranes (ASCs) segment is expected to hold the largest share of the market during the forecast period. These systems are designed to automate the process of handling containers, improving productivity and reducing operational costs. ASCs are equipped with advanced automation technologies, including sensors, cameras, and computer systems, allowing them to operate without human intervention. They are typically mounted on rails or tracks and can move along the yard's storage aisles to access containers stored in stacks.

The automated guided vehicles (AGVs) segment is projected to grow fastest during the forecast period. AGVs are versatile and can be used in various yard automation applications, such as material handling, transportation, and logistics, making them increasingly popular for automating outdoor spaces. Their ability to navigate autonomously and transport goods efficiently contributes to their rapid growth in the market.

Based on end-use industry, the market is segmented into ports, airports, warehousing, manufacturing, distribution centers, railway terminals, and others. The manufacturing segment is expected to hold the largest share of the market during the forecast period. Manufacturing facilities typically encompass large outdoor areas where various processes such as storage, material handling, and logistics operations take place. These outdoor spaces present ample opportunities for automation to enhance efficiency and productivity throughout the manufacturing supply chain.

The distribution centers segment is projected to grow fastest during the forecast period. As online shopping becomes increasingly prevalent, distribution centers are under pressure to efficiently process and deliver orders to meet the expectations of consumers for fast and reliable service. Automation helps distribution centers address challenges related to labor shortages. It also helps alleviate the high turnover rates commonly associated with manual warehouse operations. Automation technologies such as conveyor systems, sorting machines, and robotic picking systems enable distribution centers to optimize order processing, reduce turnaround times, and handle larger volumes of orders more efficiently.

North America is analyzed to be the largest region in the global yard automation market during the forecast period. With the increasing adoption of smart home technologies and the rising demand for convenience and efficiency in outdoor maintenance, North American consumers are showing a growing interest in yard automation solutions. Technological advancements, particularly in IoT, AI, and robotics, drive innovation in the yard automation sector.

Asia Pacific is analyzed to be the fastest-growing region in the yard automation market during the forecast period. One of the primary drivers of the yard automation market in the Asia Pacific is rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations. As industries expand and urban areas develop, there is a growing need for efficient management of outdoor spaces in manufacturing facilities, distribution centers, ports, and airports. Governments across the region are investing in smart cities, intelligent transportation systems, and modernization projects, which include the adoption of automation technologies in outdoor environments to improve overall efficiency and enhance the quality of urban living.

Konecranes, Cargotec (Kalmar), Liebherr Group, Terex Corporation, ABB Ltd., Siemens AG, Toyota Industries Corporation, Hyster-Yale Materials Handling, Inc., Tracsis Rail Technology Solutions, and Daifuku Co., Ltd., among others are some of the key players operating in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2021, Kalmar, part of Cargotec, received a large repeat order of six Kalmar Automatic Stacking Cranes (ASCs) from Victoria International Container Terminal (VICT). The new Kalmar ASCs will enable VICT to expand its current capacity at the Port of Melbourne located at Webb Dock East.

In November 2018, Siemens started supplying an autonomous stockyard management system for a new plant for HBIS Laoting Steel Co. Ltd., a Chinese subsidiary of one of the world's biggest iron and steel producers.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL YARD AUTOMATION MARKET, BY TYPE OF EQUIPMENT

4.1 Introduction

4.2 Yard Automation Market: Type of Equipment Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Automated Guided Vehicles (AGVs)

4.4.1 Automated Guided Vehicles (AGVs) Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Automated Rail Mounted Gantry Cranes (ARMGs)

4.5.1 Automated Rail Mounted Gantry Cranes (ARMGs) Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Automated Stacking Cranes (ASCs)

4.6.1 Automated Stacking Cranes (ASCs) Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Automated Truck Loading and Unloading Systems

4.7.1 Automated Truck Loading and Unloading Systems Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Automated Terminal Tractors

4.8.1 Automated Terminal Tractors Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL YARD AUTOMATION MARKET, BY END-USE INDUSTRY

5.1 Introduction

5.2 Yard Automation Market: End-use Industry Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Ports

5.4.1 Ports Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Airports

5.5.1 Airports Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Warehousing

5.6.1 Warehousing Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Manufacturing

5.7.1 Manufacturing Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Distribution Centers

5.8.1 Distribution Centers Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Railway Terminals

5.9.1 Railway Terminals Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Others

5.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL YARD AUTOMATION MARKET, BY REGION

6.1 Introduction

6.2 North America Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type of Equipment

6.2.2 By End-use Industry

6.2.3 By Country

6.2.3.1 U.S. Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type of Equipment

6.2.3.1.2 By End-use Industry

6.2.3.2 Canada Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type of Equipment

6.2.3.2.2 By End-use Industry

6.2.3.3 Mexico Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type of Equipment

6.2.3.3.2 By End-use Industry

6.3 Europe Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type of Equipment

6.3.2 By End-use Industry

6.3.3 By Country

6.3.3.1 Germany Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type of Equipment

6.3.3.1.2 By End-use Industry

6.3.3.2 U.K. Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type of Equipment

6.3.3.2.2 By End-use Industry

6.3.3.3 France Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type of Equipment

6.3.3.3.2 By End-use Industry

6.3.3.4 Italy Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type of Equipment

6.3.3.4.2 By End-use Industry

6.3.3.5 Spain Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type of Equipment

6.3.3.5.2 By End-use Industry

6.3.3.6 Netherlands Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type of Equipment

6.3.3.6.2 By End-use Industry

6.3.3.7 Rest of Europe Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type of Equipment

6.3.3.6.2 By End-use Industry

6.4 Asia Pacific Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type of Equipment

6.4.2 By End-use Industry

6.4.3 By Country

6.4.3.1 China Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type of Equipment

6.4.3.1.2 By End-use Industry

6.4.3.2 Japan Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type of Equipment

6.4.3.2.2 By End-use Industry

6.4.3.3 India Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type of Equipment

6.4.3.3.2 By End-use Industry

6.4.3.4 South Korea Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type of Equipment

6.4.3.4.2 By End-use Industry

6.4.3.5 Singapore Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type of Equipment

6.4.3.5.2 By End-use Industry

6.4.3.6 Malaysia Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type of Equipment

6.4.3.6.2 By End-use Industry

6.4.3.7 Thailand Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type of Equipment

6.4.3.6.2 By End-use Industry

6.4.3.8 Indonesia Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type of Equipment

6.4.3.7.2 By End-use Industry

6.4.3.9 Vietnam Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type of Equipment

6.4.3.8.2 By End-use Industry

6.4.3.10 Taiwan Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type of Equipment

6.4.3.10.2 By End-use Industry

6.4.3.11 Rest of Asia Pacific Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type of Equipment

6.4.3.11.2 By End-use Industry

6.5 Middle East and Africa Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type of Equipment

6.5.2 By End-use Industry

6.5.3 By Country

6.5.3.1 Saudi Arabia Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type of Equipment

6.5.3.1.2 By End-use Industry

6.5.3.2 U.A.E. Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type of Equipment

6.5.3.2.2 By End-use Industry

6.5.3.3 Israel Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type of Equipment

6.5.3.3.2 By End-use Industry

6.5.3.4 South Africa Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type of Equipment

6.5.3.4.2 By End-use Industry

6.5.3.5 Rest of Middle East and Africa Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type of Equipment

6.5.3.5.2 By End-use Industry

6.6 Central & South America Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type of Equipment

6.6.2 By End-use Industry

6.6.3 By Country

6.6.3.1 Brazil Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type of Equipment

6.6.3.1.2 By End-use Industry

6.6.3.2 Argentina Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type of Equipment

6.6.3.2.2 By End-use Industry

6.6.3.3 Chile Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type of Equipment

6.6.3.3.2 By End-use Industry

6.6.3.3 Rest of Central & South America Yard Automation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type of Equipment

6.6.3.3.2 By End-use Industry

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Konecranes

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Cargotec (Kalmar)

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Liebherr Group

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Terex Corporation

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 ABB Ltd.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 SIEMENS AG

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Toyota Industries Corporation

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Hyster-Yale Materials Handling, Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Tracsis Rail Technology Solutions

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Daifuku Co., Ltd.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

2 Automated Guided Vehicles (AGVs) Market, By Region, 2021-2029 (USD Mllion)

3 Automated Rail Mounted Gantry Cranes (ARMGs) Market, By Region, 2021-2029 (USD Mllion)

4 Automated Stacking Cranes (ASCs) Market, By Region, 2021-2029 (USD Mllion)

5 Automated Truck Loading and Unloading Systems Market, By Region, 2021-2029 (USD Mllion)

6 Automated Terminal Tractors Market, By Region, 2021-2029 (USD Mllion)

7 Others Market, By Region, 2021-2029 (USD Mllion)

8 Global Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

9 Ports Market, By Region, 2021-2029 (USD Mllion)

10 Airports Market, By Region, 2021-2029 (USD Mllion)

11 Warehousing Market, By Region, 2021-2029 (USD Mllion)

12 Manufacturing Market, By Region, 2021-2029 (USD Mllion)

13 Distribution Centers Market, By Region, 2021-2029 (USD Mllion)

14 Railway Terminals Market, By Region, 2021-2029 (USD Mllion)

15 Others Market, By Region, 2021-2029 (USD Mllion)

16 Regional Analysis, 2021-2029 (USD Mllion)

17 North America Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

18 North America Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

19 North America Yard Automation Market, By Country, 2021-2029 (USD Mllion)

20 U.S. Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

21 U.S. Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

22 Canada Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

23 Canada Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

24 Mexico Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

25 Mexico Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

26 Europe Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

27 Europe Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

28 Europe Yard Automation Market, By Country, 2021-2029 (USD Mllion)

29 Germany Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

30 Germany Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

31 U.K. Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

32 U.K. Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

33 France Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

34 France Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

35 Italy Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

36 Italy Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

37 Spain Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

38 Spain Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

39 Netherlands Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

40 Netherlands Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

41 Rest Of Europe Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

42 Rest Of Europe Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

43 Asia Pacific Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

44 Asia Pacific Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

45 Asia Pacific Yard Automation Market, By Country, 2021-2029 (USD Mllion)

46 China Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

47 China Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

48 Japan Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

49 Japan Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

50 India Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

51 India Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

52 South Korea Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

53 South Korea Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

54 Singapore Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

55 Singapore Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

56 Thailand Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

57 Thailand Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

58 Malaysia Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

59 Malaysia Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

60 Indonesia Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

61 Indonesia Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

62 Vietnam Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

63 Vietnam Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

64 Taiwan Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

65 Taiwan Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

66 Rest of APAC Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

67 Rest of APAC Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

68 Middle East and Africa Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

69 Middle East and Africa Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

70 Middle East and Africa Yard Automation Market, By country, 2021-2029 (USD Mllion)

71 Saudi Arabia Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

72 Saudi Arabia Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

73 UAE Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

74 UAE Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

75 Israel Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

76 Israel Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

77 South Africa Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

78 South Africa Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

79 Rest Of Middle East and Africa Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

80 Rest Of Middle East and Africa Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

81 Central & South America Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

82 Central & South America Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

83 Central & South America Yard Automation Market, By Country, 2021-2029 (USD Mllion)

84 Brazil Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

85 Brazil Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

86 Chile Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

87 Chile Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

88 Argentina Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

89 Argentina Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

90 Rest Of Central & South America Yard Automation Market, By Type of Equipment, 2021-2029 (USD Mllion)

91 Rest Of Central & South America Yard Automation Market, By End-use Industry, 2021-2029 (USD Mllion)

92 Konecranes: Products & Services Offering

93 Cargotec (Kalmar): Products & Services Offering

94 Liebherr Group: Products & Services Offering

95 Terex Corporation: Products & Services Offering

96 ABB Ltd.: Products & Services Offering

97 SIEMENS AG: Products & Services Offering

98 Toyota Industries Corporation : Products & Services Offering

99 Hyster-Yale Materials Handling, Inc.: Products & Services Offering

100 Tracsis Rail Technology Solutions: Products & Services Offering

101 Daifuku Co., Ltd.: Products & Services Offering

102 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Yard Automation Market Overview

2 Global Yard Automation Market Value From 2021-2029 (USD Mllion)

3 Global Yard Automation Market Share, By Type of Equipment (2023)

4 Global Yard Automation Market Share, By End-use Industry (2023)

5 Global Yard Automation Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Yard Automation Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Yard Automation Market

10 Impact Of Challenges On The Global Yard Automation Market

11 Porter’s Five Forces Analysis

12 Global Yard Automation Market: By Type of Equipment Scope Key Takeaways

13 Global Yard Automation Market, By Type of Equipment Segment: Revenue Growth Analysis

14 Automated Guided Vehicles (AGVs) Market, By Region, 2021-2029 (USD Mllion)

15 Automated Rail Mounted Gantry Cranes (ARMGs) Market, By Region, 2021-2029 (USD Mllion)

16 Automated Stacking Cranes (ASCs) Market, By Region, 2021-2029 (USD Mllion)

17 Automated Truck Loading and Unloading Systems Market, By Region, 2021-2029 (USD Mllion)

18 Automated Terminal Tractors Market, By Region, 2021-2029 (USD Mllion)

19 Others Market, By Region, 2021-2029 (USD Mllion)

20 Global Yard Automation Market: By End-use Industry Scope Key Takeaways

21 Global Yard Automation Market, By End-use Industry Segment: Revenue Growth Analysis

22 Ports Market, By Region, 2021-2029 (USD Mllion)

23 Airports Market, By Region, 2021-2029 (USD Mllion)

24 Warehousing Market, By Region, 2021-2029 (USD Mllion)

25 Manufacturing Market, By Region, 2021-2029 (USD Mllion)

26 Distribution Centers Market, By Region, 2021-2029 (USD Mllion)

27 Railway Terminals Market, By Region, 2021-2029 (USD Mllion)

28 Others Market, By Region, 2021-2029 (USD Mllion)

29 Regional Segment: Revenue Growth Analysis

30 Global Yard Automation Market: Regional Analysis

31 North America Yard Automation Market Overview

32 North America Yard Automation Market, By Type of Equipment

33 North America Yard Automation Market, By End-use Industry

34 North America Yard Automation Market, By Country

35 U.S. Yard Automation Market, By Type of Equipment

36 U.S. Yard Automation Market, By End-use Industry

37 Canada Yard Automation Market, By Type of Equipment

38 Canada Yard Automation Market, By End-use Industry

39 Mexico Yard Automation Market, By Type of Equipment

40 Mexico Yard Automation Market, By End-use Industry

41 Four Quadrant Positioning Matrix

42 Company Market Share Analysis

43 Konecranes: Company Snapshot

44 Konecranes: SWOT Analysis

45 Konecranes: Geographic Presence

46 Cargotec (Kalmar): Company Snapshot

47 Cargotec (Kalmar): SWOT Analysis

48 Cargotec (Kalmar): Geographic Presence

49 Liebherr Group: Company Snapshot

50 Liebherr Group: SWOT Analysis

51 Liebherr Group: Geographic Presence

52 Terex Corporation: Company Snapshot

53 Terex Corporation: Swot Analysis

54 Terex Corporation: Geographic Presence

55 ABB Ltd.: Company Snapshot

56 ABB Ltd.: SWOT Analysis

57 ABB Ltd.: Geographic Presence

58 SIEMENS AG: Company Snapshot

59 SIEMENS AG: SWOT Analysis

60 SIEMENS AG: Geographic Presence

61 Toyota Industries Corporation : Company Snapshot

62 Toyota Industries Corporation : SWOT Analysis

63 Toyota Industries Corporation : Geographic Presence

64 Hyster-Yale Materials Handling, Inc.: Company Snapshot

65 Hyster-Yale Materials Handling, Inc.: SWOT Analysis

66 Hyster-Yale Materials Handling, Inc.: Geographic Presence

67 Tracsis Rail Technology Solutions.: Company Snapshot

68 Tracsis Rail Technology Solutions.: SWOT Analysis

69 Tracsis Rail Technology Solutions.: Geographic Presence

70 Daifuku Co., Ltd.: Company Snapshot

71 Daifuku Co., Ltd.: SWOT Analysis

72 Daifuku Co., Ltd.: Geographic Presence

73 Other Companies: Company Snapshot

74 Other Companies: SWOT Analysis

75 Other Companies: Geographic Presence

The Global Yard Automation Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Yard Automation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS